Why home prices and rents are creating all sorts of confusion about inflation 😖

How is the government measuring shelter inflation? 🤨

Private sources of home prices, like S&P CoreLogic Case-Shiller and the National Association of Realtors, have reported declining prices.

Private sources of rents, like Zillow and Realtor.com, have reported declining rent prices.

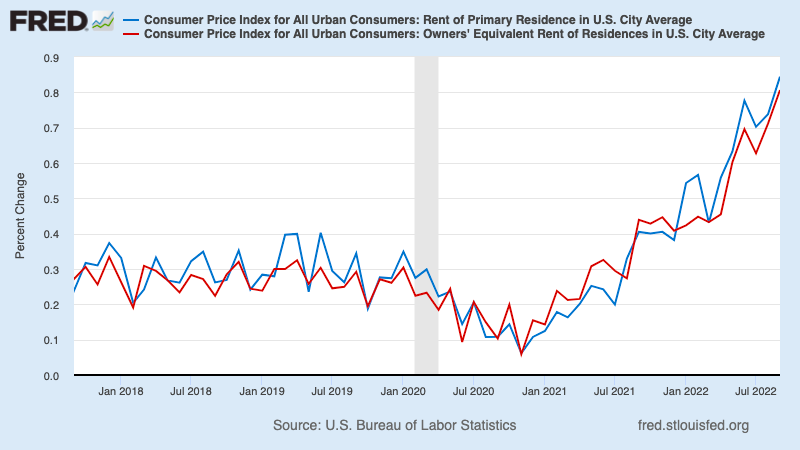

So why do authoritative measures of inflation like the Bureau of Labor Statistics’ (BLS) consumer price index (CPI) show that shelter prices — which include rent of primary residence (a.k.a., tenants’ rent) and owners’ equivalent rent (i.e., how much a homeowner would have to pay to rent their currently owned home) — continue to accelerate higher?

To begin to understand this, you first have to remember that most homeowners don’t buy a new house and move into it every month, and most renters don’t enter into a new lease every month. So most folks will go months or years without being affected by these regularly reported moves in home prices and rents.

DISCLAIMER: Before continuing this discussion, I will caveat by saying I’m no econometrician, and we’re dealing with some complicated stuff that can get profoundly wonky.1 I’m mostly attempting to offer some high-level clarifications on what seem like discrepancies in the government’s inflation reports.