Legendary stock picker Peter Lynch made a remarkably prescient market observation in 1994 🎯

It speaks to 5 truths about the stock market 📜

[NOTE: There will be no newsletter on Sunday, April 3. TKer will be on vacation.]

Peter Lynch, the legendary stock picker who ran Fidelity’s market-beating Magellan Fund for 13 years, made a prescient observation in a speech he gave to the National Press Club back in October 7, 1994.

It comes from the 38-minute mark of this video (via @DividendGrowth):

Some event will come out of left field, and the market will go down, or the market will go up. Volatility will occur. Markets will continue to have these ups and downs. … Basic corporate profits have grown about 8% a year historically. So, corporate profits double about every nine years. The stock market ought to double about every nine years. So I think — the market is about 3,800 today, or 3,700 — I'm pretty convinced the next 3,800 points will be up; it won't be down. The next 500 points, the next 600 points — I don’t know which way they’ll go. So, the market ought to double in the next eight or nine years. They’ll double again in eight or nine years after that. Because profits go up 8% a year, and stocks will follow. That's all there is to it.

When he says “the market,” Lynch is referring the Dow Jones Industrial Average, which closed at 3,797 on the day he gave the talk.

If you compound that by an 8% growth rate over 27.5 years, which would get you to present day, then you get 31,520.

The Dow closed Friday at 34,861, which is pretty darn close. For context, a 7% growth rate would’ve gotten you to 24,405 and a 9% rate would’ve gotten you to 40,613.

If you did this exercise with the S&P 500, which closed at 455 on the day of Lynch’s talk, then you’d get 3,778 assuming an 8% compound annual growth rate. The S&P closed Friday at 4,543. (A 9% rate would’ve gotten you to 4,867.)

According to S&P Dow Jones Indices, S&P 500 earnings per share (EPS) were $30.11 for the 12 months ending Q3 1994, around the time Lynch gave that speech. If you compounded that by 8% over 27.5 years, you’d get $250. S&P Dow Jones Indices estimates EPS for the 12 months ending March 2022 was actually $211, which is close. (They estimate S&P EPS will be $246 in 2023.)

Lynch was not predicting the precise point of the market in March 2022. He was talking about how markets trend over longer-term periods while acknowledging short-term volatility. If you allow him some margin of error to account for unpredictable short-term swings, then you may be able to better appreciate how his thoughts speak to some fundamental market truths we often talk about here at TKer.

I think three elements of what Lynch said are critical for investors to understand.

1: ‘Some event will come out of left field and the market will go down or the market will go up. Volatility will occur.‘

This relates to TKer stock market truth No. 8: “The most destabilizing risks are the ones people aren’t talking about.“

Russia’s invasion of Ukraine is a good example. For investors, a conflict between Russia and Ukraine had not been a concern, so markets weren’t prepared for it. This would explain why stocks went into a deep correction amid the initial news and buildup.

With these types of unforeseen events, prices will swing wildly as markets digest every positive and negative development as the situation unfolds.

This stands in contrast to the risks everyone has been talking about, like inflation and tighter monetary policy. These risks had investors concerned for months before those fears were confirmed, and the actual news eventually had a limited effect on market volatility.

2: ‘I’m pretty convinced the next 3,800 points will be up; it won't be down. The next 500 points, the next 600 points — I don’t know which way they’ll go.‘

Over time, the stock market’s biggest moves will be to the upside (which relates to TKer stock market truth No. 4), and the long game is undefeated (which is TKer stock market truth No. 1.) But you can certainly get smoked in the short term (TKer stock market truth No. 2).

As we discuss frequently here on TKer, big sell-offs are actually pretty normal. The S&P 500 experiences an average max drawdown (i.e., the biggest intra-year sell-off) of 14% a year.

For what it’s worth, the current market correction has seen the S&P 500 fall 12% from its high of 2022, which is less bad than average.

Lynch’s comment speaks to the advantage of a long-term investment horizon, which is a valuable edge most investors have.

3: ‘Profits go up 8% a year, and stocks will follow. That's all there is to it.’

The stock market has historically usually gone up because earnings have usually gone up. That’s because earnings are the most important driver of stock prices, which is TKer stock market truth No. 5.

Check out this chart of S&P 500 earnings since 1986, courtesy of Yardeni Research. It’s on a logarithmic scale, which smooths out the curve you get when growth is compounding at a steady rate over time.

There’s some short term noise. But over time, earnings have been going up and to the right.

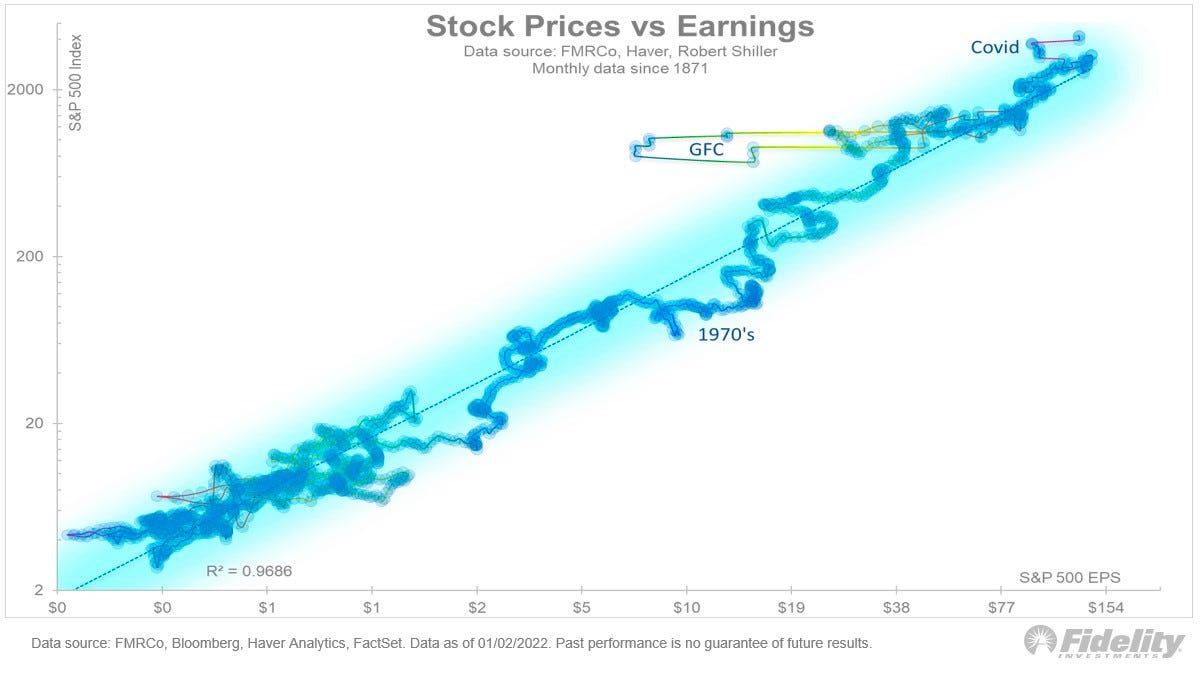

Jurrien Timmer, director of global macro at Fidelity Investments, recently shared a chart showing the tight relationship between earnings and stock prices.

Stock prices are on the y-axis, accompanied by earnings on the x-axis. The data goes back all the way to 1871. The r-squared of 0.9686 in this linear regression is very close to 1, which means earnings do an extremely good job of explaining how stock prices behave.

In other words, stocks go where profits go.

“That's all there is to it,” Lynch said.

-

More from TKer:

Keep reading with a 7-day free trial

Subscribe to 📈 TKer by Sam Ro to keep reading this post and get 7 days of free access to the full post archives.