Don't confuse 'normalizing' with something more alarming 🤨

Contextualizing the recent uptick in debt delinquencies 💳

An economy that’s normalizing after an unusual period (e.g., the emergence of the COVID-19 pandemic) should see the return of both good things and not-so-good things.

Among the good things are job gains and spending growth.

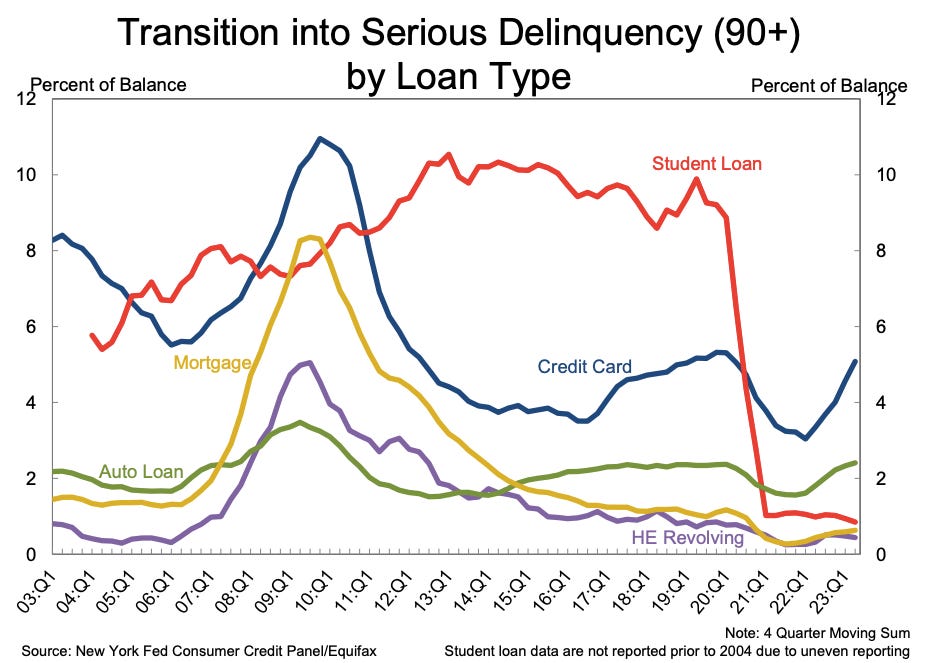

Among the not-so-good things are debt delinquency rates returning to historical averages after being unusually low.

The latest sign of the latter happening comes from the New York Fed’s Q2 Household Debt and Credit report (emphasis added):

Aggregate delinquency rates were roughly flat in the second quarter of 2023 and remained low, after declining sharply through the beginning of the pandemic. As of June, 2.7% of outstanding debt was in some stage of delinquency, 2 percentage points lower than the last quarter of 2019, just before the COVID-19 pandemic hit the United States.

The share of debt newly transitioning into delinquency increased for credit cards and auto loans, with increases in transition rates of 0.7 and 0.4 percentage points respectively. Credit cards balances saw the most pronounced worsening in performance in 2023Q2 after a period of extraordinarily low delinquency rates during the pandemic. Transition rates for credit cards and auto loans are now slightly above pre-pandemic (2019Q4) levels. Early delinquency transition rates for mortgages edged up by 0.1 percentage point but remain well below its pre-pandemic level. Student loan performance was unchanged, with reported delinquency rates at historic lows as the federal repayment pause remains in place until August 31, 2023.

During the early periods of the pandemic, consumers had limited opportunities to spend. Meanwhile, many saw their paychecks continue to come in, bolstered by fiscal stimulus. This led to households accumulating trillions in excess savings while paying down debt balances.

Now, household finances are normalizing. And as a result, more people are struggling to keep up.

This hasn’t slammed spending 👍

Despite delinquency rates trending higher for several quarters, consumer spending has held up.