Trillion dollar exposure 💰

And a disclosure about my trillion dollar lifestyle 💰

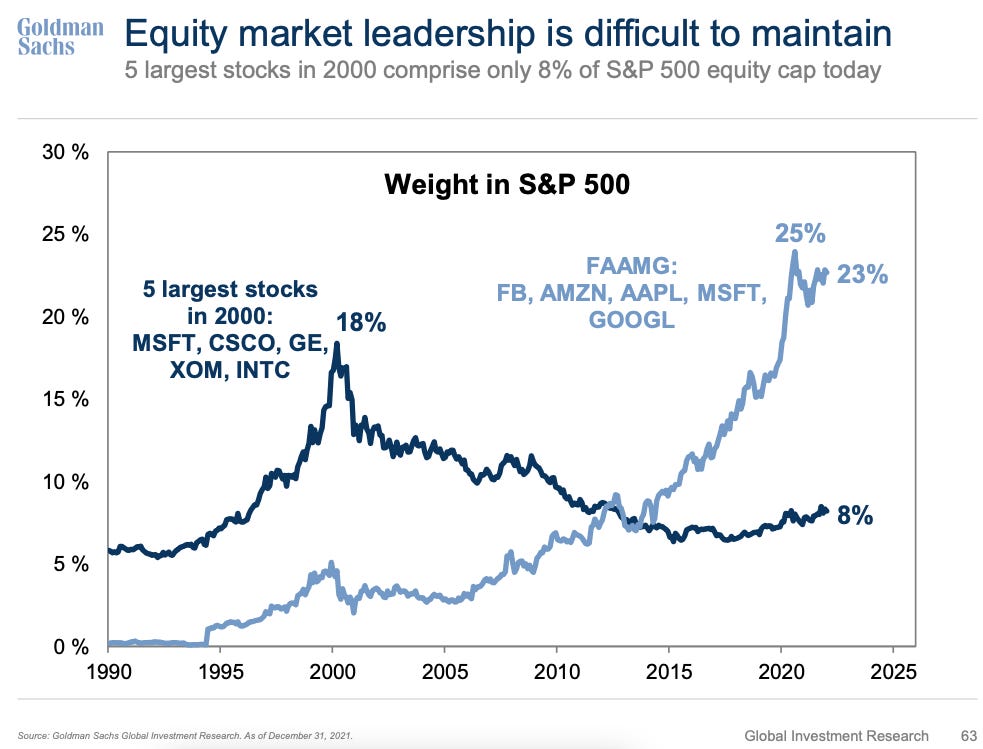

I’m guessing you’ve seen a chart that looks something like the one below.

If you haven’t, the message is simple: Five stocks (Facebook,1 Apple, Amazon, Microsoft, and Google2) account for about a quarter of the market capitalization of the S&P 500, which consists of 500 companies.

This is because of their massive market values: Apple is worth $2.8 trillion, Microsoft is worth $2.4 trillion, Google is worth $1.8 trillion, Amazon is worth $1.6 trillion, and Facebook is worth $876 billion.

For context, the 20 smallest companies in the S&P 500 are each worth less than $10 billion.

The idea that 1% of the companies in the index account for about 25% of the total market value is jarring, and some folks see that as a vulnerability for the stock market.

Two quick things: First, there isn’t much evidence that shows a relationship between market concentration and forward market returns (see chart). Second, market concentration isn’t unusual (see this and this).

In fact, companies used to represent even bigger shares of the market back in the day.

“AT&T was 13% of total U.S. stock-market value back in 1932; General Motors, 8% in 1928; IBM, 7% in 1970,“ Jason Zweig, a WSJ columnist, wrote a little while back.

It’s imprecise to call them 5 companies

While it may be technically accurate to say these five stocks represent five companies, it’s also a gross oversimplification of the businesses and markets these companies are exposed to.

Consider Microsoft. According to its most recent earnings announcement, the company reports three separate multi-billion business segments comprised of ten massive businesses including commercial products (e.g. Office), consumer products (e.g. Skype), intelligent cloud (Azure), gaming (e.g. Xbox), and LinkedIn. Microsoft even has an advertising business, which Axios’ Sara Fischer points out is bigger than Snap and Twitter combined!3

Apple, Google, Amazon and Facebook similarly engage in a wide array of businesses that hold leadership positions.

They make a ton of money

Importantly, these valuations are propped up by an ungodly amount of earnings.

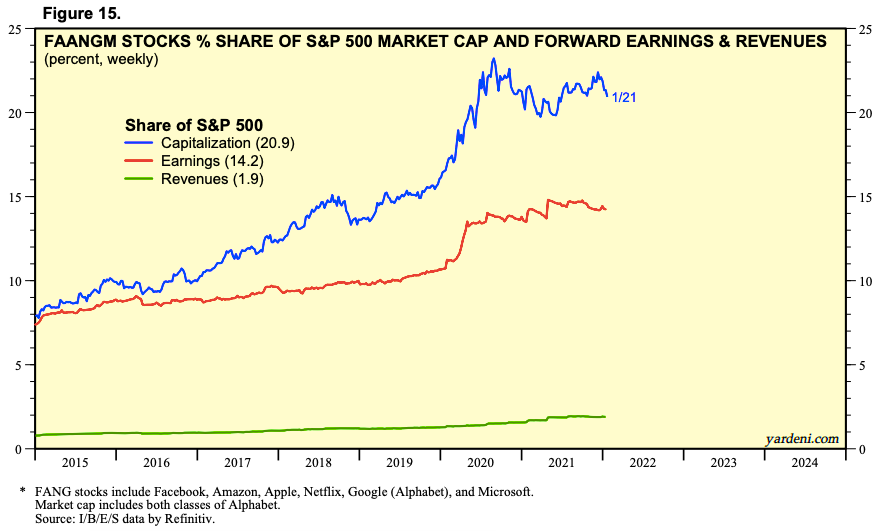

Check out this chart of the big tech growth names, courtesy of Yardeni Research, which is a bit more up-to-date than the chart above.

While these so-called FAANGM4 companies account for 1% of the names in the S&P 500, they account for a whopping 14% of the index’s earnings.5

From an investor’s perspective, the worst case scenario may be that these companies get broken up, in which case they might lose some of the benefits of scale. But even in a break-up, investors would either be left with shares of the broken up company or they’d be bought out.

Like the S&P 500, the biggest five stocks in the U.S. market attract raise eyebrows because of the trajectories of their prices. But a closer look at things like business diversification and earnings show that these concerns may be a bit overblown.

DISCLOSURE:

Most of my savings sit in equity mutual funds and ETFs that track the S&P 500, which means I’m significantly exposed to the companies mentioned above. None of these companies pay me. However, literally every person I know — including myself — regularly does business with at least several of these companies in multiple ways.

I use an iPhone (AAPL) and everyone I know is either on an iPhone or an Android (GOOGL) phone. I use WhatsApp (FB) to communicate with people overseas. Amid the pandemic, I’ve been using Google Meet (GOOGL) and Microsoft Teams (MSFT) a lot more.

For work, I mostly use Chrome (GOOGL) on my MacBook Air (AAPL). I work with a lot of data, though I don’t have Office (MSFT). When someone sends me an Excel file (MSFT) I open it with Sheets (GOOGL). My website is powered by AWS (AMZN), though when there’s an outage I can’t help but be envious of those using Azure (MSFT). And when you subscribe to TKer, the GIF in the welcome email was created on GIPHY (FB).

When I publish, I share my work on LinkedIn (MSFT). Facebook (FB) is a much bigger platform for sharing content generally, but their algorithm doesn’t seem to pick up my stuff. Though lately, I’ve noticed my pieces have been surfacing in Google Search (GOOGL) results. Yahoo Search doesn’t seem to be sending me much traffic, though I’ll note that Yahoo Search is actually powered by Bing (MSFT).

In my free time, you might catch me scrolling through Instagram (FB) while I’m streaming something from Apple TV+ (AAPL) or Prime Video (AMZN). Yes, I have subscriptions to Netflix and Hulu, though I stream it all through my Apple TV (AAPL) hardware.

I have an Echo Dot (AMZN) and Echo Show (AMZN), but I only ever use them to set timers and turn my lights on and off. I don’t use Siri (AAPL), but my sister uses it to send text messages while driving. I don’t use Nest (GOOGL) or Ring (AMZN), but my homeowner friends seem to be fans of one or the other.

For online shopping, I’m hooked on Amazon (AMZN) like everyone else. I will, however, say that Apple Pay (AAPL) and Google Pay (GOOGL) have made it a lot easier to conduct transactions on other sites.

Just to be clear, everything about me isn’t wired. I wear a mechanical watch. You won’t be able to convince me to get an Apple Watch (AAPL) or FitBit (GOOGL).

Also, I do get outside. I’ll pop in my AirPods (AAPL) and walk to the Whole Foods (AMZN) in downtown Brooklyn where I get groceries. It’s a block past the Apple Store (AAPL), but a block before the Best Buy where the new Xbox (MSFT) has been sold out for weeks – though, they do have the extremely popular Oculus 2 (FB) in stock.

When I vacation, I like secluded beaches far from any Wi-Fi or cellular signal. But even out there, I’ll see people on their Kindles (AMZN) and iPads (AAPL).

AT&T (T) used to be my wireless carrier before I switched to Verizon a few years ago. In high school, I drove a 1979 Chevy Impala station wagon (GM). I now live in NYC, where I don’t have a car.

Some recent stock market features from TKer: