Proof that 'past performance is no guarantee of future results' 📊

Winning fund managers rarely keep winning 📉

It’s hard enough to construct a stock portfolio in a way that beats the competition.

Even if you are a fund manager who generated industry-leading returns in any given year, history says it’s an almost insurmountable task to stay on top consistently in subsequent years.

On Tuesday, S&P Dow Jones Indices (SPDJI) published their latest Persistence Scorecard, which tracks the performance of equity funds over time. The data confirmed that most top-performing fund managers rarely stay on top.

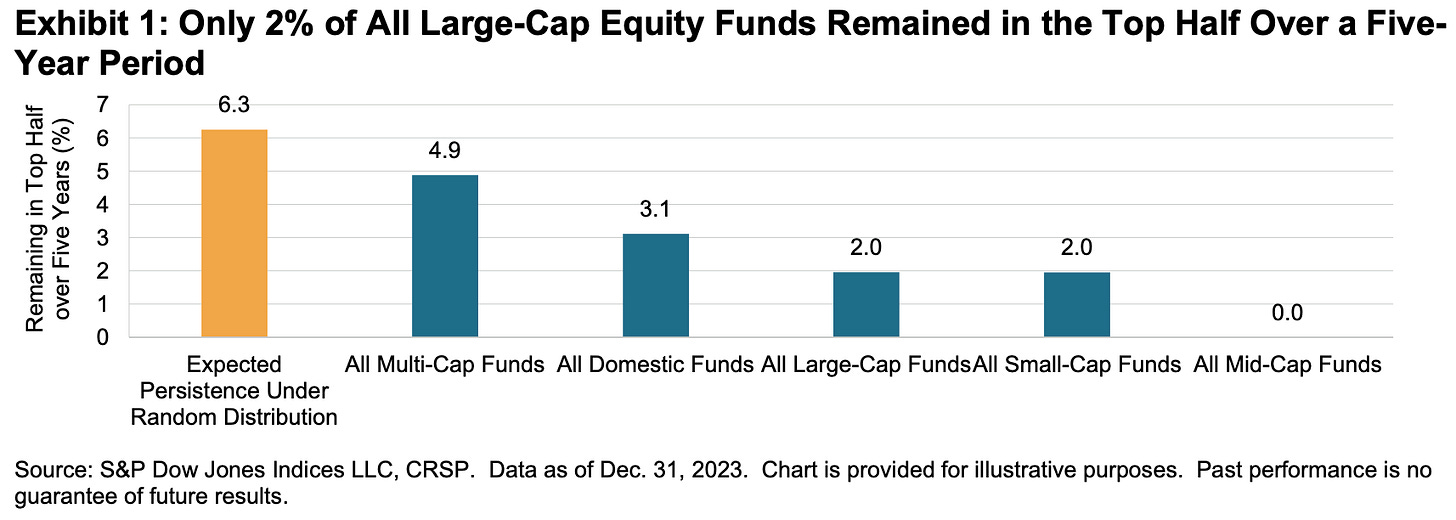

The researchers reviewed the performance of actively managed equity funds across categories over five years through 2023. Just 4.9% of funds were able to remain in the top half of performance over the period. (See the chart above.)

“Among top-quartile funds within all reported active domestic equity categories as of December 2019, not a single fund remained in the top quartile over the next four years,“ SPDJI analysts observed.