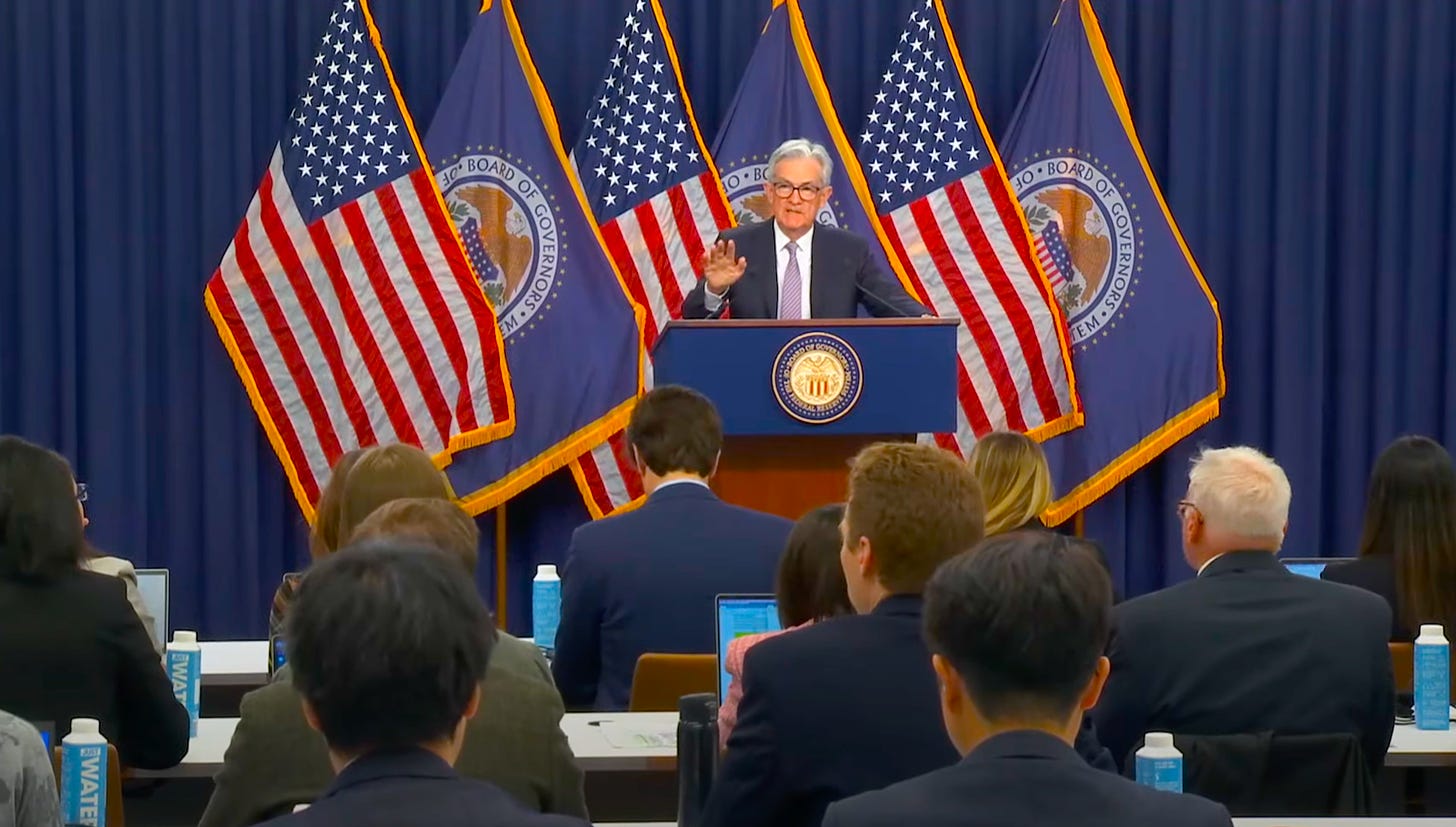

The end of rate hikes wouldn't be the end of tight monetary policy 🦅

The Fed signaled a notable change in its policy path ✏️

The Federal Reserve has signaled that the current stretch of interest rate hikes may have ended for this monetary policy cycle.

While this development may be less hawkish than signaling additional rate hikes, it shouldn’t be confused with being dovish.

If you’re behind on what’s going on with monetary policy, read The complicated mess of the markets and economy, explained 🧩 and TKer's 2022 word of the year: 'Pain' 🥊.

Key phrase replaced ✏️

Keep reading with a 7-day free trial

Subscribe to 📈 TKer by Sam Ro to keep reading this post and get 7 days of free access to the full post archives.