Most stock-picking pros have been underperforming this year's market rally 🫤

New data confirms this persistent trend 📊

It remains tough to generate returns in the stock market that beat (or outperform) a passively managed fund tracking the S&P 500.

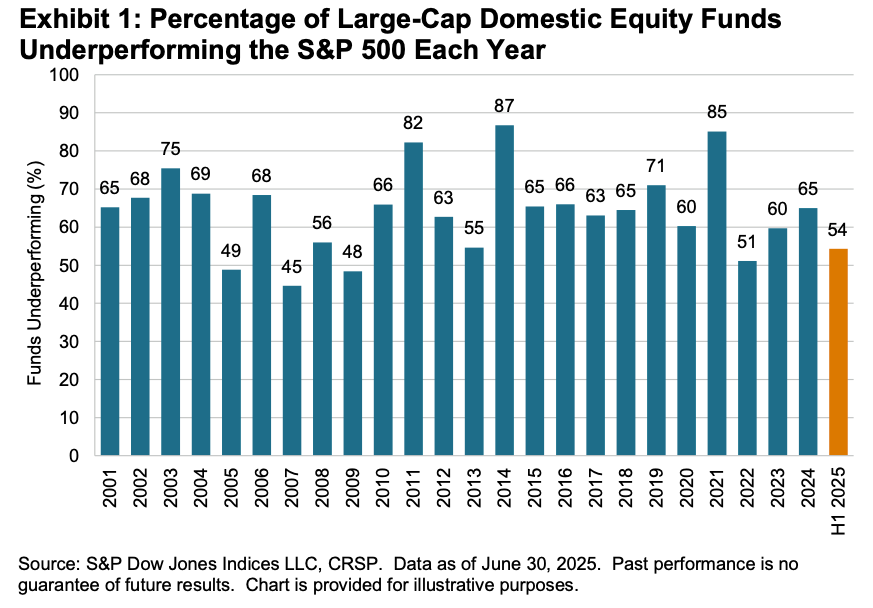

According to new data from S&P Dow Jones Indices (SPDJI), 54.3% of U.S. large-cap equity fund managers underperformed the S&P 500 in the first six months of 2025.

For what it’s worth, that metric is relatively low in the context of recent history.

“This was an improvement from the 65% rate observed over full-year 2024 and places the industry on track for the best year since 2022,” SPDJI analysts wrote. “The dueling winds from the outperformance of the U.S. equity market's largest stocks, coupled with macro uncertainty and higher dispersion, amalgamated in greater potential opportunities for stock pickers to shine than in previous years.”

That said, we’re on track for a 16th consecutive year in which the majority of fund managers in this category have lagged the index.

And as you stretch the time horizon, the numbers get even more dismal. Over a three-year period, 64.9% underperformed the S&P 500. Over a five-year period, 86.9% underperformed. And over a 20-year period, 91% underperformed.

To be fair, the goal of every fund manager and investor isn’t necessarily to beat some benchmark. Nevertheless, for more active investors, seeing a low-cost index fund consistently produce better returns may be disheartening.