Most stock-picking pros underperformed in 2024's market rally 🫤

New data confirms this persistent trend 📊

It remains incredibly difficult to generate returns in the stock market that beat (or outperform) a passively managed fund tracking the S&P 500.

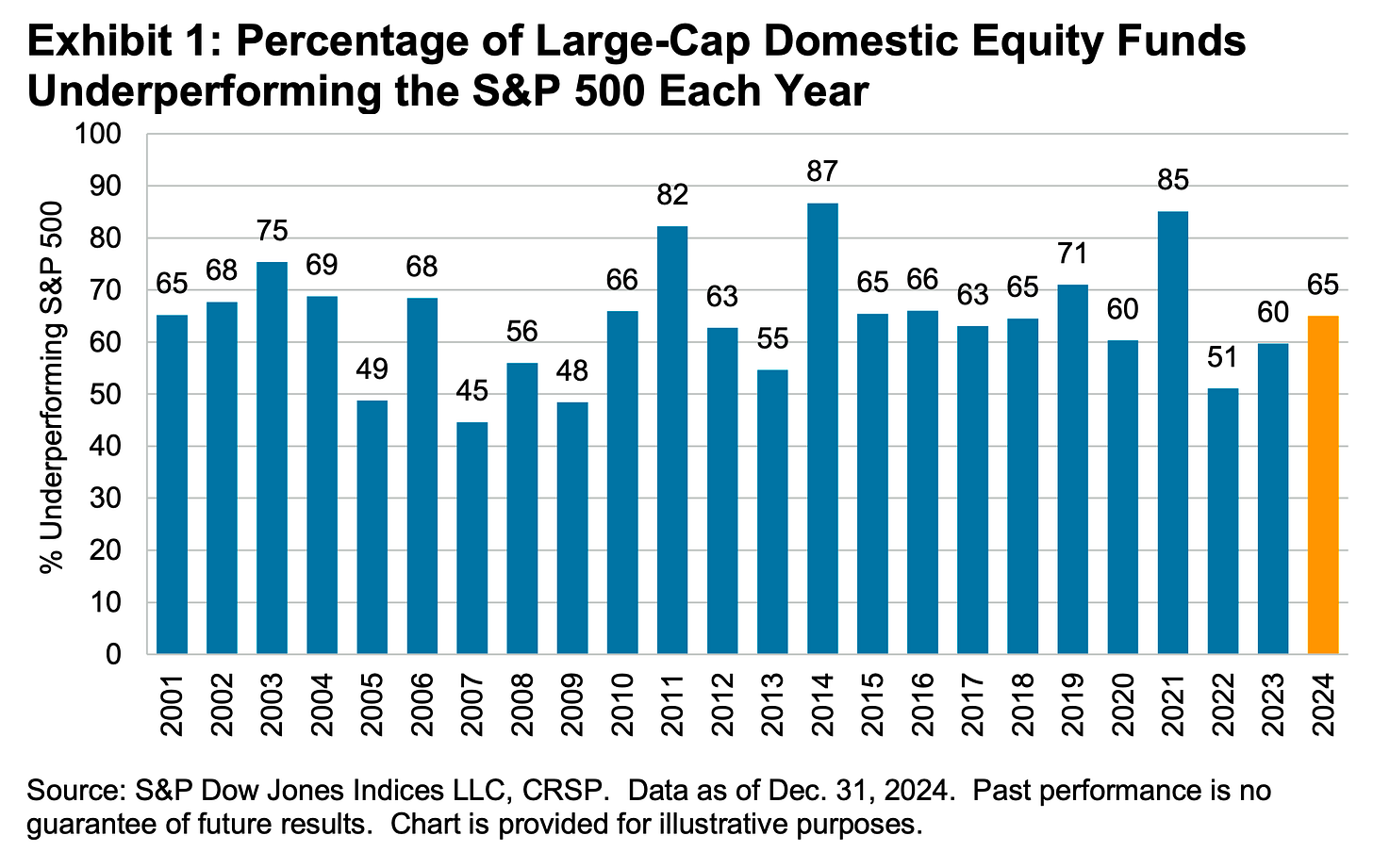

According to new data from S&P Dow Jones Indices (SPDJI), 65% of U.S. large-cap equity fund managers underperformed the S&P 500 in 2024.

The fact that a handful of “magnificent” stocks have been driving market performance continues to make things hard for stock pickers.

“When an index’s largest constituents are outperforming, active management may become especially challenging, since larger stocks are often underweighted by active managers,“ SPDJI’s Anu Ganti said. “Still, 35% of All Large-Cap funds managed to outperform The 500, so there may have been pockets of opportunity for nimble stock pickers.”

This 2024 performance follows 14 consecutive years in which the majority of fund managers in this category have lagged the index.

And as you stretch the time horizon, the numbers get even more dismal. Over a three-year period, 85% underperformed the S&P 500. Over a 15-year period, 90% underperformed. And over a 20-year period, 92% underperformed.

To be fair, the goal of every fund manager and investor isn’t necessarily to beat some benchmark. Nevertheless, for more active investors, seeing a low-cost index fund consistently produce better returns may be disheartening.

Past performance is no guarantee of future results 📉

Keep reading with a 7-day free trial

Subscribe to 📈 TKer by Sam Ro to keep reading this post and get 7 days of free access to the full post archives.