One of the most misunderstood moments in stock market cycles ⏱️

Plus a charted review of the macro crosscurrents 🔀

📉 The stock market fell, with the S&P 500 shedding 2.3% last week to close at 5,638.94. It’s now down 9.2% from its February 19 closing high of 6144.15 and up 57.6% from its October 12, 2022 closing low of 3,577.03. For more on market moves, read: Investing in the stock market is an unpleasant process 📉

-

The stock market is a discounting mechanism, which means its price reflects expectations for the future, and its price fluctuations reflect the market’s attempt to factor in changes to those expectations.

Believe it or not, in a given moment, the stock market does not care too much about the present state of things. That’s because expectations for the present will have been priced into the market days, weeks, and months in the past.

That is to say, the stock market reacts to news to the degree the new information 1) is not in line with what the market expected for the present, and 2) changes what the market expects for the future.

There are some more factors that drive stock prices over time. But in the context of digesting major news headlines, these are the two relationships to watch.

Because the stock market is so heavily dependent on expectations for the future, we inevitably get moments when stock market behavior appears to conflict with information about the present. Specifically, we sometimes get stock prices falling amid good news and rising amid bad news.

These are some of the most misunderstood moments in stock market cycles.

That time stocks surged as the economy crashed 🤯

One of the more dumbfounding instances of this counterintuitive dynamic came during the spring of 2020 when the economy was reeling from the COVID-19 pandemic lockdowns.

After a sharp 35% drop, the S&P 500 bottomed and inflected upward on March 23 that year.

But we continued to get disastrous economic reports for weeks as the stock market rallied.

This resulted in one of the defining screengrabs of the pandemic. It was from the April 9 episode of “Mad Money with Jim Cramer.” Cramer’s show highlighted how the stock market had its best week in decades while the chyron reported the cumulative three-week tally of unemployment insurance claims ballooned to 16 million.

People were confused.

Yes, the economy was in bad shape in April. But expectations were already extremely low, which meant the bar for developments that could cause stocks to go higher was also very low.

In retrospect, it seems the stock market got it right.

It wasn’t until June that we learned job creation resumed in May. And it wasn’t until July 2021 that we learned that the recession had ended in April 2020.

The stock market, for its part, recovered all of its pandemic losses and reached new record highs in August 2020. (So, if you had dumped stocks as the news was getting bad and you had waited for good news to get back in, then you might’ve actually missed out on considerable gains you could’ve earned by just holding through the crisis.)

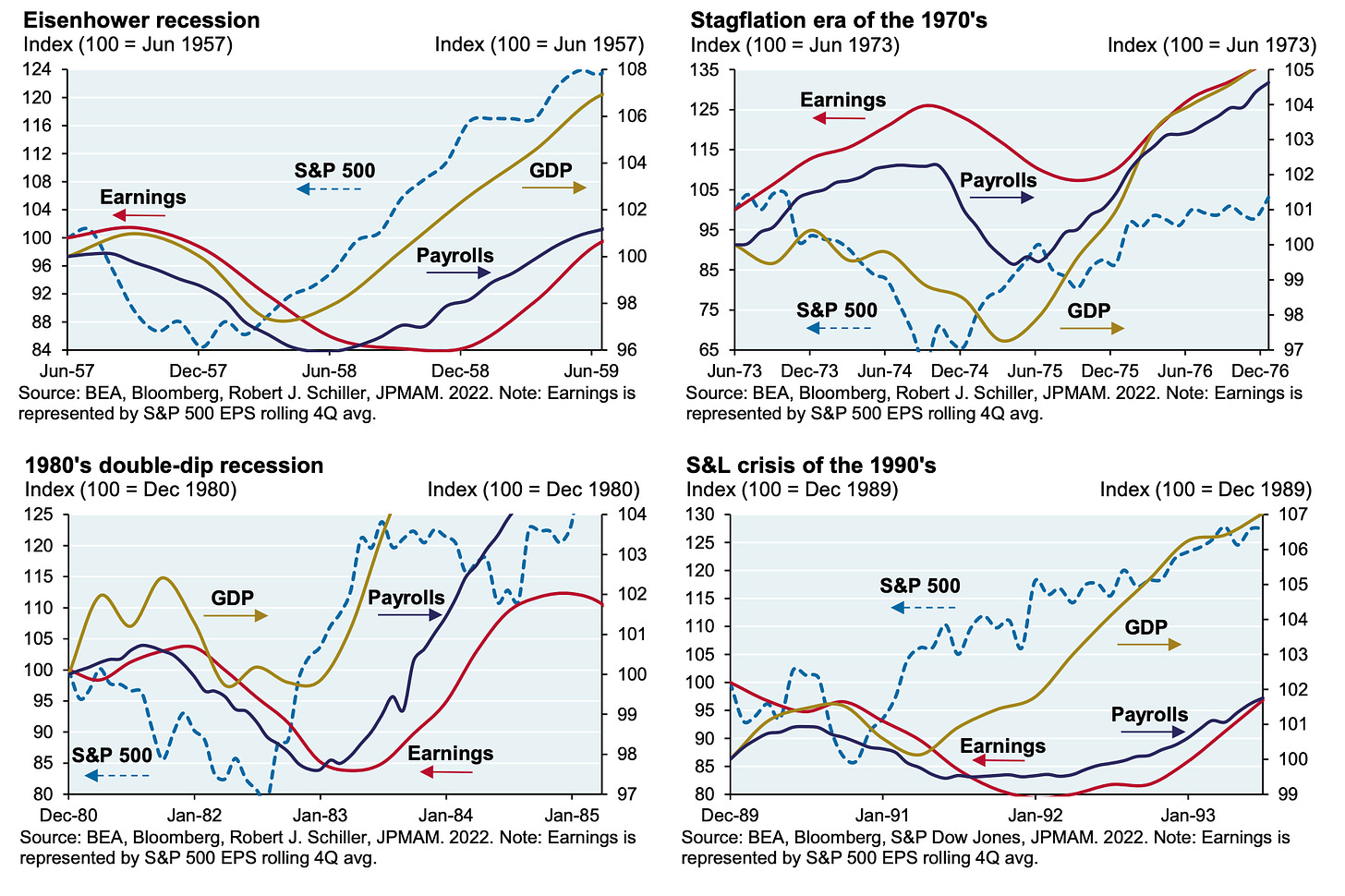

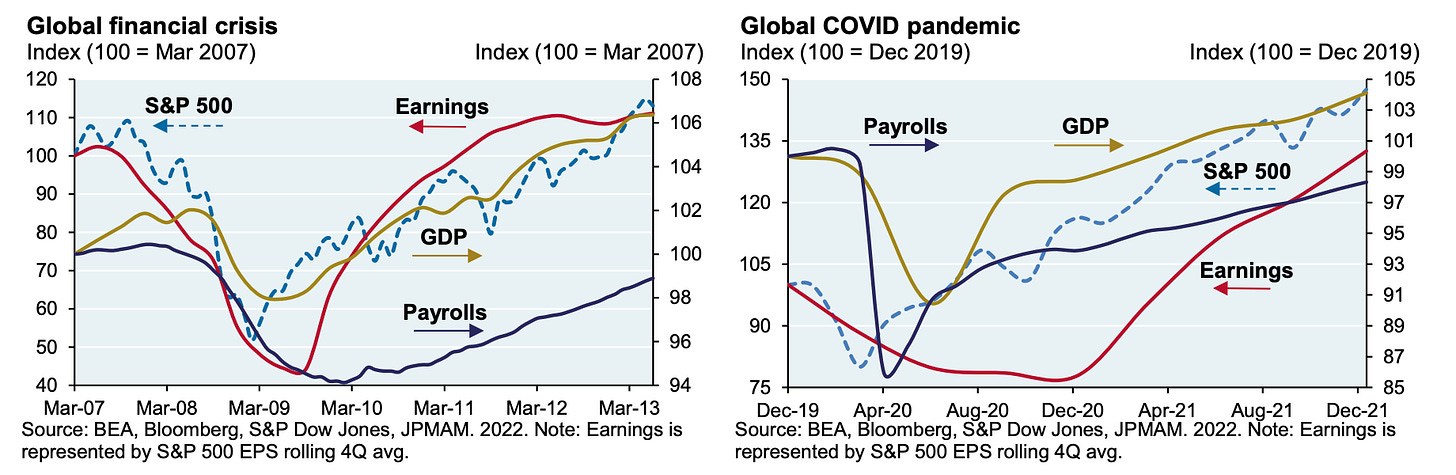

This was not just a pandemic recession phenomenon. The stock market usually begins its recovery long before the economy. JPMorgan’s Michael Cembalest reviewed the history in an October 2022 research note.

“There is a remarkable consistency to the patterns shown below: equities tend to bottom several months (at least) before the rest of the victims of a recession,” he wrote.

As you can see in Cembalest’s charts, stock prices (dotted blue line) tend to inflect upwards before we see improvements in earnings (red line), GDP (yellow line), and employment (purple line).

Historically, the stock market bottomed about five months before the economy. Sometimes the lead time is longer. Sometimes its shorter. On one extremely rare occasion — the Dotcom bubble — the market bottomed after the economy.

The economic news has been getting gloomier 👀

The U.S. economy has been cooling for a while as the major tailwinds early in the recovery normalized.

The good news had been that the economy was nevertheless still growing bolstered by consumers’ ability to spend and businesses’ willingness to invest.

While we might not necessarily be heading for recession, we could be in the midst of a “growth scare,” which has historically come with big stock market sell-offs followed by rapid rallies.

Growth scare-y anecdotes have been accumulating recently. Since the beginning of March:

Delta Airlines warned that their “outlook has been impacted by the recent reduction in consumer and corporate confidence caused by increased macro uncertainty.“

According to the NFIB’s February Small Business Optimism survey, capital spending plans tumbled to their lowest level since 2020.

From the NY Fed’s February Survey of Consumer Expectations: “Households expressed more pessimism about their year-ahead financial situations in February, while unemployment, delinquency, and credit access expectations deteriorated notably.“

From the University of Michigan’s March Survey of Consumers: “Consumer sentiment slid another 11% this month, with declines seen consistently across all groups by age, education, income, wealth, political affiliations, and geographic regions. …expectations for the future deteriorated across multiple facets of the economy, including personal finances, labor markets, inflation, business conditions, and stock markets.“

Wall Street firms, including Goldman Sachs, Morgan Stanley, and JPMorgan cut their GDP growth forecasts.

Even President Trump euphemistically warned that Americans could face “some disturbance” and a “period of transition” as his administration moves forward with costly tariffs. Treasury Secretary Bessent echoed the sentiment, warning of an economic “detox period.”

Because the stock market is a discounting mechanism, you could argue that the current drawdown that began on Feb. 19 was the market pricing in the bad news we’re getting now.

This again speaks to the quandary investors face as they think about making adjustments to their portfolios. The stock market does not price in what’s going on today. It’s pricing in what’s expected in the weeks, months, and years ahead.

And that future is uncertain. It could be worse than what we currently expect. It could be better.

No one can say for sure that the stock market hit its low for the year. However, we also shouldn’t be surprised if we soon experience a sustained rally as incoming news just confirm gloomy expectations that have already been priced into the market.

Zooming out 🔭

In hindsight, divergences in the stock market and the economy make sense. But in the moment, it often feels wrong.

What feels right is when the stock market falls as you get information that indicates the present and near future are deteriorating, and vice versa.

However, there is likely to be a moment where the stock market moves higher as it resumes pricing in a better future. And that moment is likely to happen when the economic headlines are bad.

It all speaks to the perils of trying to time the market.

Is it possible we learn that the economic situation proves far worse than what’s priced into the market today? Absolutely.

Can we guarantee that? Absolutely not.

-

Related from TKer:

Timely perspective from the paid TKer archives ⏳

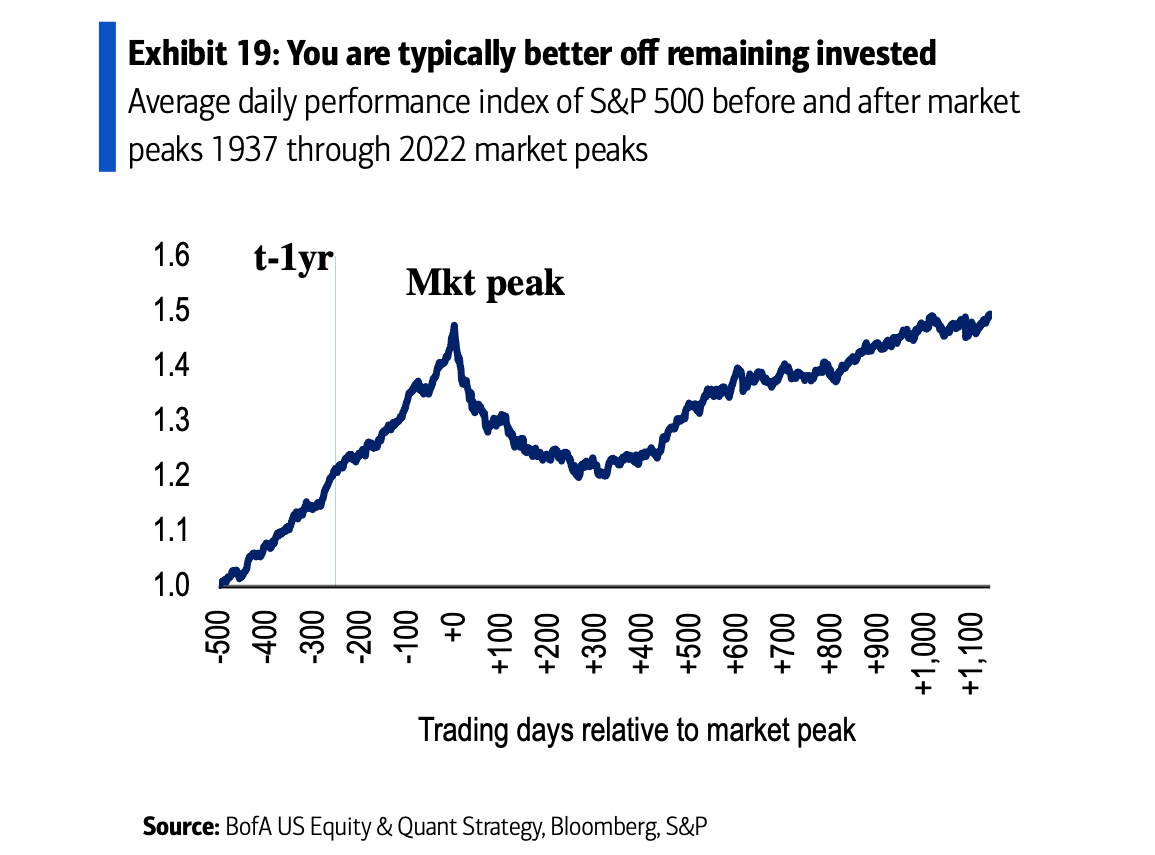

Why is it so treacherous to time market tops? Below is an excerpt from the July 9, 2024, TKer:

…Unfortunately, timing market tops is hard.

Sure, you may not have to pinpoint the exact top and subsequent bottom to improve your returns.

But you have to come pretty darn close.

BofA’s Savita Subramanian recently examined this question in a June note to clients (emphasis added):

Q: Is it better to sell early or late?

A: Neither. Remaining invested is generally superior to emotional selling. With perfect foresight, selling 1 to 3 months early would have protected investors as gains sacrificed were lower than losses over the subsequent 1 to 3 months. But the tradeoff neutralized at 6-months and skewed positive at 12m holding periods…

Keep in mind that if you are a long-term investor, timing the market comes with not one, but two trades. You have to sell what you believe is the top, and then you also have to know under what conditions you would buy back in…

Read the rest at: BofA: 'Q: Is it better to sell early or late? A: Neither.' ⏰

Review of the macro crosscurrents 🔀

There were several notable data points and macroeconomic developments since our last review: