This year's historic stock market swing brings attention to an unsettling trend 🎢

Volatility shocks are more common 🛬

The stock market has experienced some stomach-churning volatility this year, with the S&P 500 plummeting 18.9% from its February 19 closing high of 6,144.15 to its April 8 closing low of 4,982.77.

The market has since recovered almost all of those losses, with the S&P closing at 6,022.24 on Wednesday.

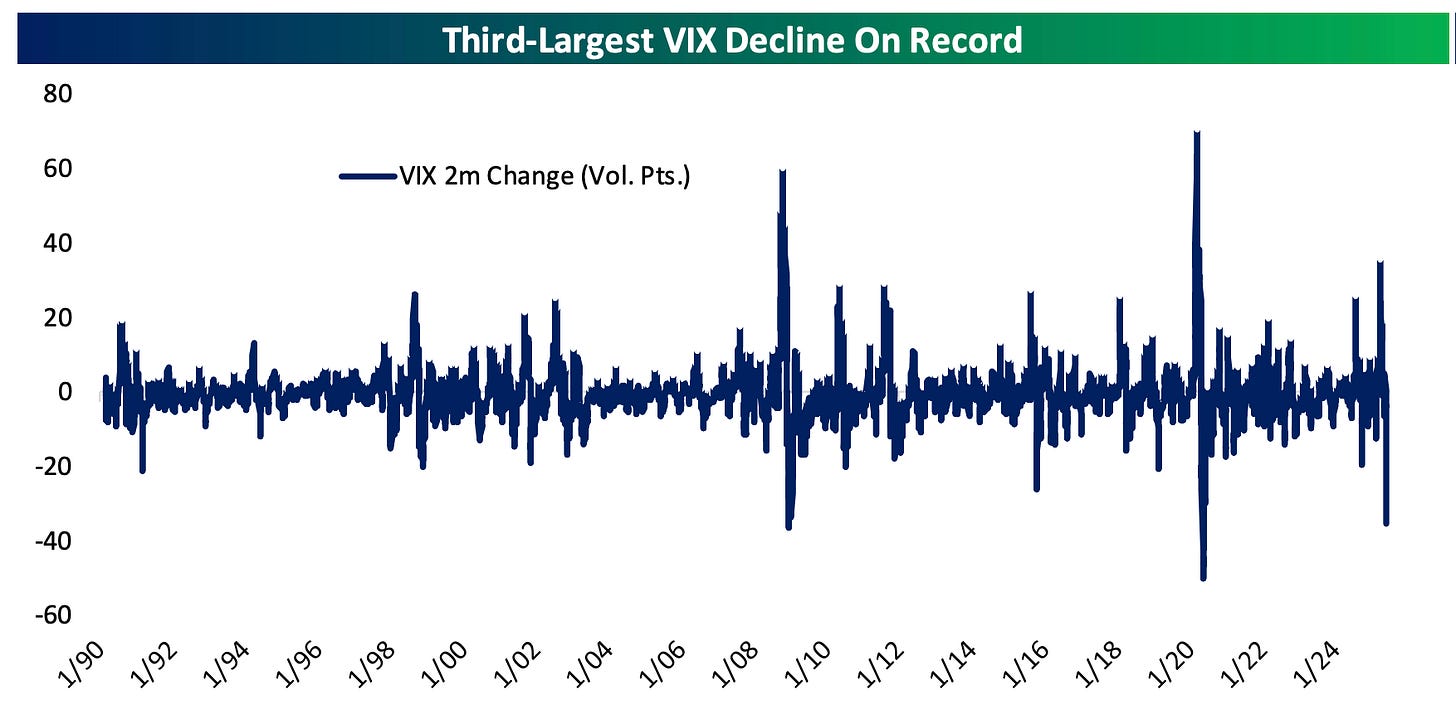

Volatility, as measured by the CBOE Volatility Index (VIX), made a historic swing during this period.

“[T]he 35 point drop in the VIX over [the two months since April 2] is the third-largest in the history of the index back to 1990, only overshadowed by the two months ended December 26, 2008, and May 14, 2020,” Bespoke Investment Group analysts observed on Monday.