Remember these squiggly lines when analysts talk about earnings forecasts 〰

Analysts never nail their forecasts 😞

Earnings are the most important driver of stock prices in the long run.

So, analysts’ estimates for where earnings are headed in the near future can have a huge impact on where stock prices go in the near term.

But even the most well-resourced professionals are not great at accurately predicting earnings.

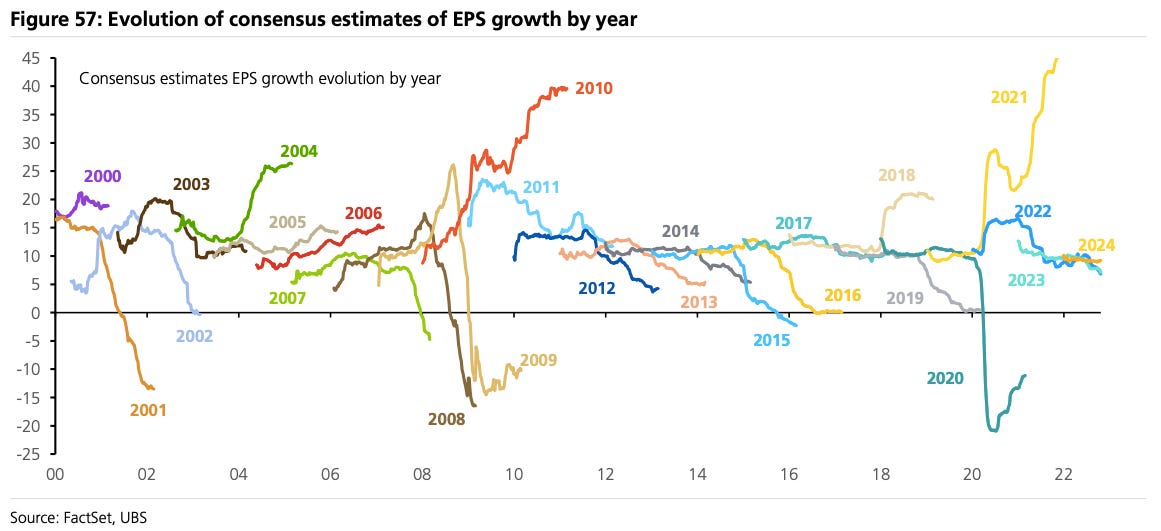

Consider the chart above1 from UBS, which plots analysts’ S&P 500 earnings per share (EPS) growth forecasts. It shows how analysts’ estimates for a given year’s EPS evolve from when estimates are first published until the actual EPS is known. As time progresses and more information emerges, the lines will squiggle up if initial estimates are too low or squiggle down if the estimates are too high.

As you can see, you rarely see a squiggle starts and ends at the same level of growth.

A few observations: