Some top forecasters are making a bold 2026 prediction that market skeptics will hate 😤

Are high valuations justified? Are bubble-like valuations justified? Prominent strategists chime in ⚖️

Throughout history, the bearish cases against the stock market have almost always had one thing in common: They warned that valuations were high.

When a valuation metric like the price-earnings (P/E) ratio is above its historical average, it’s not unreasonable to argue the market is expensive. In fact, history says the market usually — but not always — generates below-average returns when the P/E is above-average.

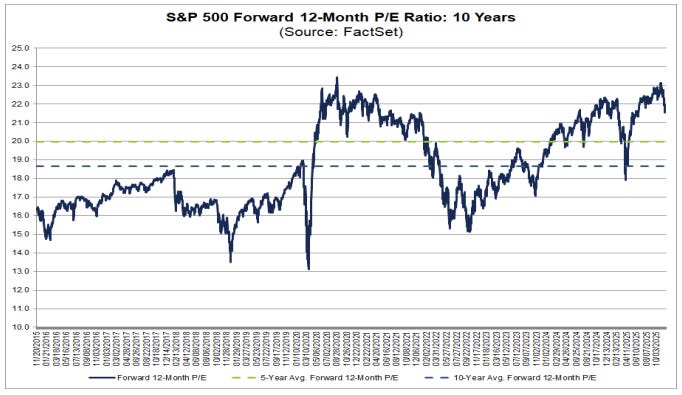

Lately, the most popular metric under scrutiny has been the forward (P/E) ratio, which has been hovering between 21x and 23x the next 12 months’ estimated earnings. It’s been notably above the 10-year average of 18.7, according to FactSet.

It’s a setup that often has strategists forecasting weak — or even negative — returns.

So it might surprise you to learn that several prominent Wall Street strategists are defending valuations at these levels as they forecast robust returns in the stock market in 2026.

“We expect equity valuations to remain elevated,” Deutsche Bank strategists wrote on Monday.

It’s a call that market skeptics are sure to hate.

Strategists from HSBC, Wells Fargo, and Morgan Stanley are also making the case for valuations staying high. Let’s dig into what they’re all saying.