You can make any piece of data look bad if you try 🔄

Let's review 9 unsettling market observations that miss the point 🙃

There’s more than one way to frame a piece of economic or financial market data.

It might be better than expected relative to economists’ expectations, but it could also be worse than expected relative to traders’ expectations. That same stat could be down on a month over month basis and also up on a year over year basis. It may be high relative to the 10-year average but low relative to the 5-year average. It may look bad on an absolute basis but it may look good relative to what may be the normal course of business.

Consider the recent consumer price index report released on Wednesday. The inflation storyline has plenty of political implications these days, especially with midterm elections right around the corner. Following the report, the White House press secretary tweeted “our economy had 0% inflation in July.“ Critics, many of whom were motivated by the opposite political agenda, took issue with the White House touting the month-over-month figure while the year-over-year figure was 8.5%.

Both figures are accurate. But they each lead people to very different conclusions.

Kyla Scanlon has a great discussion on this in her newsletter (which is absolutely worth subscribing to):

…The thing is (and I think part of the reason people were mad) is when you say that things are getting better, people often interpret that as you saying that things are good.

Those are two different things - good versus getting better.

Velocity and acceleration. Inflation is still high - the car (inflation) is still zooming along, as shown in the first picture of this article - but it’s decelerating. The rate of change in July prices was zero.

There are all sorts of motivations for why someone will choose one framing over another. Maybe it better fits with your political agenda. Maybe it better confirms your priors. Maybe it helps bring clicks to your news site. Maybe it better explains the day’s market moves.

At TKer, we try to focus on the big picture. Specifically, we’re looking to understand what data tells us about the long-term themes that drive the markets and the economy over relatively long investment time horizons.

With that in mind, below are nine unsettling — albeit accurate — market observations that miss the point when you take a look at the big picture.

1. Companies announce layoffs ✂️

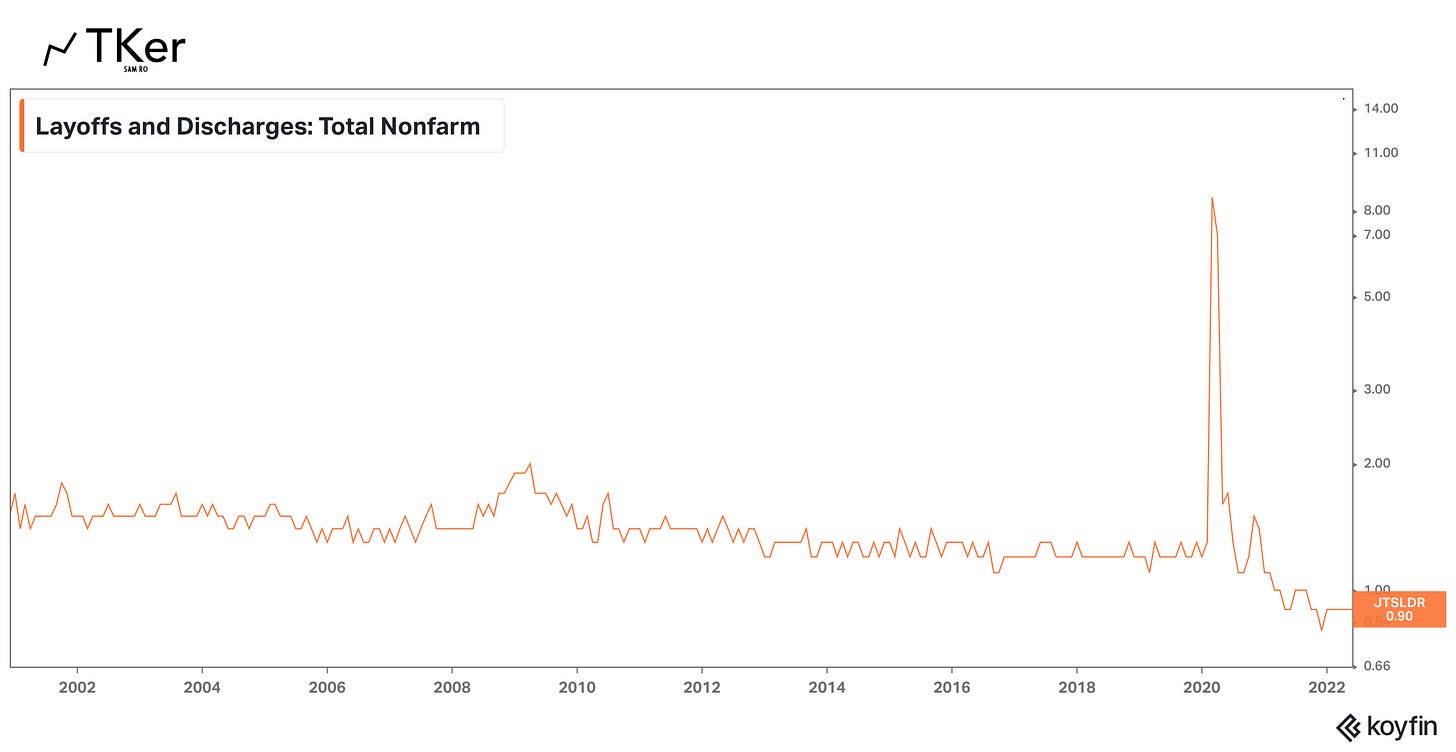

The reports are accurate. For months, layoffs have been affecting an array of companies, including well known names JPMorgan, Netflix, Tesla, Coinbase, Robinhood, and Peloton. And the numbers are not small. According to the BLS, 1.3 million workers were laid off in June alone. It’s an incredibly challenging situation for everyone impacted.

BUT, this is not yet a sign of a labor market downturn. Those 1.3 million layoffs represents represent about 0.9% of the 152 million employed during the period. Believe it or not, this is an unusually low layoff rate. In fact, the layoff rate has been below pre-pandemic lows for 16 straight months. Some experts even believe employers are actually reluctant to layoff workers despite the ongoing economic slowdown.

Read more about what’s going on with layoffs here and here.

2. Consumers are tapping into savings 💸

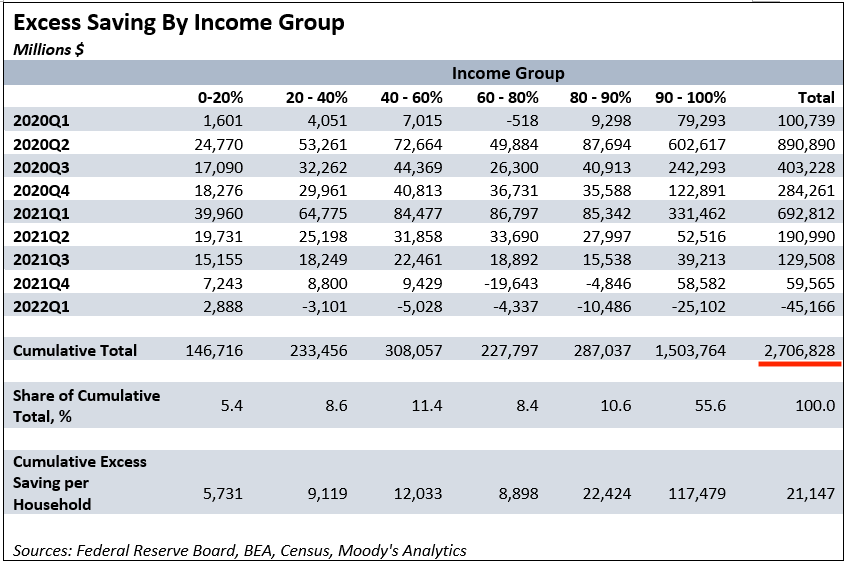

The reports are accurate. The personal saving rate is coming down, and consumers are drawing from the more than $2 trillion in estimated excess savings they have accumulated since the start of the pandemic.

BUT, the point of having a rainy day fund is so that you have something for rainy days, and these are rainy days. One of the most bullish aspects of excess savings is consumers have a much bigger financial cushion to fall back on should economic conditions turn against them. With inflation eating away at purchasing power, thank goodness consumers have savings to tap. This is a much better situation than one where consumers have to forego spending on critical goods.

Read more about the savings tailwind here and here.