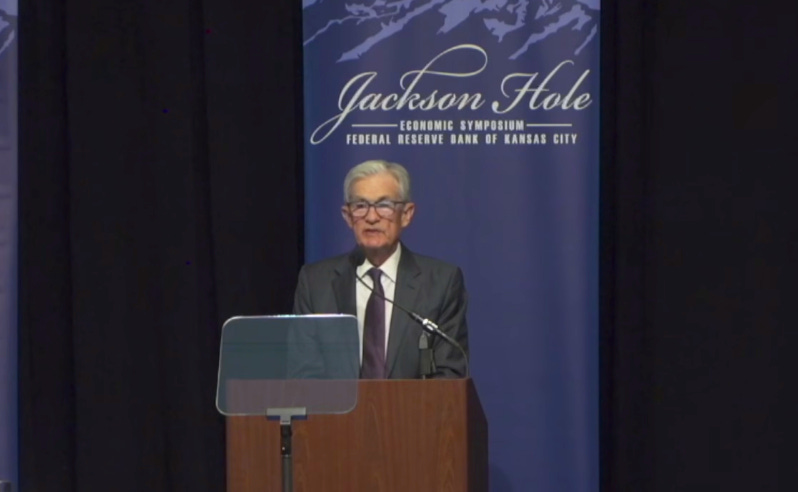

Fed Chair Powell: It's a 'challenging situation' ⚖️

Plus a charted review of the macro crosscurrents 🔀

📈The stock market rose, with the S&P 500 climbing 0.3% to end the week at 6,466.91. The index is now up 10% year-to-date. For more on the market, read: 15 charts to consider with the stock market at record highs 📊📈

-

Federal Reserve Chair Jerome Powell acknowledged tha…