Is good economic news really all that surprising? 📰

Let's talk about news sentiment and why I created TKer 📈

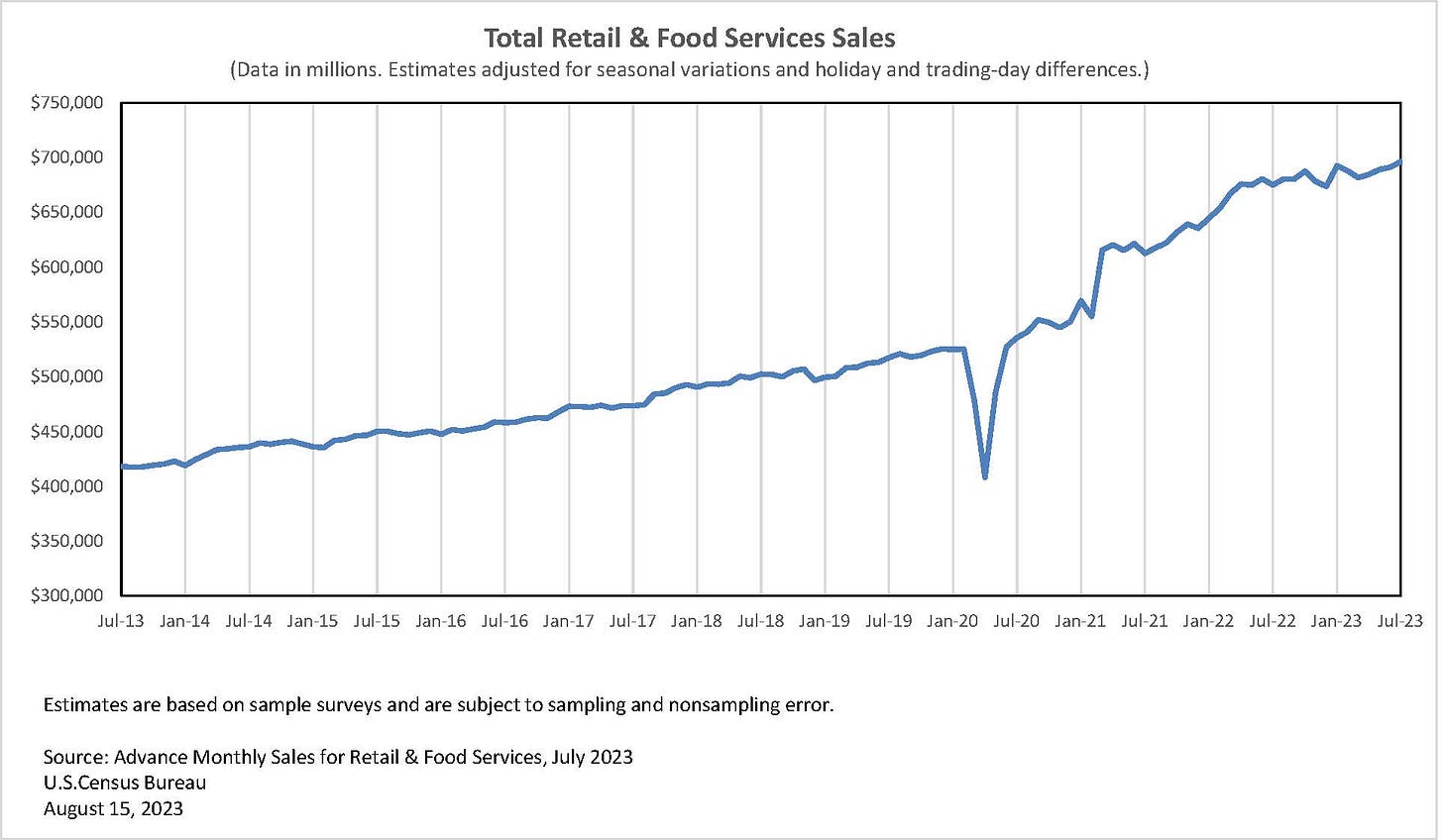

People continue to be blindsided by the resilience in personal consumption growth.

According to Census Bureau data, retail sales in July increased by 0.7% to $696.4 billion. As many news headlines show, this pace exceeded many economists’ forecasts. (See here, here, here, here, here, and here.)

“The media was flooded with stories …

Keep reading with a 7-day free trial

Subscribe to 📈 TKer by Sam Ro to keep reading this post and get 7 days of free access to the full post archives.