Why elevated interest rates aren't a big problem for the stock market 🤨

Four observations addressing investor concerns 👍

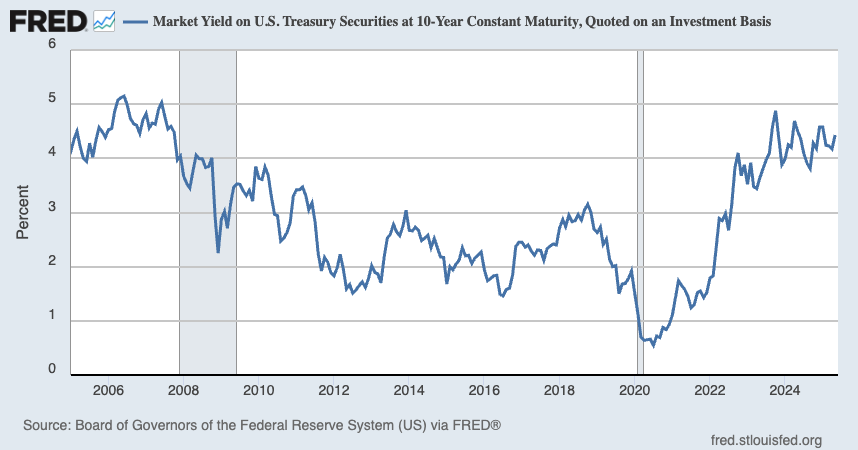

When interest rates rise, it’s tempting to jump to the conclusion that the stock market should suffer.

After all, higher rates mean higher financing costs. This is bad because: 1) customers will have a harder time financing purchases, which is a headwind for sales, and 2) higher interest expenses are a negative for earnings.

On a slightly wonkier note, higher interest rates cause the theoretical intrinsic value of a company to fall as the present value of future cash flows shrinks.

That said, the full story is nuanced. Here are four observations that help explain why the stock market is trading near record highs even as interest rates trend at elevated levels.