Doubt about the P/E ratio's long-term signal for the stock market 🧠

Historical P/E data has issues 📜

Wall Street’s stock market forecasters are split on where prices are headed. Some expect strong returns. Some expect weak returns.

“S&P 500 valuation suggests 1-2% price return over next decade,“ BofA’s Savita Subramanian wrote on Monday. “There's no way to sugarcoat it: the S&P 500 is statistically expensive.”

Her view is based on the signal from the S&P 500’s price-to-normalized-earnings ratio. While price-to-earnings (P/E) valuation ratios won’t tell you much about short-term returns, they have a decent historical track record of predicting long-term returns. And when the ratios have been high, the long-term forward returns have been low.

Subramanian’s observation follows Goldman Sachs’ forecast for 3% annualized total returns for the S&P over the next 10 years.

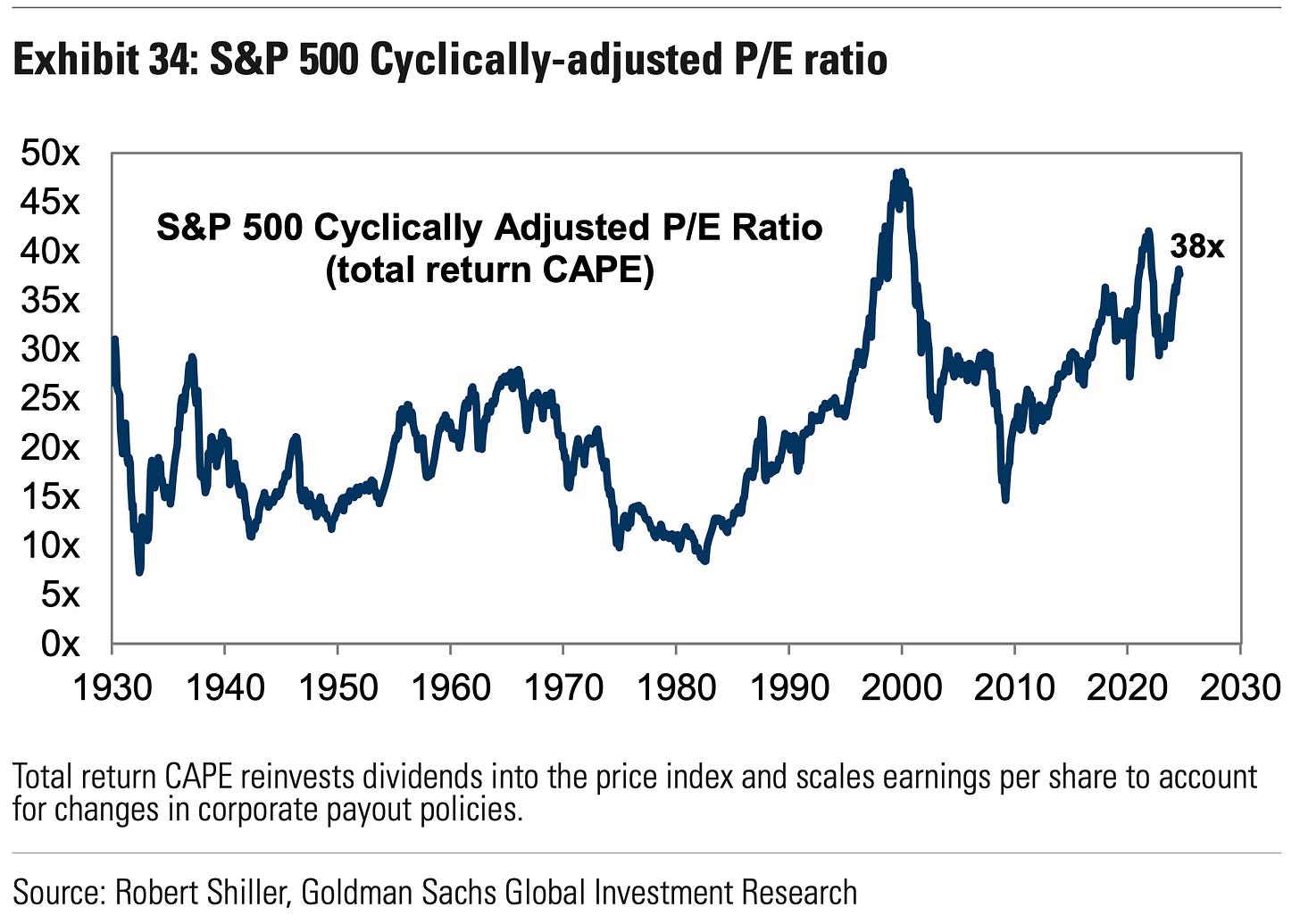

Goldman Sachs analysts led by David Kostin pointed to the cyclically-adjusted price-to-earnings ratio (CAPE) — among other metrics — to similarly argue that elevated valuations portend low long-term returns in the market.

It’s certainly possible that the signal we’re getting from above-average valuations proves accurate, and average returns are depressed for the next decade.

But it’s also far from guaranteed that we get this outcome.

How we think about valuations may be due for a change 🤔

Kostin cautioned about the difficulty of predicting long-term returns. (Read more here and here.)

Among other things, he noted that evolving demographics could affect how the market thinks about valuations.