Unsettling stats about consumer health are missing the bigger picture 💵

Americans have money, and they're spending it 🛍️

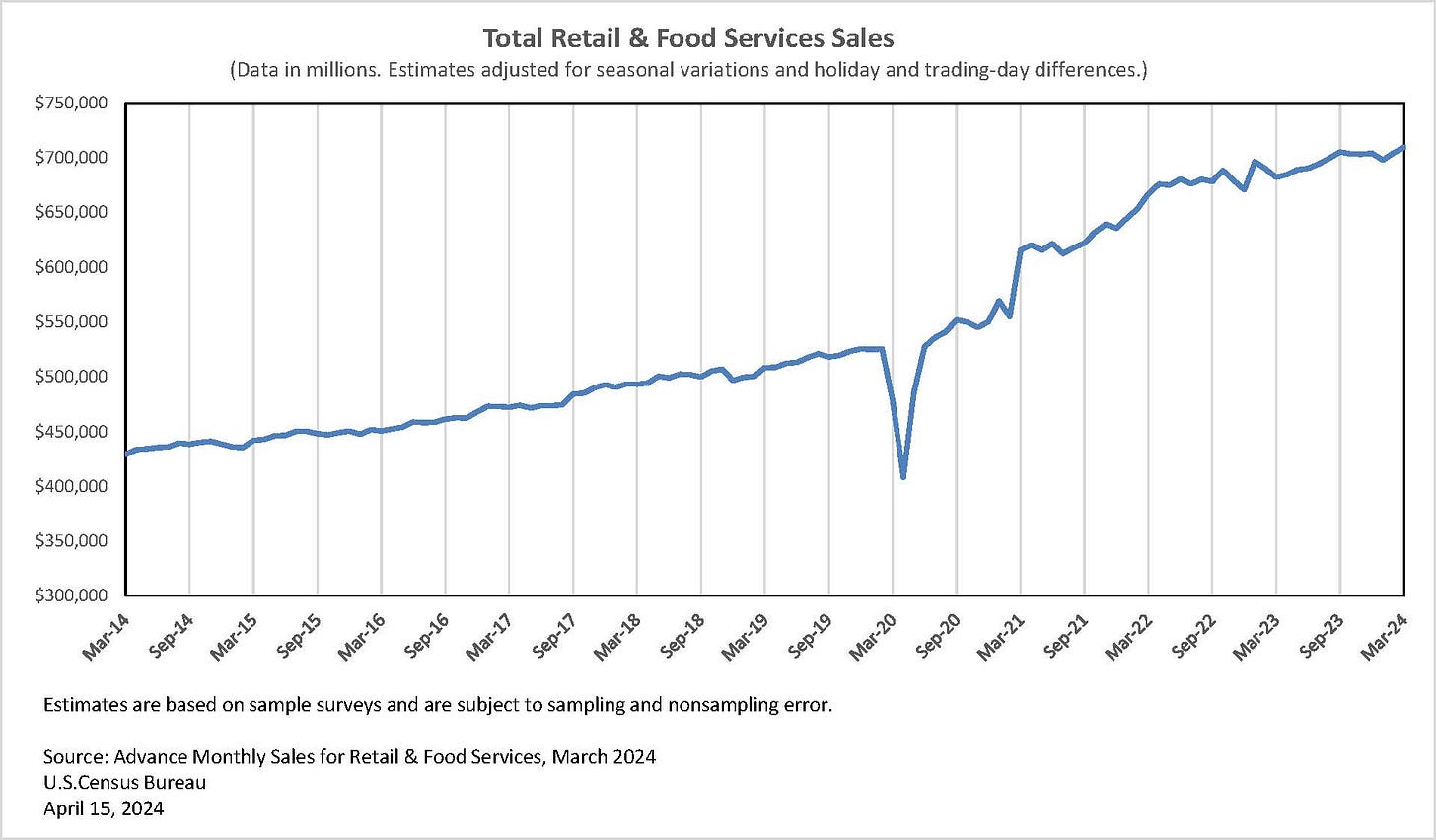

Americans are spending at a healthy clip.

According to Census data released Monday, retail sales increased 0.7% in March to a record $709.6 billion.

The consumer’s impulse to spend is critical for economic growth: Personal consumption expenditures account for 69% of GDP.

But can consumers keep spending?

Skeptics who argue the answer is “no” often point to two metrics: 1) the declining personal saving rate, and 2) the record-high level of total credit card debt.

On their own, these metrics sound unsettling. But they belie the more comprehensive story, which is that consumer finances remain strong by historical standards.

With a little more context, you’ll better understand why consumers have been spending at a growing rate and why they may continue to do so in the months to come.