The market beatings will continue until inflation improves 🥊

Renewed concerns about inflation have the Fed triggered 📉

It’s a bear market.

On Monday, the S&P 500 tumbled 3.9% to close at 3,749.63. That put the index down 21.8% from its January 3 all-time closing high of 4,796.56. This was the first time the S&P closed down by at least 20% from its high, confirming that we’ve been in an official bear market.

By the end of the week, the S&P had fallen to 3,674.84, down 23.4% from its high.

Historically, bear markets have come with more pain. According to Howard Silverblatt of S&P Dow Jones Indices, the average bear market has lasted 18.6 months and has seen the S&P 500 fall 38.3% before bottoming.1 The ones that came with economic recessions tended to be worse. Though, it’s not crazy to think this could be a bear market without a recession.

While the stock market is likely to generate healthy returns in the long run, there’s good reason for investors to manage expectations in the short run as the Federal Reserve gets increasingly aggressive with monetary policy.

‘The worst mistake we could make‘ 🦅

The stock market’s recent sharp declines came in the wake of the May consumer price index report — released on June 10 — which was much hotter than expected. The news intensified worries about inflation persisting and renewed calls for a more hawkish Federal Reserve.2

And the hits kept coming last week.

The New York Fed’s May Survey of Consumer Expectations released Monday confirmed that the inflation we’ve been experiencing today has folks increasingly convinced that inflation is likely to remain elevated down the road. The median expectation for inflation one year ahead was 6.6% in May. This tied the highest reading (March) since the survey’s inception in June 2013.3

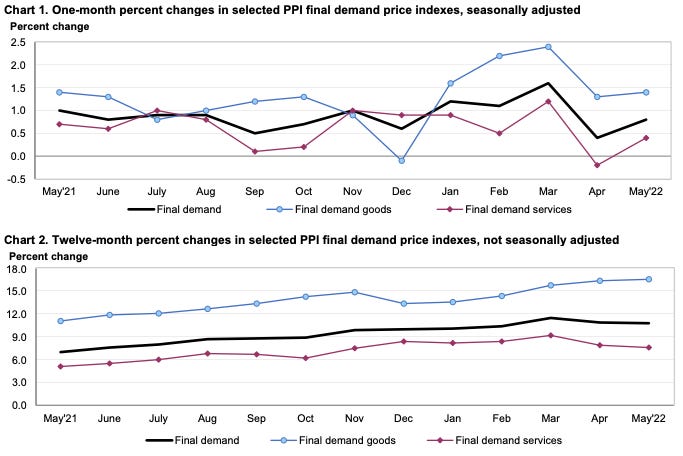

On Tuesday, we learned that producer price growth in May accelerated to 0.8% from April. This reflected a worrisome 10.8% gain from a year ago. Excluding food and energy prices, which tend to be much more volatile in the short-run, core PPI was up 0.5% for the month and 8.3% for the year. Prices for both goods and services rose at an increasing rate.

Also on Tuesday, the National Federation of Independent Business reported that its small business Optimism Index in May fell to its lowest level since April 2020 as inflation concerns persisted. From the report: “The net percent of owners raising average selling prices increased 2 points from April to a net 72% seasonally adjusted (the same as March 2022 and a record high reading).“

To be clear, none of these metrics reflect sudden and sharp deteriorations. They’ve been trending unfavorably for months.

The issue right now is that they continue to show little or no improvement despite months of tighter monetary policy from the Fed. We’re not close to seeing “clear and convincing” evidence that inflation is cooling, which the Fed needs to see before it will let up on tightening monetary policy.

This is why on Wednesday, the Fed unleashed a very aggressive 75 basis point interest rate hike, the biggest rate hike since 1994.

“We have to restore price stability,” Fed chairman Jerome Powell said on Wednesday. “It’s the bedrock of the economy. If you don’t have price stability, the economy is not going to work as it's supposed to.”

"The worst mistake we could make would be to fail [on lowering inflation],” he said. “We have to restore price stability. We really do."

The stock market’s conundrum 😵💫

None of this is great news for those hoping for a sustained recovery in the financial markets to begin soon.

The Fed wants tighter financial conditions, and a robust stock market rally would be the opposite.

Powell all but confirmed that the Fed was hoping for a bear market.

“Over the course of this year, financial markets have responded and have generally shown that they understand the path we're laying out,” he said Wednesday.

Vickie Chang, global markets strategist at Goldman Sachs, explained this dynamic on Tuesday (emphasis added):

“The recent market correction has been a Fed-driven one, as equities have steadily priced in more tightening this year while simultaneously worrying that such front-loaded tightening will ultimately lead to a policy reversal. Our US economists also do not see major financial imbalances of the sort that led to the retrenchment episodes of the 2000s. So, for equities to recover in a sustained way, history suggests that this kind of monetary tightening-induced contraction is most likely to end when the Fed shifts policy direction. While a shift towards Fed easing is unlikely without an outright move into recession, as in late 2018, a clear signal that tightening risks are receding may be sufficient.”

And so until inflation shows signs of letting up, investors should manage their expectations for near-term returns. (Read more about the stock market’s conundrum here.)

Keep reading with a 7-day free trial

Subscribe to 📈 TKer by Sam Ro to keep reading this post and get 7 days of free access to the full post archives.