Revisiting the key chart to watch amid the Fed's war on inflation 📈

A once-doubtful economic scenario has become reality 👍

We now know it’s possible to cool the economy and bring down inflation without having to experience a recession.

In March 2022, the Federal Reserve raised interest rates for the first time in over three years in its effort to fight inflation by reining in economic activity. At the time, many experts insisted that this meant sending the economy into recession.

But Fed Chair Jerome Powell noted, “The American economy is very strong and well positioned to handle tighter monetary policy.”

Powell was right.

The case for the unemployment rate not rising 🤔

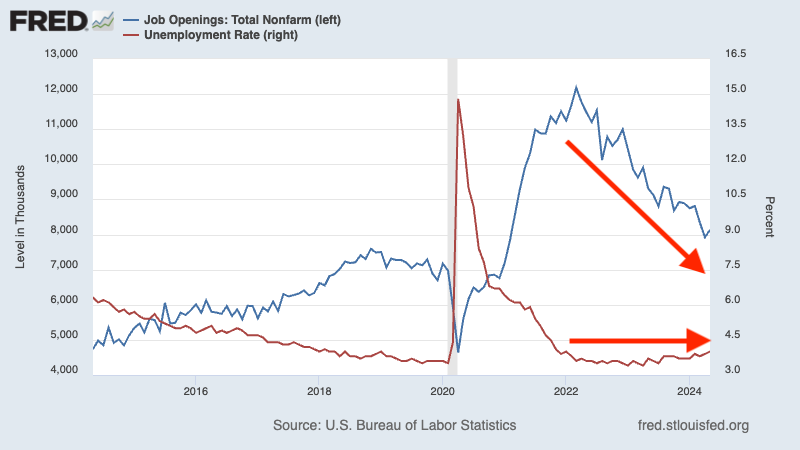

When the central bank announced that first rate hike over two years ago, I suggested to TKer readers that the key chart to watch would be job openings versus the unemployment rate. The rationale was straightforward: