A few thoughts on the stock market rout 🎢

If it's an average year, then it could get worse before it gets better 📉

In the July 11 newsletter to paid subscribers, I wrote:

“In the same way it’s smart to keep your seat belts buckled for an accident that may never happen, it can be wise to be mentally on guard for that next big stock market sell-off.”

To be clear, that was not a prediction for oncoming market volatility.

Rather, it was a reminder that market volatility is normal. And for much of this year, we hadn’t experienced much of it.

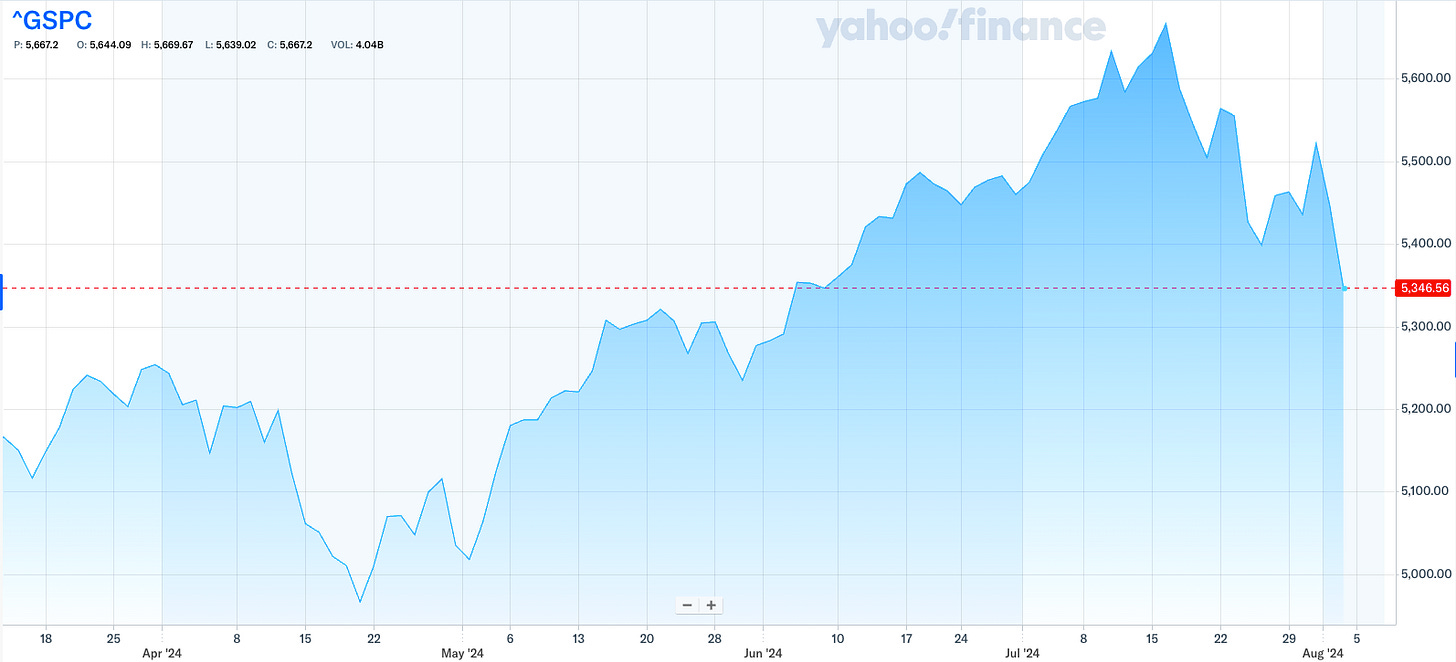

History shows that in the second year of bull markets, the S&P 500 sees an average max drawdown of about 9%. When you consider all calendar years, the S&P sees an average drawdown of 14%.

The S&P closed at 5,346.56 on Friday, down 6% from its July 16 high of 5,669.67.

That means if this proves to be an average year, prices could fall much more.

Though, it’s also worth remembering that in an average year, prices usually recover and end the year higher. Read more here.