700+ reasons why S&P 500 index investing isn't very 'passive'💡

The S&P 500 dynasty has seen a lot of stocks get added and booted 🥾

Passive investing is a concept usually associated with buying and holding a fund that tracks an index. And no passive investment strategy has attracted as much attention as buying an S&P 500 index fund.1

However, the S&P 500 — an index of 500 of the largest U.S. companies — is anything but a static set of 500 stocks.2

This year alone, four names have been added (Constellation Energy, Nordson, Molina Healthcare, and Camden Property Trust) and four have been removed (Gap, Xilinx, IHS Markit, and People’s United Financial).

Some companies get dropped because they’re laggards — Gap was moved to the S&P MidCap 400. Some get replaced because they’ve been acquired — Camden Property Trust, IHS Markit, and Xilinx were all taken over by other companies.

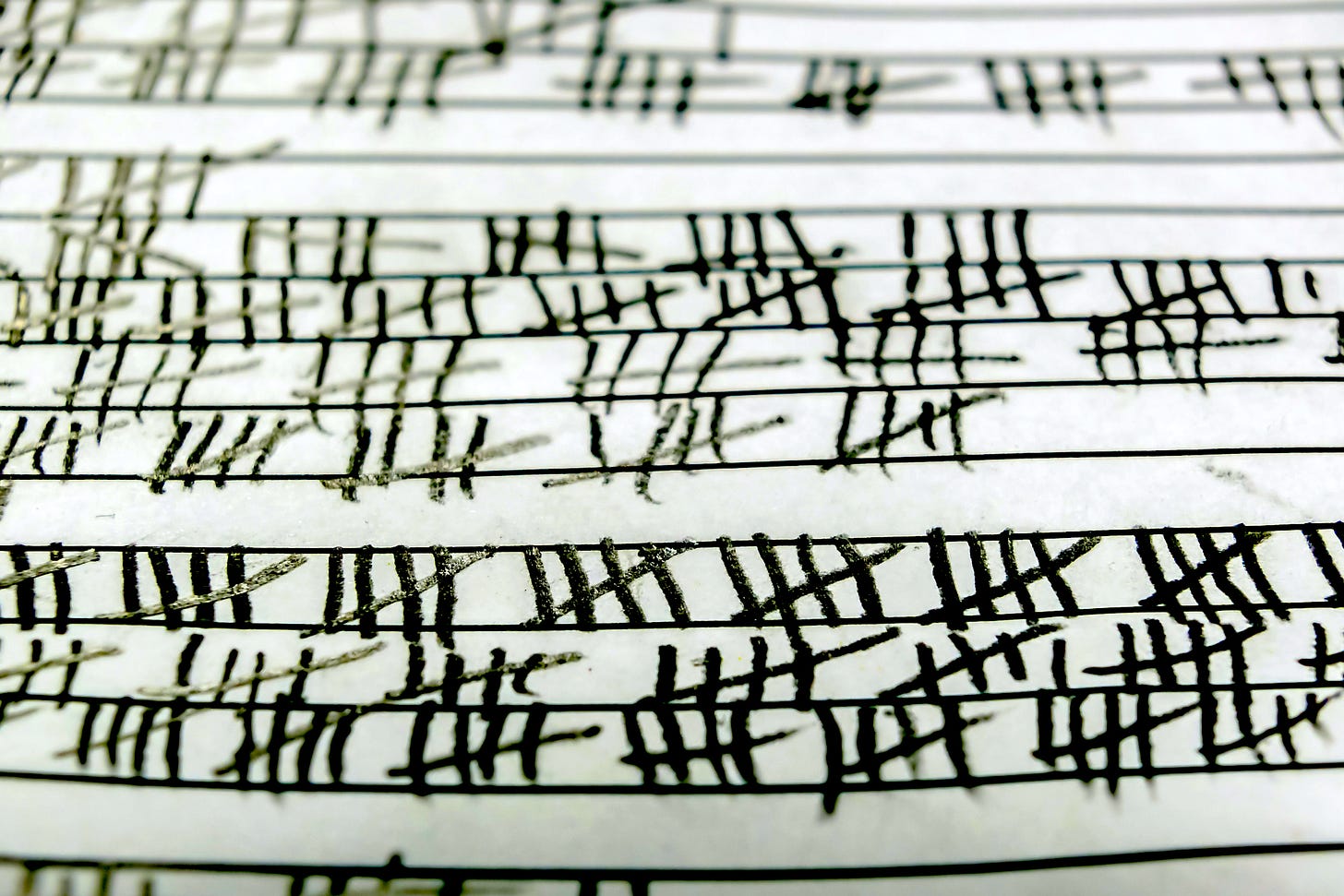

Since January 1995, 728 tickers have been added to the S&P 500, while 724 have been removed.3

This comes with two big implications.