What happened after the last time the S&P 500's forward P/E was this high 🤔

Plus a charted review of the macro crosscurrents 🔀

📈The stock market rallied to all-time highs, with the S&P 500 setting an intraday high of 6,920.34 on Wednesday and a closing high of 6,890.89 on Tuesday. The index is now up 16.3% year-to-date. For more on recent market moves, read: The stock market and the economy are diverging 📊

-

It’s not hard to argue that stock market valuations are high.

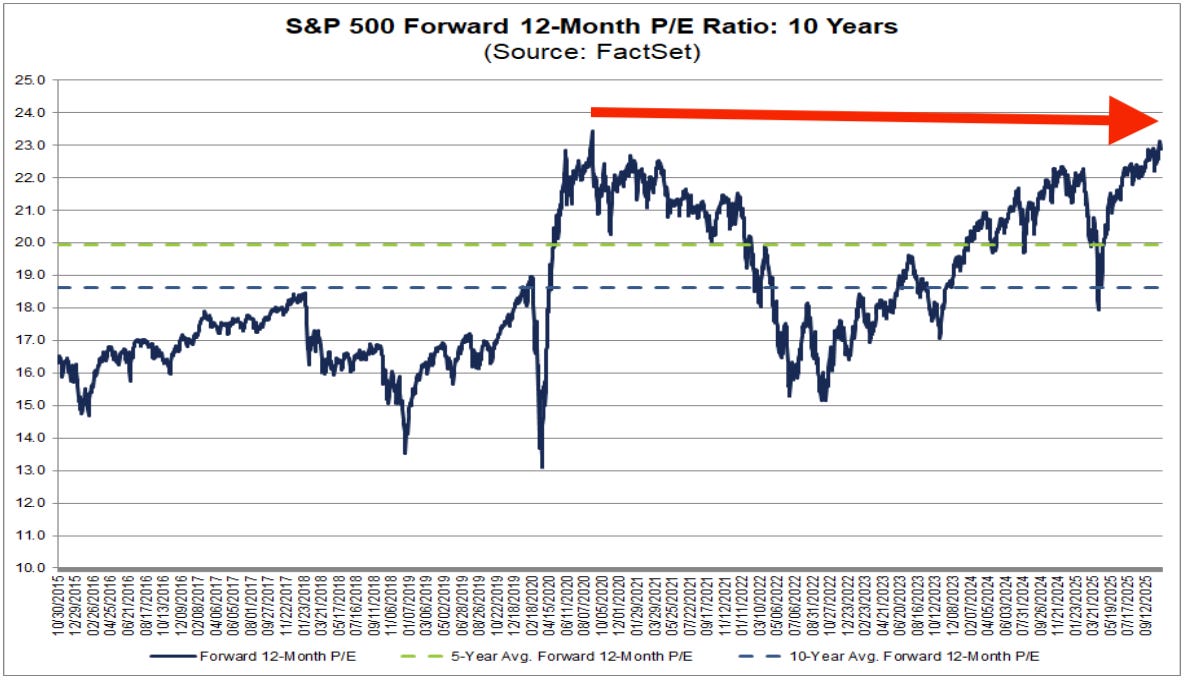

According to FactSet, the forward price-earnings (P/E) multiple for the S&P 500 is 22.9x, which is significantly above its 10-year average of 18.6x.

So, what are we supposed to do with this information?

Some people may be inclined to dial back their exposure to stocks under the assumption that prices are due for a correction. Some might sell everything. Some might even short the market.

The problem is that valuation ratios alone aren’t particularly reliable predictors of where prices are headed. Forward P/Es tell you almost nothing about what prices will do over the next 12 months. P/E ratios seem to provide a stronger signal on long-term returns, but the signal is far from perfect.

We don’t have to go back too far to see another instance when the forward P/E was this high. In 2020, this metric surged as stock prices rebounded from their pandemic lows, topping out at 23.6x in August of that year.

The S&P 500 was trading at around 3,500 back then. And as always, there was a healthy mix of optimism and skepticism.

Today, the index is near 6,900.

That’s right. The S&P just about doubled in five years.

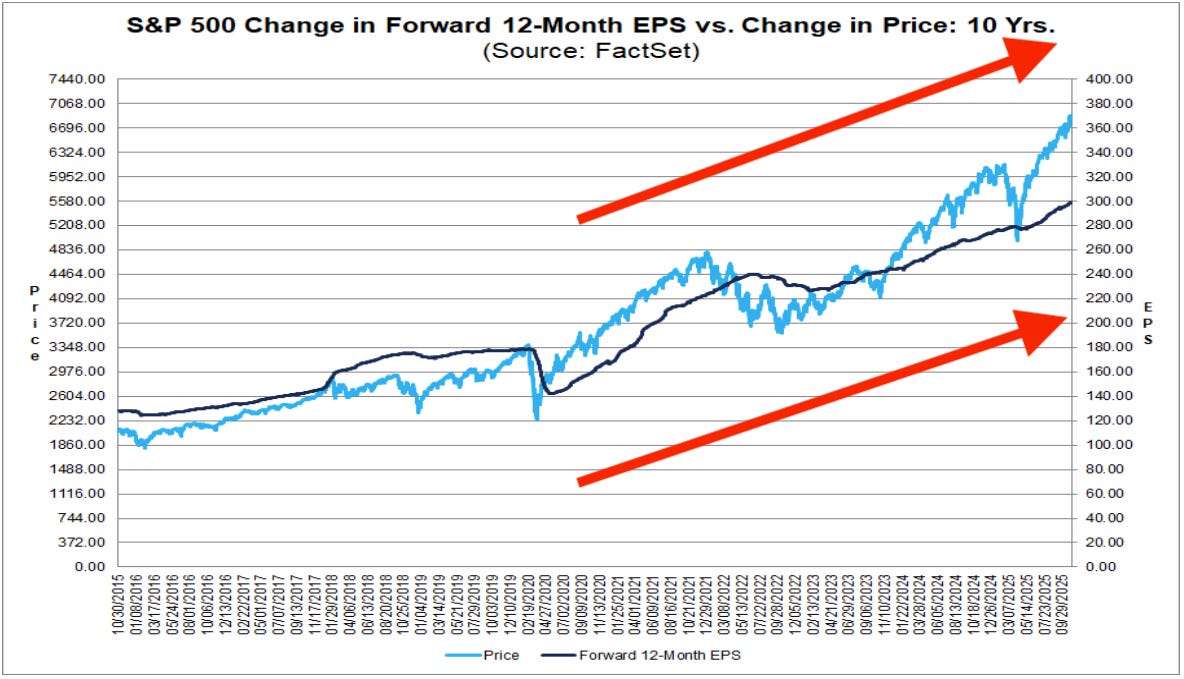

And if you’re keeping track of the math, the reason why stock prices doubled as the P/E ratio was relatively unchanged is because earnings also doubled during the period, bolstered by stubbornly high profit margins.

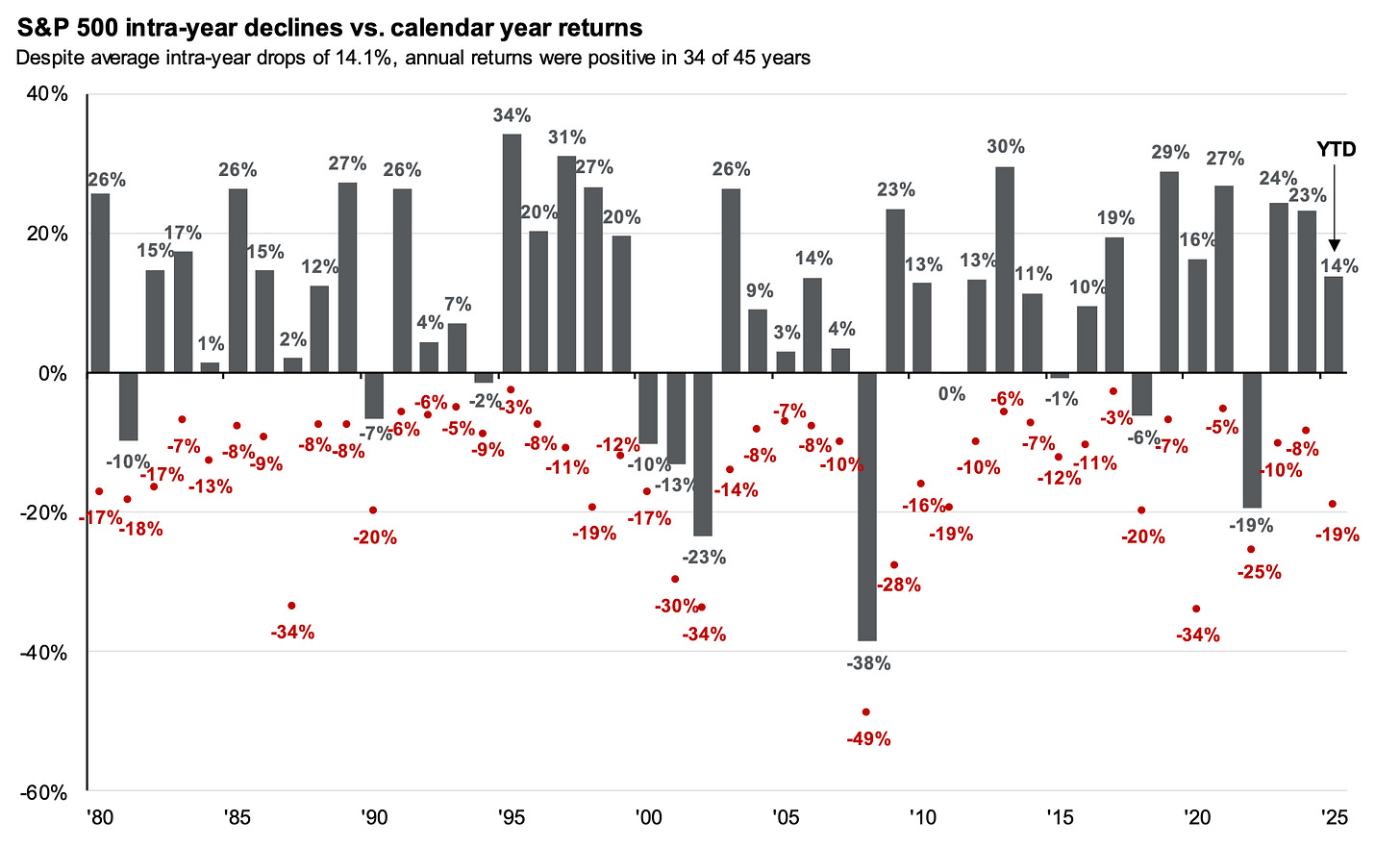

To be clear, this wasn’t smooth sailing. We had a bear market in 2022 and a 19% rout at the beginning of this year.

If you successfully sold the highs and bought the lows during that period, then I’m happy for you.

But most of us are terrible at timing the market in such a way that yields a return that’s better than simply holding or dollar-cost-averaging during the period.

Zooming out 🔭

Maybe we’re due for a correction that sees stock prices falling sharply lower, which would cause P/E multiples to move closer to their historical averages.

Or maybe valuations remain stretched.

Or maybe we get an outcome where prices climb and valuations come down.

“P/E multiples can compress from prices falling but also from earnings rising,” BofA’s Savita Subramanian wrote earlier this month.

That’s right. If earnings are heading higher, P/E multiples can actually come down as long as prices are rising at a slower rate.

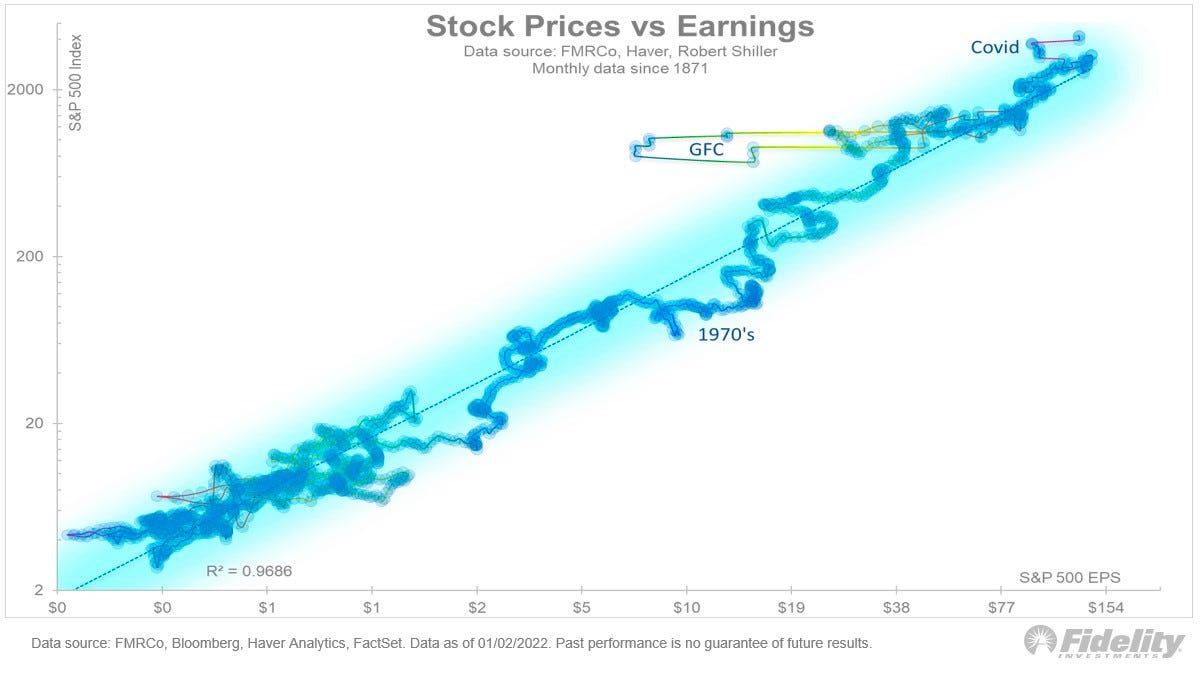

The critical variable we keep falling back on is earnings, which makes sense when you remember they’re the most important long-term driver of stock prices.

And fortunately for investors, earnings are expected to grow at a double-digit rate through at least 2027.

As long as valuations are elevated, expect to hear more about how the market is at greater risk of tumbling. Just keep in mind that market sell-offs are never guaranteed, and when they happen, they are incredibly difficult to trade profitably.

-

Related from TKer:

That time people freaked out about the CAPE ratio 10 years ago 😱

The intimidating math hurdle a beaten down stock market always clears 🙌

BofA: ‘Q: Is it better to sell early or late? A: Neither.’ ⏰

A time-tested way to buy stocks when the market is tumbling 📉

Watch! 📺

I caught up with Spencer Israel on Stock Market TV! We talked about market bubbles, the definition of bearishness, what it’s like to be an independent financial writer, and more! Check it out on YouTube here! (I come in at the 32-minute mark.)

Review of the macro crosscurrents 🔀

There were several notable data points and macroeconomic developments since our last review:

🚨Due to the government shutdown, we are not getting economic data from federal agencies, including the Census Bureau, the Bureau of Labor Statistics, and the Bureau of Economic Analysis. Until the government reopens, we’ll be leaning more on private sources of data.

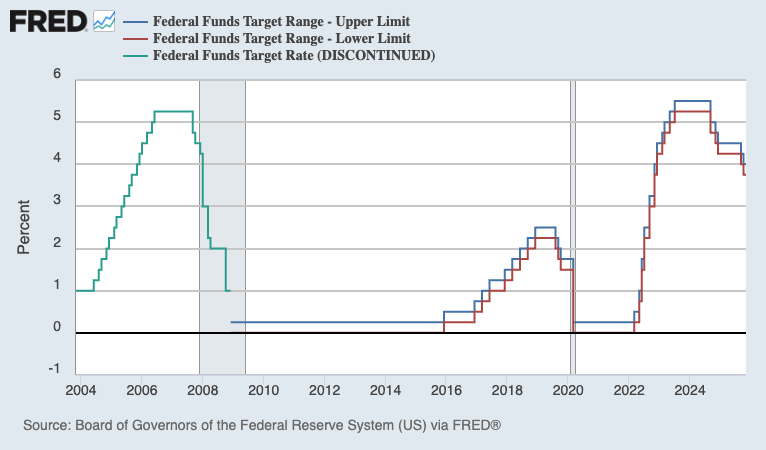

✂️ Fed cuts rates. On Wednesday, the Federal Reserve lowered its benchmark interest rate target range to 3.75% to 4%, down from 4% to 4.25%.

From the Fed’s policy statement: “Available indicators suggest that economic activity has been expanding at a moderate pace. Job gains have slowed this year, and the unemployment rate has edged up but remained low through August; more recent indicators are consistent with these developments. Inflation has moved up since earlier in the year and remains somewhat elevated.”

Regarding the next policy meeting, Powell said: “A further reduction in the policy rate at the December meeting is not a foregone conclusion — far from it.“

For more on what Fed policy could mean for markets, read: About Fed rate cuts and stocks ⚖️

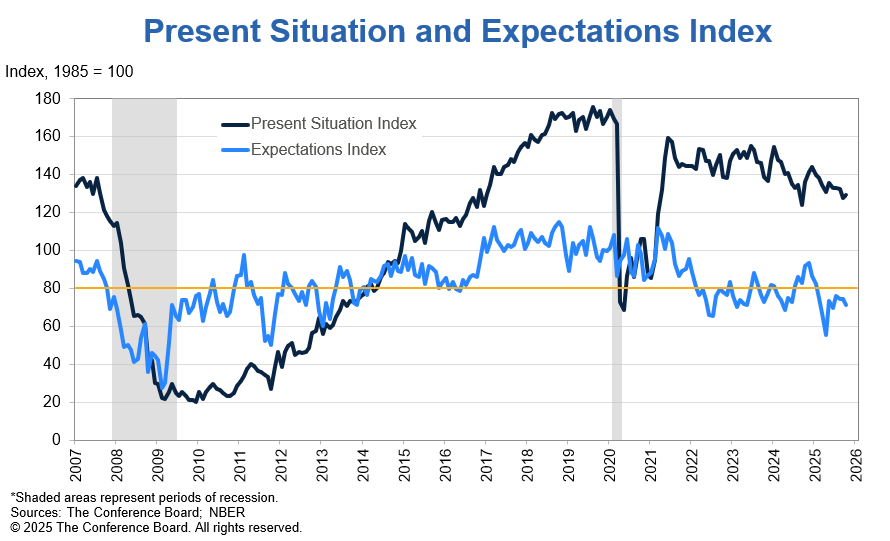

👎 Consumer confidence ticks lower. The Conference Board’s Consumer Confidence Index ticked 1 point lower in October. From the firm’s Stephanie Guichard: “The Present Situation Index regained some strength after September’s drop. Consumers’ view of current business conditions inched upward, while their appraisal of current job availability improved for the first time since December 2024. On the other hand, all three components of the Expectations Index weakened somewhat. Consumers were a bit more pessimistic about future job availability and future business conditions while optimism about future income retreated slightly.”

Relatively weak consumer sentiment readings appear to contradict relatively strong consumer spending data. For more on this contradiction, read: What consumers do > what consumers say 🙊 and We’re taking that vacation whether we like it or not 🛫

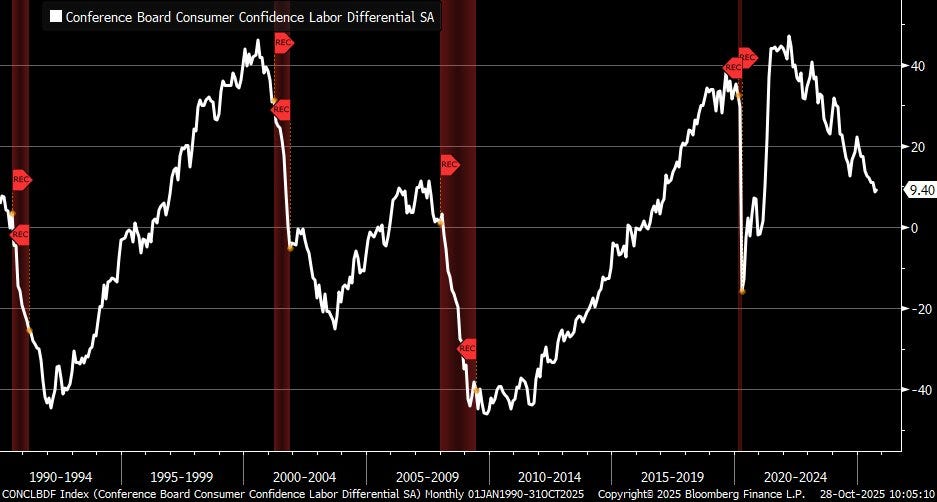

👎 Consumers don’t feel good about the labor market. From The Conference Board: “27.8% of consumers said jobs were ‘plentiful,’ up from 26.9% in September. Still, 18.4% of consumers said jobs were ‘hard to get,’ up from 18.2%.“

Many economists monitor the spread between these two percentages (a.k.a., the labor market differential). The direction of the spread reflects a cooling labor market.

From Schwab’s Kevin Gordon: “Some minor relief for the Conference Board’s labor differential in October ... downtrend still unmistakable, though.“

More from The Conference Board: “Consumers were more worried about the labor market outlook in October. 15.8% of consumers expected more jobs to be available, down from 16.6% in September. 27.8% anticipated fewer jobs, up from 25.7%.“

For more on the labor market, read: The labor market is cooling 💼

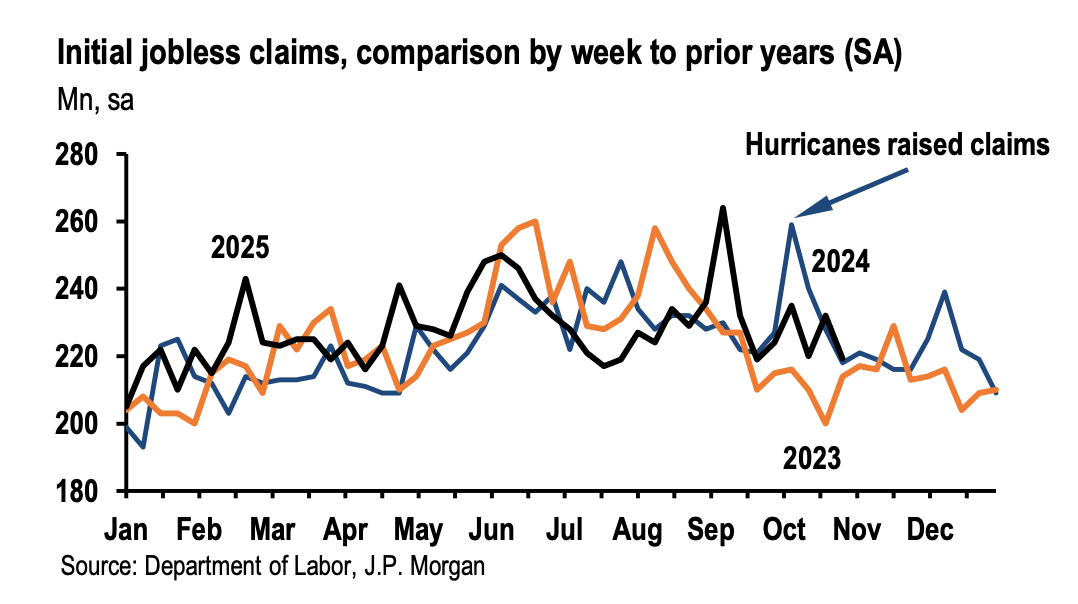

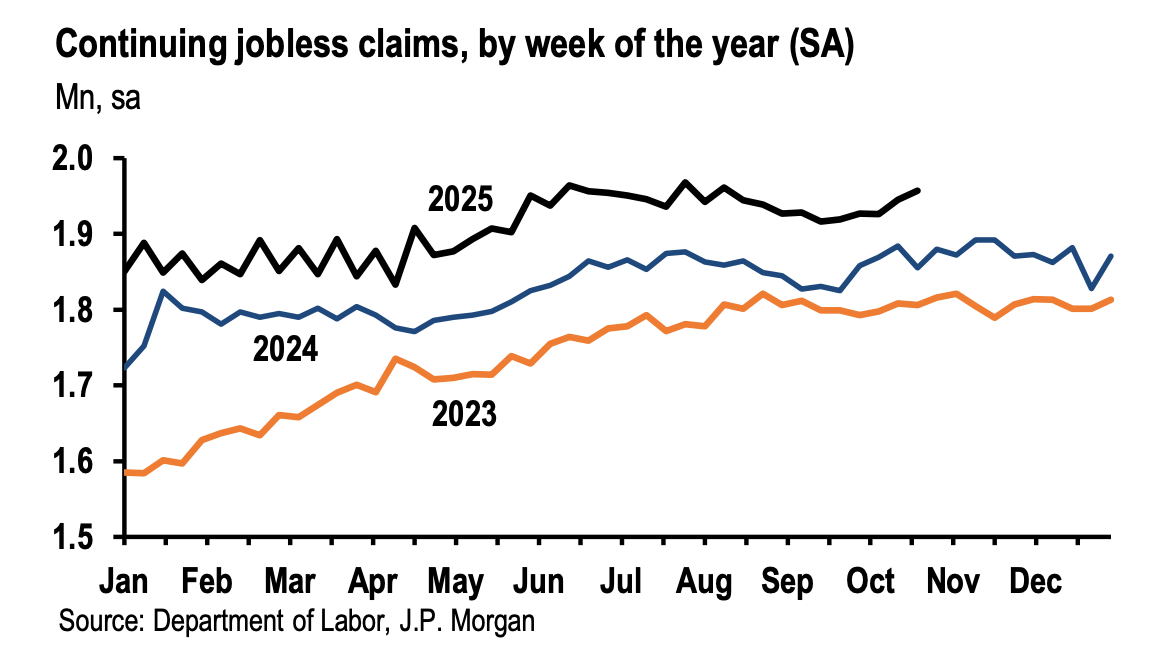

💼 Estimated new unemployment claims decline, total continuing claims rise. While the Department of Labor is not publishing unemployment claims reports, economists are estimating national numbers using state-level reports. From JPMorgan: “For the week ending October 25, initial claims dropped back to 219k from 232k in the prior week. This number is based on aggregating the available state data, which excluded reported values for Arizona and Massachusetts — two states that have frequently failed to report figures on Thursdays since the federal government shutdown began — as well as the District of Columbia. We extrapolated the missing values based on how they changed during the same week one year earlier in the non-seasonally adjusted data, then applied the seasonal factors to the resulting NSA state aggregate. Last week’s increase appeared concerning against the historical seasonal pattern of declines around this time of year, but the latest figure is more aligned with these prior dynamics over the year.“

From JPMorgan: “Continuing claims rose to a two-and-a-half-month high of 1.957 million for the week ending October 18, a further rise from the 1.945 million recorded the previous week. The same states as above failed to release figures for the current reporting period.“

Low initial claims confirm suggest layoff activity remains low. Elevated continued claims confirm hiring activity is weakening. This dynamic warrants close attention, as it reflects a deteriorating labor market.

For more context, read: The hiring situation 🧩 and The labor market is cooling 💼

👎 Job growth is low. According to payroll processor ADP, private U.S. employers added just 14,250 jobs in the four weeks ending Oct. 11.

Reacting to the report, Renaissance Macro’s Neil Dutta warned that this pace of job creation “would not be enough to keep the unemployment rate from rising.“

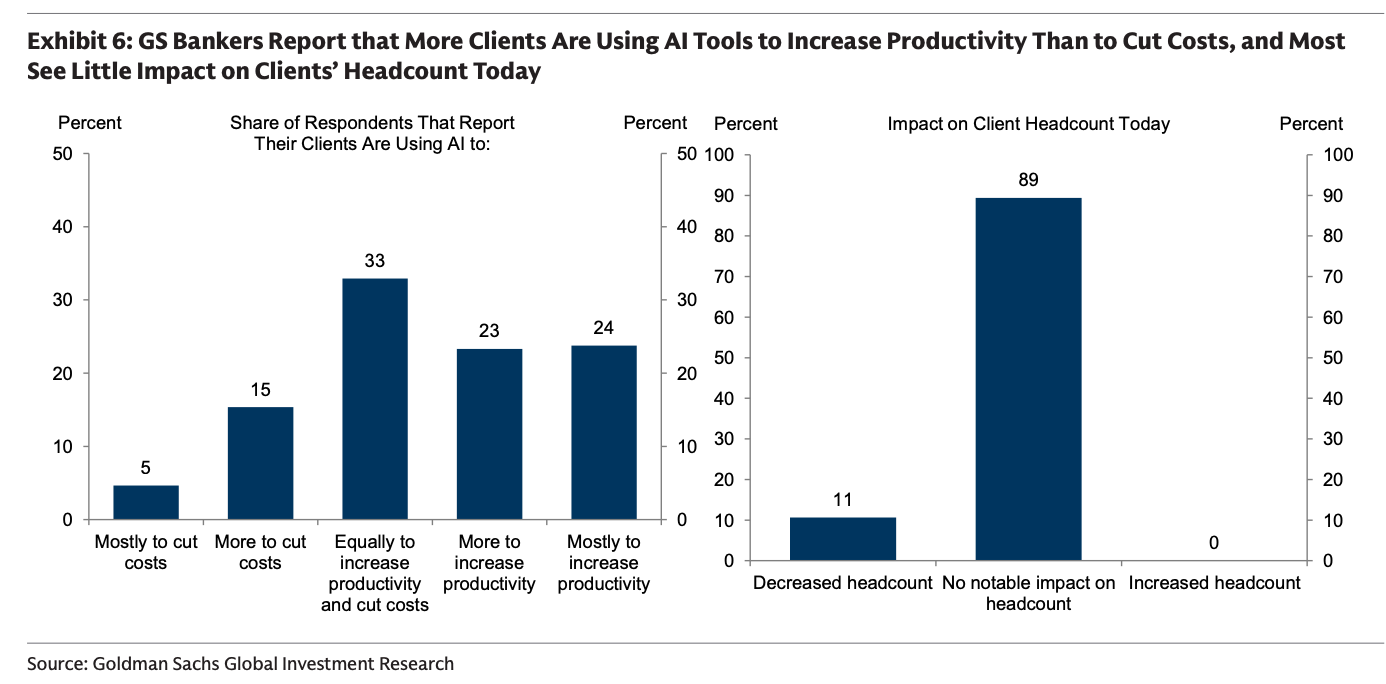

🤖 Companies are using AI for productivity. From Goldman Sachs’ survey of its investment bankers: “AI has so far been more used to increase productivity and revenue (47%) than to cut costs (20%). Furthermore, our survey suggests that only 11% of US companies are actively reducing headcount due to AI.”

For more on how AI could affect the economy, read: The next couple of years for the job market could be tough 🫤

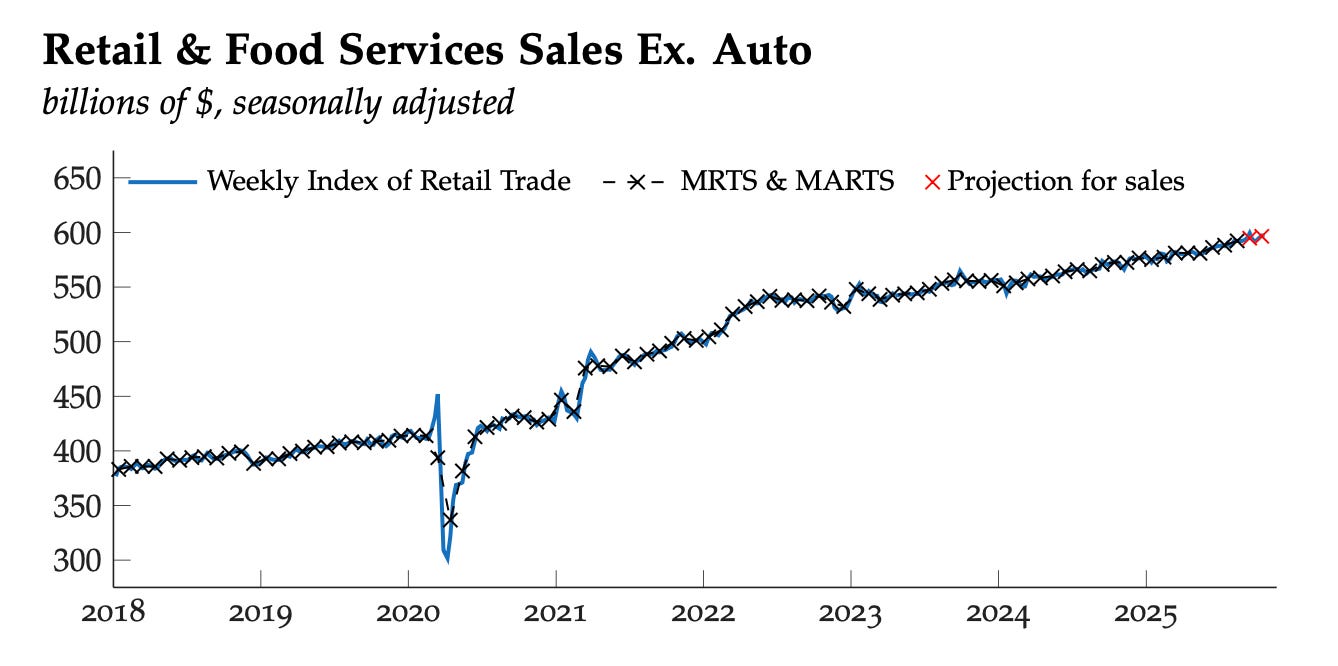

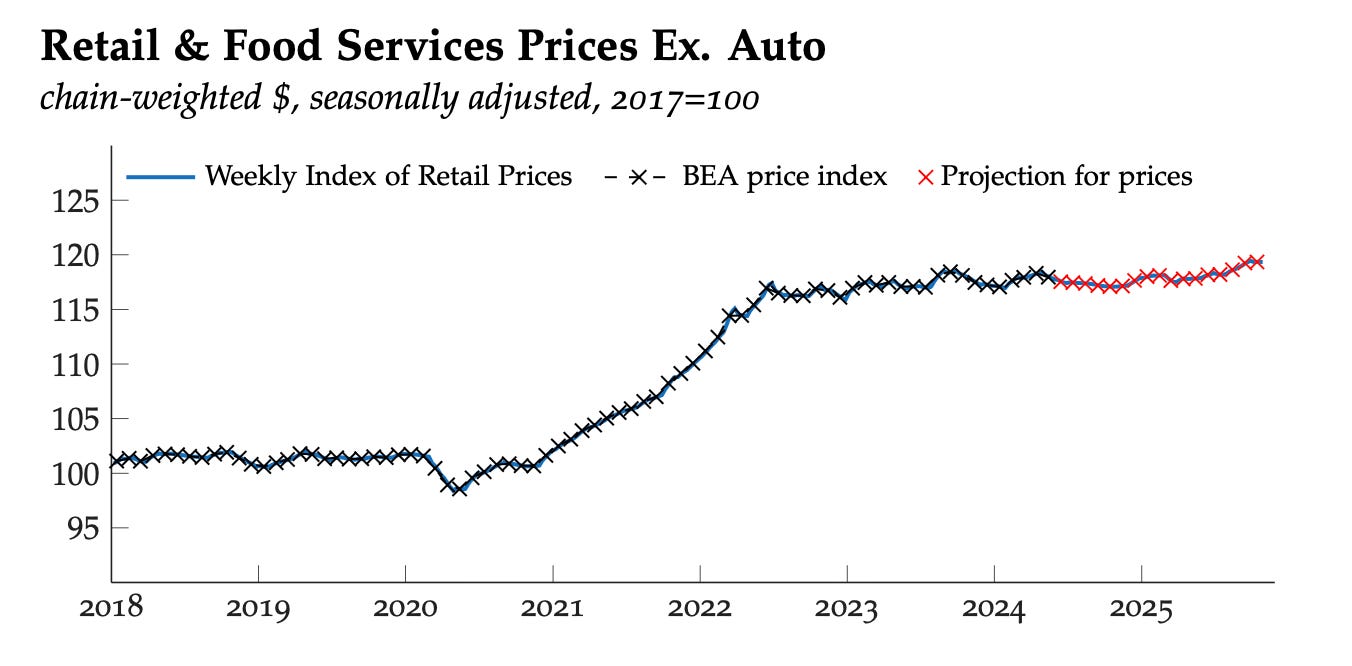

🛍️ Retail sales are holding up. According to the Chicago Fed’s Advance Retail Trade Summary, sales climbed 0.3% in October.

Adjusted for inflation, sales were up 0.2% during the period.

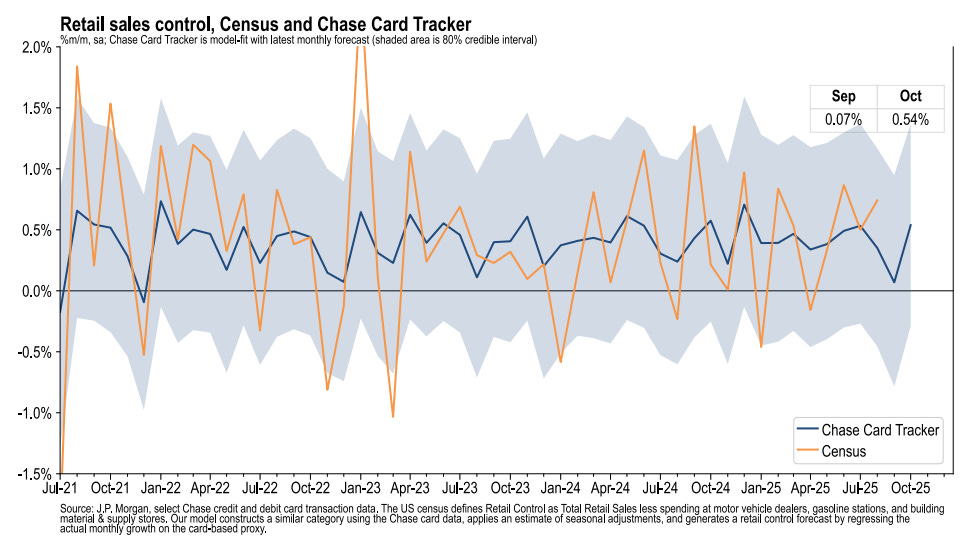

💳 Card spending data is holding up. From JPMorgan: “As of 24 Oct 2025, our Chase Consumer Card spending data (unadjusted) was 1.8% above the same day last year. Based on the Chase Consumer Card data through 24 Oct 2025, our estimate of the US Census September control measure of retail sales m/m is 0.07%.”

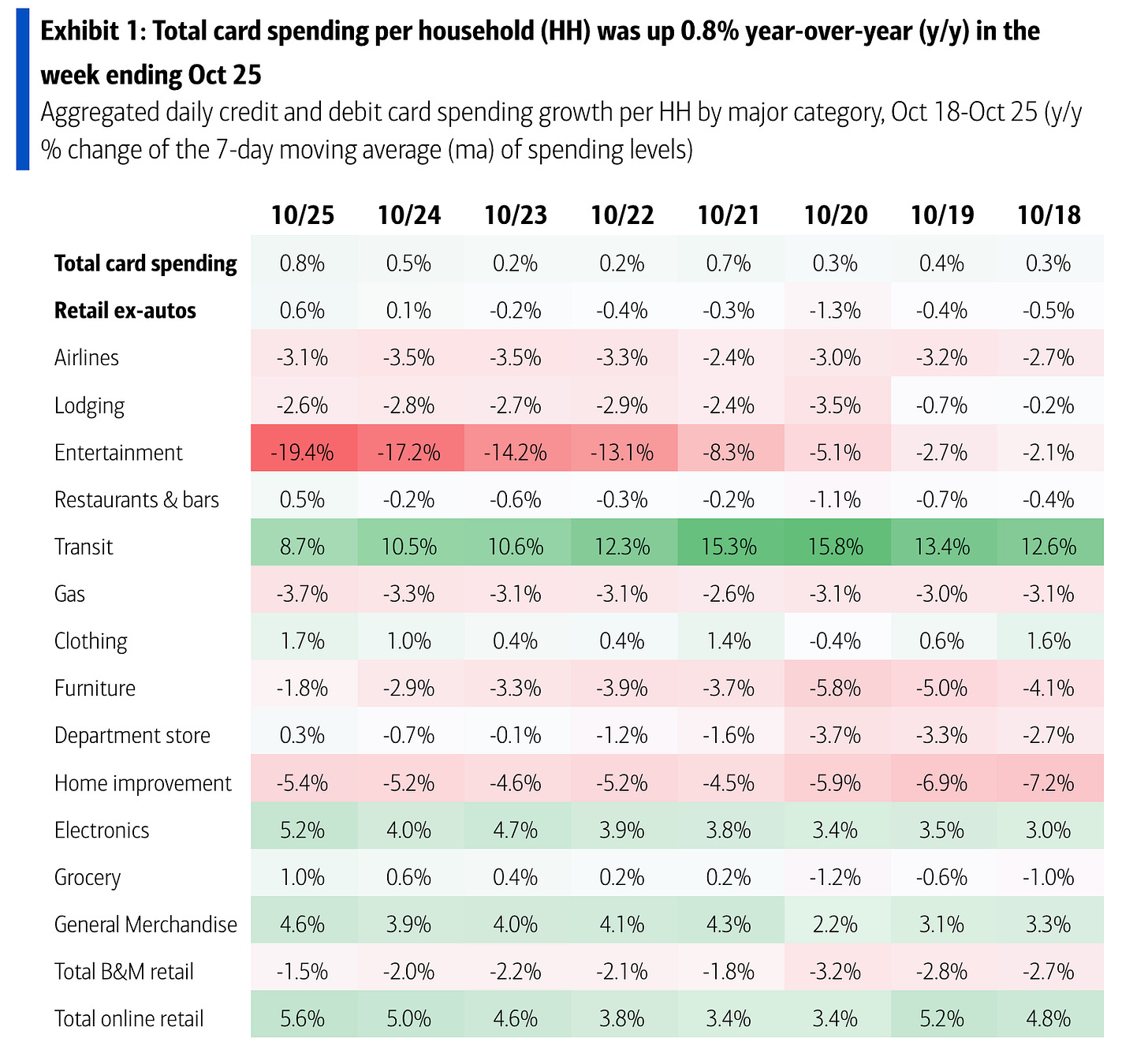

From BofA: “Total card spending per HH was up 0.8% y/y in the week ending Oct 25, according to BAC aggregated credit & debit card data. Y/y entertainment spending growth saw the biggest decline since last week. Department stores saw the biggest rise. Total card spending growth was up 0.4% y/y in week ending Oct 25 in DC MSA after a pull back last week.“

For more on economic activity, read: 9 once-hot economic charts that cooled 📉 and We’re at an economic tipping point ⚖️

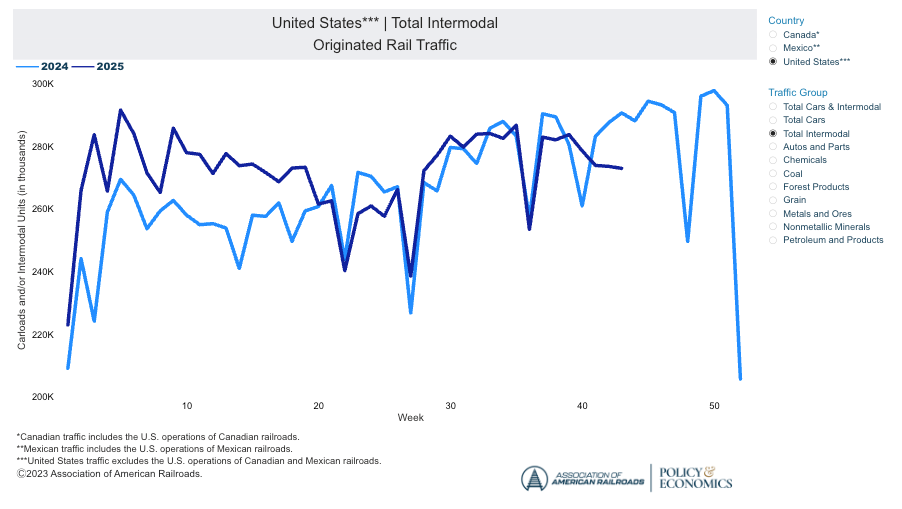

🚂 Freight rail traffic is down. Here’s Renaissance Macro’s Neil Dutta on AAR data: “Intermodal railcar loadings have declined against last year. For the week ending October 25, intermodal railcar loadings have declined 5.4 percent against the same week a year ago. Typically, we see intermodal carloads rising heading into this time of year. Perhaps inventories are not rising all that much heading into the holiday shopping season?“

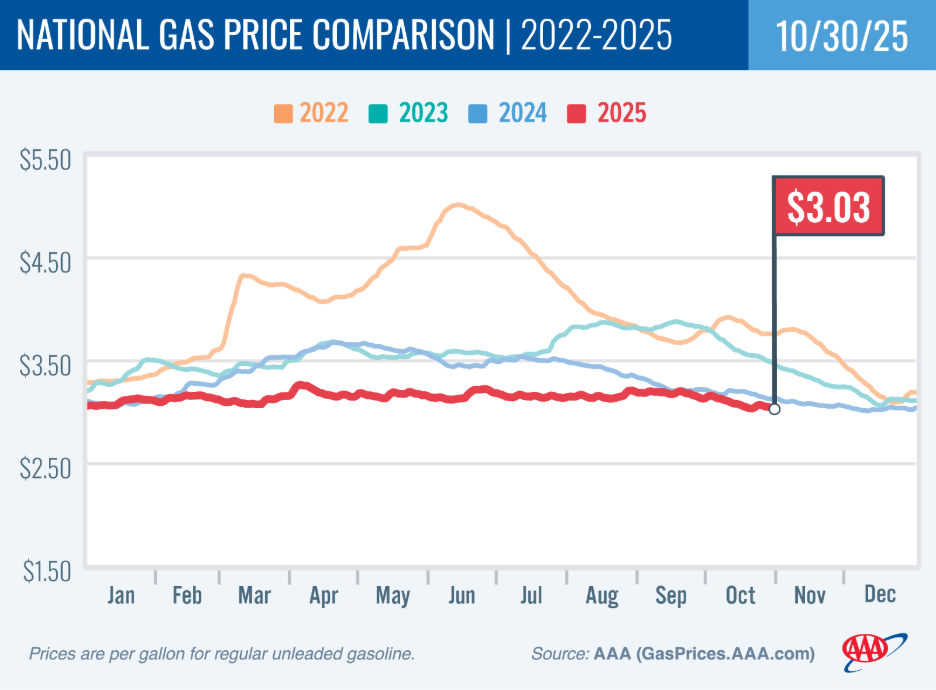

⛽️ Gas prices tick lower. From AAA: “The national average for a gallon of regular was $3.15 one month ago and $3.07 a week ago. Today, the average is $3.03, once again creeping closer to the 3-dollar mark but not quite there yet. Gas prices have been cruising this month, as crude oil prices have remained relatively low due to higher supply and lower demand. Heading into November, drivers may see gas prices continue to fall and perhaps stay low over the busy Thanksgiving travel period.”

For more on energy prices, read: Higher oil prices meant something different in the past 🛢️

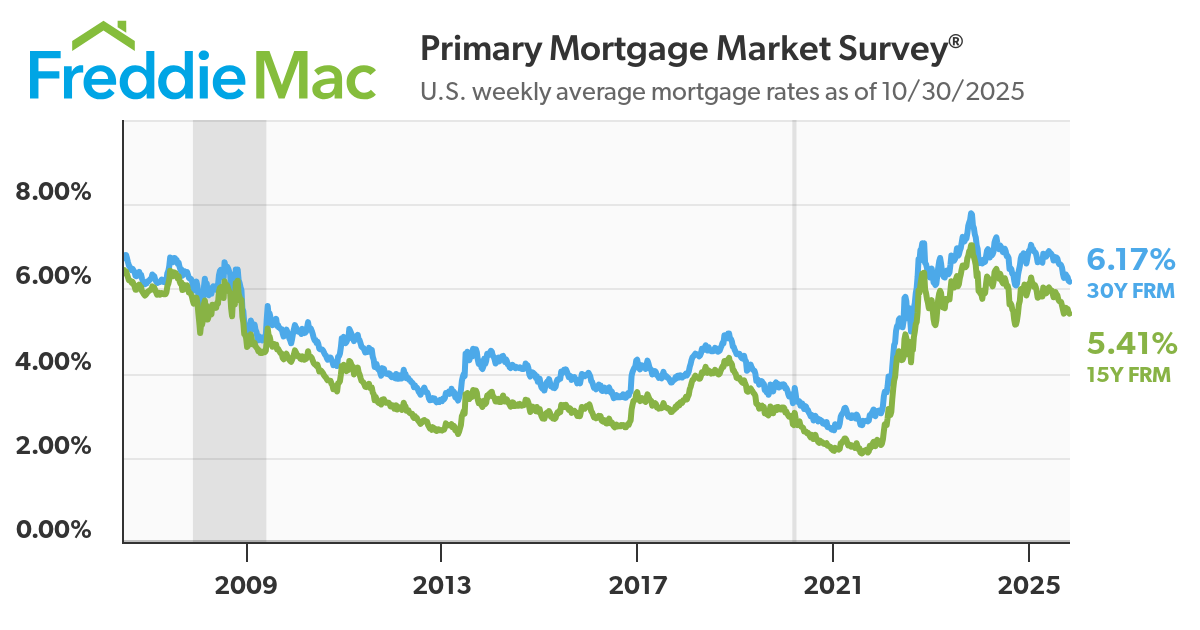

🏠 Mortgage rates tick lower. According to Freddie Mac, the average 30-year fixed-rate mortgage declined to 6.17%, down from 6.19% last week: “Mortgage rates decreased for the fourth consecutive week. The last few months have brought lower rates and homebuyers are increasingly entering the market.”

As of the summer, there were 147.9 million housing units in the U.S., of which 86.1 million were owner-occupied and about 39% were mortgage-free. Of those carrying mortgage debt, almost all have fixed-rate mortgages, and most of those mortgages have rates that were locked in before rates surged from 2021 lows. All of this is to say: Most homeowners are not particularly sensitive to the small weekly movements in home prices or mortgage rates.

For more on mortgages and home prices, read: Why home prices and rents are creating all sorts of confusion about inflation 😖

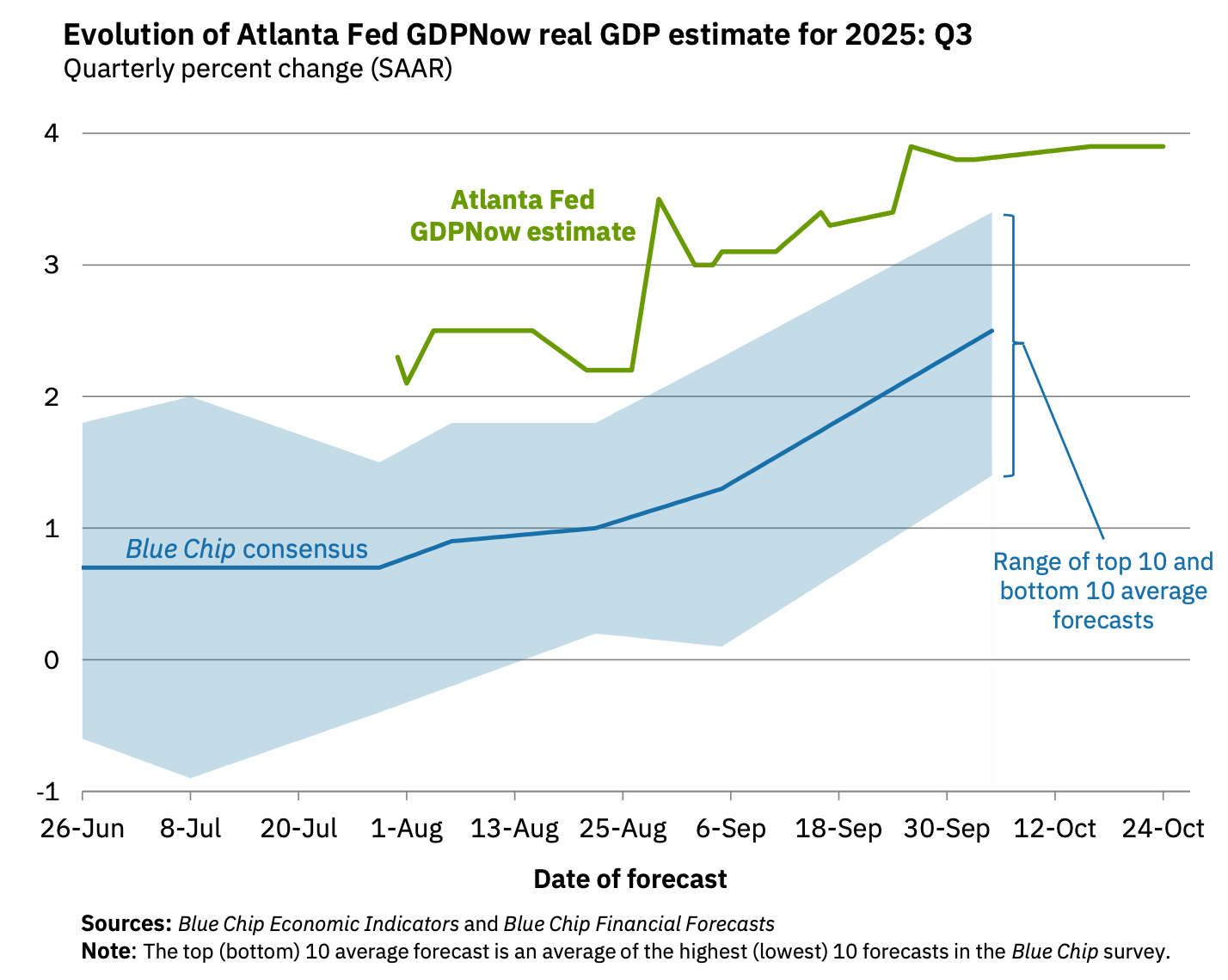

📈 Near-term GDP growth estimates are tracking positively. The Atlanta Fed’s GDPNow model sees real GDP growth rising at a 3.9% rate in Q3.

For more on GDP and the economy, read: 9 once-hot economic charts that cooled 📉 and We’re at an economic tipping point ⚖️

Putting it all together 📋

🚨 The Trump administration’s pursuit of tariffs is disrupting global trade, with significant implications for the U.S. economy, corporate earnings, and the stock market. Until we get more clarity, here’s where things stand:

Earnings look bullish: The long-term outlook for the stock market remains favorable, bolstered by expectations for years of earnings growth. And earnings are the most important driver of stock prices.

Demand is positive: Demand for goods and services remains positive, supported by healthy consumer and business balance sheets. Job creation, although cooling, also remains positive, and the Federal Reserve — having resolved the inflation crisis — shifted its focus toward supporting the labor market.

But growth is cooling: While the economy remains healthy, growth has normalized from much hotter levels earlier in the cycle. The economy is less “coiled” these days as major tailwinds like excess job openings and core capex orders have faded. It has become harder to argue that growth is destiny.

Actions speak louder than words: We are in an odd period, given that the hard economic data decoupled from the soft sentiment-oriented data. Consumer and business sentiment has been relatively poor, even as tangible consumer and business activity continues to grow and trend at record levels. From an investor’s perspective, what matters is that the hard economic data continues to hold up.

Stocks are not the economy: There’s a case to be made that the U.S. stock market could outperform the U.S. economy in the near term, thanks largely to positive operating leverage. Since the pandemic, companies have aggressively adjusted their cost structures. This came with strategic layoffs and investment in new equipment, including hardware powered by AI. These moves are resulting in positive operating leverage, which means a modest amount of sales growth — in the cooling economy — is translating to robust earnings growth.

Mind the ever-present risks: Of course, we should not get complacent. There will always be risks to worry about, such as U.S. political uncertainty, geopolitical turmoil, energy price volatility, and cyber attacks. There are also the dreaded unknowns. Any of these risks can flare up and spark short-term volatility in the markets.

Investing is never a smooth ride: There’s also the harsh reality that economic recessions and bear markets are developments that all long-term investors should expect as they build wealth in the markets. Always keep your stock market seat belts fastened.

Think long-term: For now, there’s no reason to believe there’ll be a challenge that the economy and the markets won’t be able to overcome over time. The long game remains undefeated, and it’s a streak that long-term investors can expect to continue.

For more on how the macro story is evolving, check out the previous review of the macro crosscurrents. »

Key insights about the stock market 📈

Here’s a roundup of some of TKer’s most talked-about paid and free newsletters about the stock market. All of the headlines are hyperlinked to the archived pieces.

10 truths about the stock market 📈

The stock market can be an intimidating place: It’s real money on the line, there’s an overwhelming amount of information, and people have lost fortunes in it very quickly. But it’s also a place where thoughtful investors have long accumulated a lot of wealth. The primary difference between those two outlooks is related to misconceptions about the stock market that can lead people to make poor investment decisions.

The makeup of the S&P 500 is constantly changing 🔀

Passive investing is a concept usually associated with buying and holding a fund that tracks an index. And no passive investment strategy has attracted as much attention as buying an S&P 500 index fund. However, the S&P 500 — an index of 500 of the largest U.S. companies — is anything but a static set of 500 stocks.

The key driver of stock prices: Earnings💰

For investors, anything you can ever learn about a company matters only if it also tells you something about earnings. That’s because long-term moves in a stock can ultimately be explained by the underlying company’s earnings, expectations for earnings, and uncertainty about those expectations for earnings. Over time, the relationship between stock prices and earnings has a very tight statistical relationship.

Stomach-churning stock market sell-offs are normal🎢

Investors should always be mentally prepared for some big sell-offs in the stock market. It’s part of the deal when you invest in an asset class that is sensitive to the constant flow of good and bad news. Since 1950, the S&P 500 has seen an average annual max drawdown (i.e., the biggest intra-year sell-off) of 14%.

How the stock market performed around recessions 📉📈

Every recession in history was different. And the range of stock performance around them varied greatly. There are two things worth noting. First, recessions have always been accompanied by a significant drawdown in stock prices. Second, the stock market bottomed and inflected upward long before recessions ended.

In the stock market, time pays ⏳

Since 1928, the S&P 500 has generated a positive total return more than 89% of the time over all five-year periods. Those are pretty good odds. When you extend the timeframe to 20 years, you’ll see that there’s never been a period where the S&P 500 didn’t generate a positive return.

What a strong dollar means for stocks 👑

While a strong dollar may be great news for Americans vacationing abroad and U.S. businesses importing goods from overseas, it’s a headwind for multinational U.S.-based corporations doing business in non-U.S. markets.

Stanley Druckenmiller's No. 1 piece of advice for novice investors 🧐

…you don't want to buy them when earnings are great, because what are they doing when their earnings are great? They go out and expand capacity. Three or four years later, there's overcapacity and they're losing money. What about when they're losing money? Well, then they’ve stopped building capacity. So three or four years later, capacity will have shrunk and their profit margins will be way up. So, you always have to sort of imagine the world the way it's going to be in 18 to 24 months as opposed to now. If you buy it now, you're buying into every single fad every single moment. Whereas if you envision the future, you're trying to imagine how that might be reflected differently in security prices.

Peter Lynch made a remarkably prescient market observation in 1994 🎯

Some event will come out of left field, and the market will go down, or the market will go up. Volatility will occur. Markets will continue to have these ups and downs. … Basic corporate profits have grown about 8% a year historically. So, corporate profits double about every nine years. The stock market ought to double about every nine years… The next 500 points, the next 600 points — I don’t know which way they’ll go… They’ll double again in eight or nine years after that. Because profits go up 8% a year, and stocks will follow. That's all there is to it.

Warren Buffett's 'fourth law of motion' 📉

Long ago, Sir Isaac Newton gave us three laws of motion, which were the work of genius. But Sir Isaac’s talents didn’t extend to investing: He lost a bundle in the South Sea Bubble, explaining later, “I can calculate the movement of the stars, but not the madness of men.” If he had not been traumatized by this loss, Sir Isaac might well have gone on to discover the Fourth Law of Motion: For investors as a whole, returns decrease as motion increases.

Most pros can’t beat the market 🥊

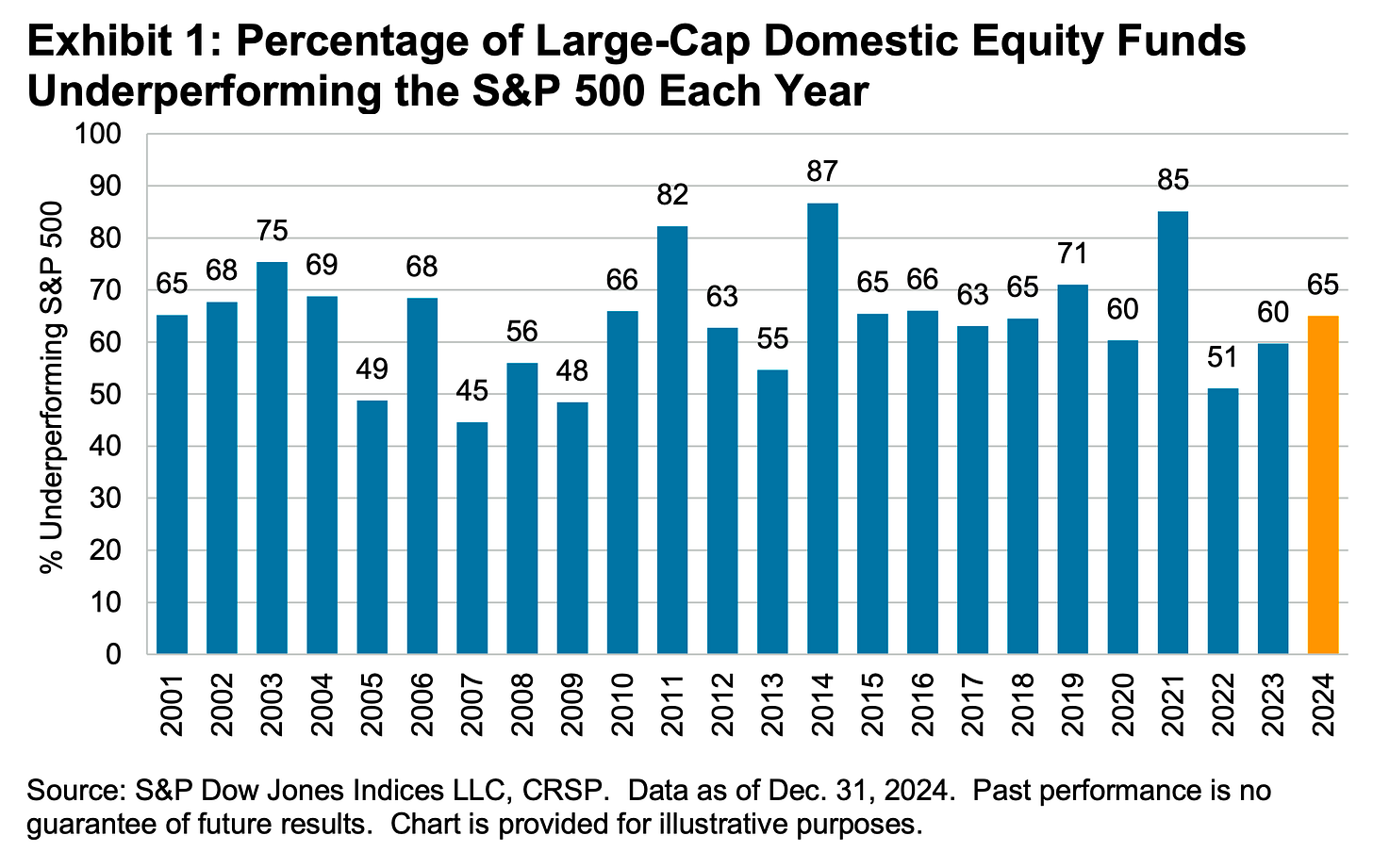

According to S&P Dow Jones Indices (SPDJI), 65% of U.S. large-cap equity fund managers underperformed the S&P 500 in 2024. As you stretch the time horizon, the numbers get even more dismal. Over a three-year period, 85% underperformed. Over a 10-year period, 90% underperformed. And over a 20-year period, 92% underperformed. This 2023 performance follows 14 consecutive years in which the majority of fund managers in this category have lagged the index.

Proof that 'past performance is no guarantee of future results' 📊

Even if you are a fund manager who generated industry-leading returns in one year, history says it’s an almost insurmountable task to stay on top consistently in subsequent years. According to S&P Dow Jones Indices, just 4.21% of all U.S. equity funds in the top half of performance during the first year were able to remain in the top during the four subsequent years. Only 2.42% of U.S. large-cap funds remained in the top half

SPDJI’s report also considered fund performance relative to their benchmarks over the past three years. Of 738 U.S. large-cap equity funds tracked by SPDJI, 50.68% beat the S&P 500 in 2022. Just 5.08% beat the S&P in the two years ending 2023. And only 2.14% of the funds beat the index over the three years ending in 2024.

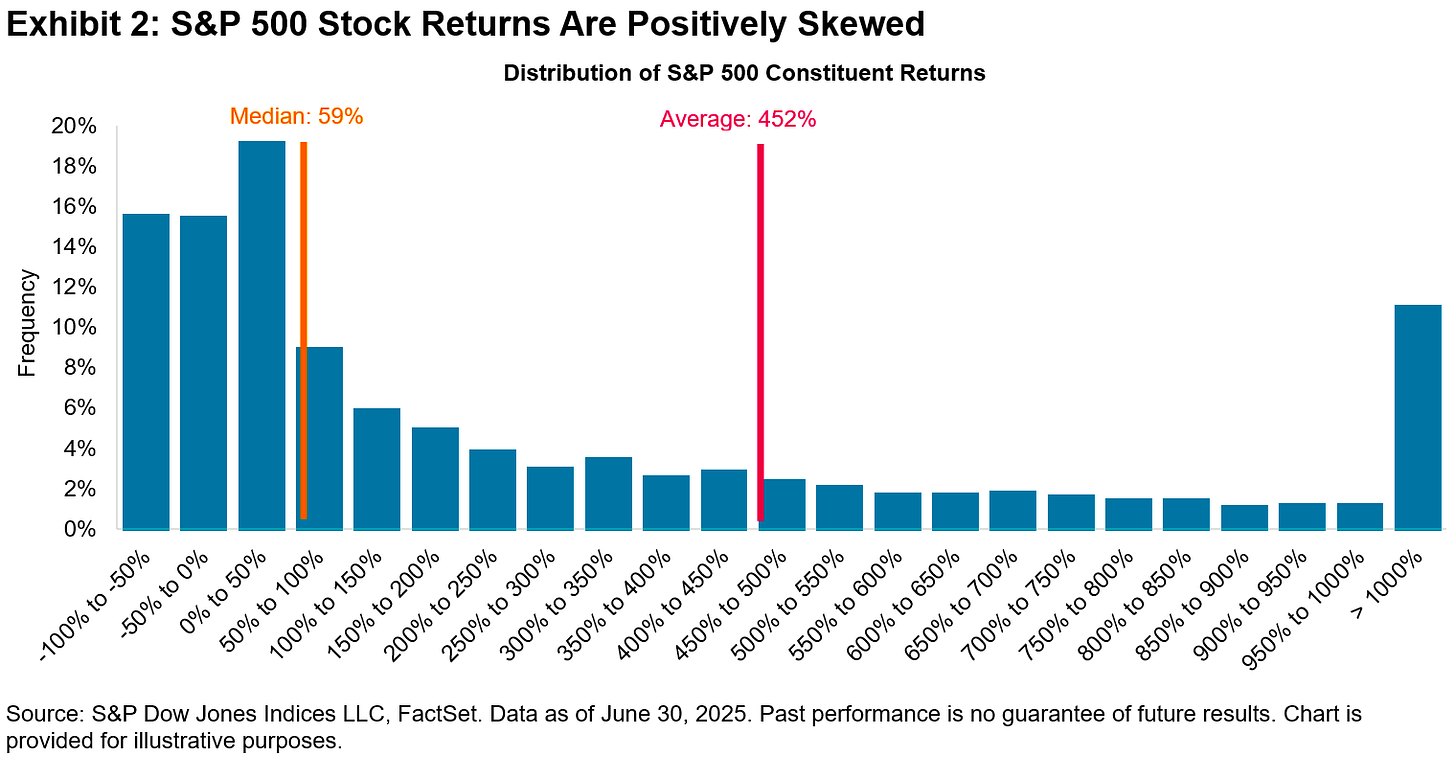

The odds are stacked against stock pickers 🎲

Picking stocks in an attempt to beat market averages is an incredibly challenging and sometimes money-losing effort. Most professional stock pickers aren’t able to do this consistently. One of the reasons for this is that most stocks don’t deliver above-average returns. According to S&P Dow Jones Indices, only 19% of the stocks in the S&P 500 outperformed the average stock’s return from 2001 to 2025. Over this period, the average return on an S&P 500 stock was 452%, while the median stock rose by just 59%.

Thank you as always! I have two questions here that have been floating in my brain as a economics/finance layperson. Per the post, consumer spending is still ticking up, but consumer sentiment is falling and continuing jobless claims are also rising. I'm curious, is there a tipping point number that continuing jobless claims could hit that would cause a drop in consumer spending?

I've also listened to some coverage saying that it's mostly higher income folks that are sustaining consumer spending growth. Is consumer spending impervious to the effects of joblessness until higher income folks are the ones who are being laid off and can't find a new job?