22 eye-catching charts as we consider what's next for the stock market 📈

An illustrated guide to what's behind the forecasts 🔎

Wall Street’s top strategists have published hundreds of pages of interesting research in recent weeks as they prepare clients for the coming year.

In a nutshell, we’ve read that despite elevated political uncertainty, Wall Street expects the economy to keep growing, which should be good for sales growth. Juiced by profit margin expansion, earnings are expected to grow at a double-digit rate. This earnings growth will be crucial, as valuations already seem stretched.

But what was behind these takeaways?

Below is a roundup of some of the more important charts informing Wall Street’s outlook for the market.

More companies are expected to report earnings growth 🤲

Much has been made about how earnings growth has been driven largely by a handful of big tech companies. Rest assured, Wall Street expects many more companies to generate healthy earnings growth in the coming year.

Morgan Stanley’s Michael Wilson addressed this in his Nov. 18 note: “While it’s been predominantly a cost cutting and efficiency gains story to date, more companies are participating in the earnings recovery (~60% of S&P 500 companies have positive EPS growth today versus ~50% in 1Q 2023). We expect this broadening in earnings growth to continue as the Fed cuts rates into next year and business cycle indicators continue to improve. A potential rise in corporate animal spirits post the election (as we saw following the 2016 election and as discussed above) could catalyze a more balanced earnings profile across the market in 2025.“

For more on earnings growth, read: The stock market's bottom line is looking up 👍

A lot of sectors are expected see profit margins expand 💰

The most surprising business story of the past four years is arguably the persistence of high profit margins.

For 2025, analysts expect profit margins to expand once again, which is critical to the earnings growth narrative. And the gains are expected to broadbased.

“[W]e see upside for margins in 2024 as companies benefit from lower costs (as inflation cools), take advantage of efficiency gains, and exert pricing power,” HSBC’s Nicole Inui said in her Dec. 6 note.

For more on profit margins, read: The most surprising business story of the past four years is expected to persist 🤯

Earnings forecasts tend to be pretty accurate 🤷🏻♂️

Relative to price targets, which often miss the mark by a wide margin, earnings forecasts have been relatively accurate.

From FactSet’s John Butters: “Over the past 25 years (1999 – 2023), the average difference between the bottom-up EPS estimate at the beginning of the year (December 31) and the final EPS number for that same year has been 6.3%. … However, this 6.3% average includes four years in which the difference between the bottom-up EPS estimate at the start of the year and the final EPS number for that same year exceeded 25%: 2001 (+36%), 2008 (+43%), 2009 (+28%), and 2020 (+27%). These large differences can be attributed to events that may have been difficult for analysts to predict at the start of the year. In 2001, the country endured the 9/11 attacks. In 2008 and 2009, the country was in the midst of economic recession. In 2020, economic lockdowns were implemented due to the COVID-19 pandemic. If these four years with unusual circumstances were excluded, the average difference between the bottom-up EPS estimate at the start of the year and the final EPS number for that year would be 1.1%.“

For more on earnings forecasts, read: Wall Street strategists are nailing one of their more important forecasts for 2024 🎯

Valuations could keep moving higher 👀

With a forward price-to-earnings (P/E) ratio of about 22, the S&P 500 is arguably expensive relative to history.

But that doesn’t mean P/E ratios are doomed to fall.

As UBS’s Jonathan Golub discussed in a Dec. 9 research note: “Many investors assume that stock valuations — or equity risk premia — mean revert toward fair value. Our work indicates that valuations have an upward bias in non-recessionary periods, but correct sharply around economic contractions. With current recession risks contained, multiples are most likely to drift higher in 2025.“

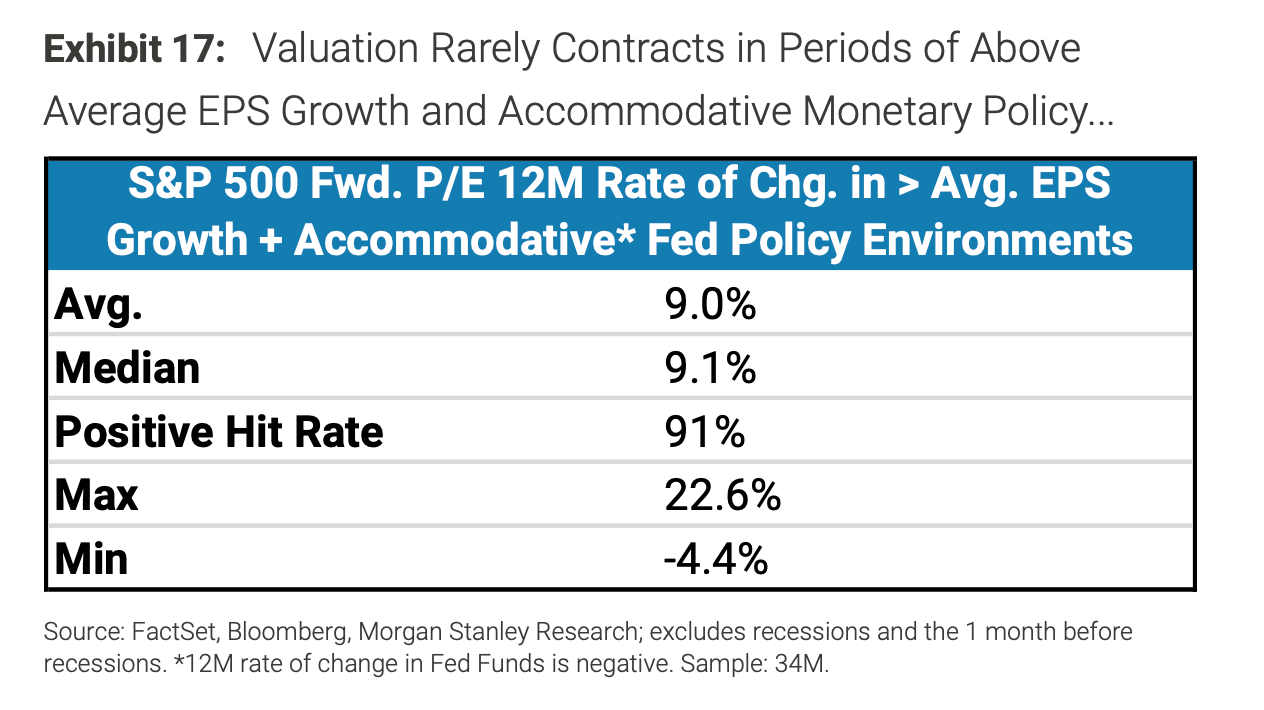

This echoes Wilson’s findings. From his Nov. 18 note: “We see the market multiple staying elevated relative to history at 21.5x (a ~3.5 turn premium to the 10-year average) as our work shows it’s rare to see significant multiple compression in periods of above average earnings growth and accommodative monetary policy. In Exhibit 17, we illustrate this dynamic by showing that the median 12-month rate of change on the forward P/E is 9% when EPS growth is above the historical average of 8% and the Fed Funds Rate is down year-over-year (in line with our economists' forecasts).”

For more on valuations, read: Doubt about the P/E ratio's long-term signal for the stock market 🧠

The S&P 500 is higher quality than it used to be 🏆

BofA’s Savita Subramanian has written quite a bit about why it could be a mistake to compare today’s P/E ratios to the past.

Simply put, the companies in today’s S&P 500 are just better. From Subramanian’s Nov. 26 note: “The S&P 500 is less levered and higher quality than in prior decades, with index composition shifting from 70% asset-intensive manufacturing, financials and real estate in 1980 to 50% asset-light innovation-oriented companies today. While high valuation is still concerning, this shift suggests that models that forecast future returns based on valuation may be excessively punitive.“

For more on why we should rethink P/E ratios, read: The problem with historical P/E data 📜

The S&P 500 is getting more productive

S&P 500 revenue per worker improved from the 1980s to the early 2000s. The metric has been moving sideways ever since. Subramanian believes this metric could improve with the adoption of artificial intelligence (AI) technologies.

“Today's backdrop rhymes with the mid-1980s efficiency era: post-peak rates and inflation, a higher real rates regime, and a renewed focus on productivity / efficiency / Tech tools,” Subramanian said in her Nov. 26 note.

For more on how productivity is improving, read: Promising signs for productivity ⚙️ and Companies everywhere confirm AI is happening 🤖