We're at an economic tipping point ⚖️

At least there's a glass-half-full way of looking at what could be the next recession 🥃

For months, we’ve been talking about how the once-hot U.S. economy, supported by massive tailwinds, has become far less “coiled.” This has been reflected in numerous economic metrics that have cooled.

This wasn’t necessarily bad news coming into 2025, as it mostly reflected normalization. Hot economic metrics were mostly returning to pre-pandemic trends.

But that modest amount of economic growth we’ve been experiencing has flattened out, thanks to persistent heightened uncertainty driven by the Trump administration’s chaotic approach to economic policy, combined with tight monetary policy.

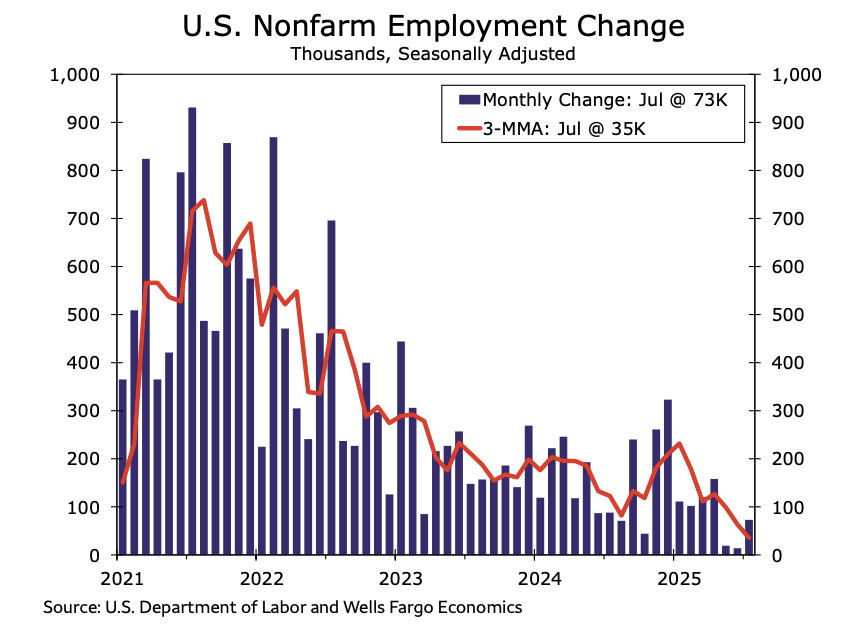

On Friday, we learned that U.S. employers created just 73,000 jobs in July. After May and June’s numbers were revised lower, we learned the three-month moving average was a paltry 35,000.

That means the labor market, comprising 159.5 million jobs, is growing by just 0.02% per month.

“Friday’s jobs report, with its below-consensus July reading and very large May and June revisions, reflects a US economy closer to a tipping point than markets or the Fed previously thought,” Nicholas Colas, co-founder of DataTrek Research, wrote on Monday. “Monthly job growth that hovers around zero for a few months in a row is a classic early recession indicator.”

Job creation is arguably the most important indicator of economic growth.

And it’s not the only metric that’s cooling.