An ETF for every craving, but many will be wrong for your investment diet 🍲

Plus a charted review of the macro crosscurrents 🔀

📈The stock market rallied to all-time highs, with the S&P 500 setting an intraday high of 6,508.23 and a closing high of 6,501.86 on Thursday. The index is now up 9.8% year-to-date. For more on the market, read: 15 charts to consider with the stock market at record highs 📊📈

-

If a new product improves on something by making it cheaper or faster, then there will be demand for that product.

Exchange-traded funds (ETFs) have made it cheaper and faster to make trades that involve more than just buying or selling a single stock. In the 32 years since SPDR S&P 500 (SPY 0.00%↑ ) became the first U.S.-listed ETF, the industry has grown significantly, with approximately $12 trillion in assets under management today.

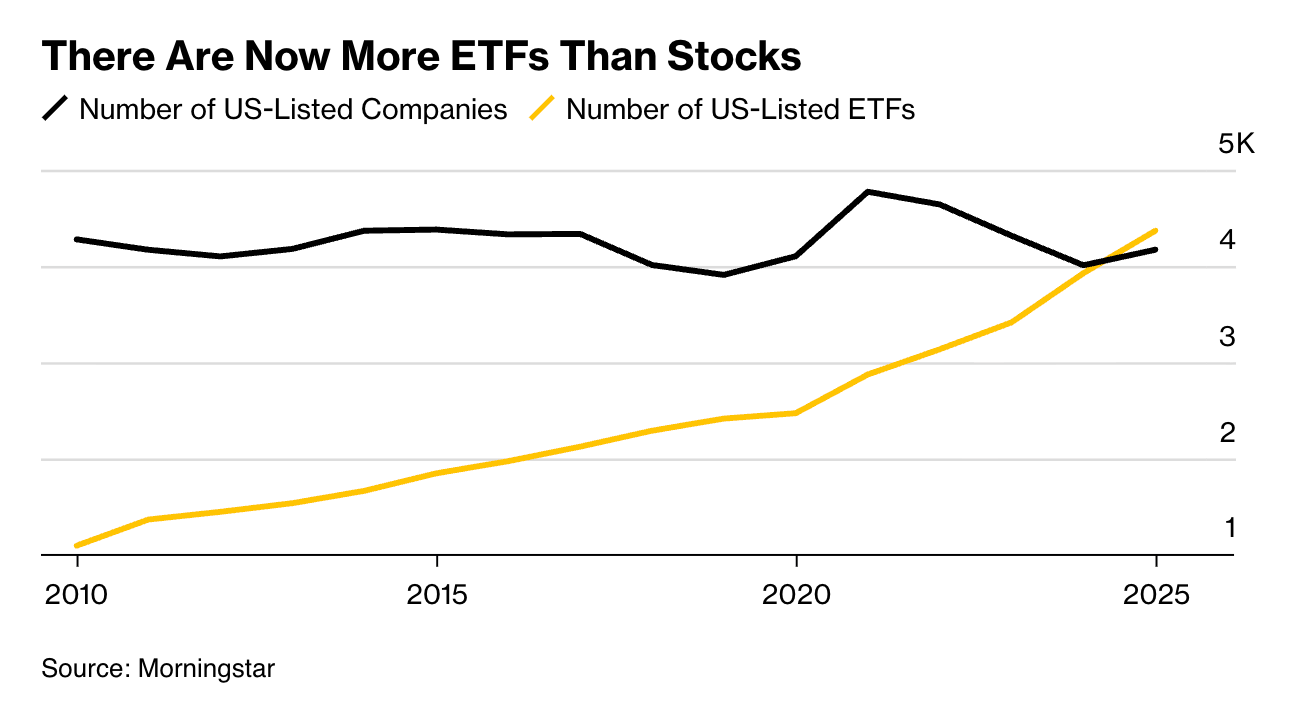

And according to Morningstar data (first reported by Bloomberg), there are now more ETFs listed on U.S. exchanges than there are individual stocks.

After I read Bloomberg’s article, I posted the chart above on X with the caption: “There are now more recipes than there are ingredients.“

The post was reposted a couple of hundred times, and it garnered a couple of hundred thousand views. It struck a chord.

On one side, some found the development to be alarming. How could there be more ETFs than there are individual stock tickers? This must be a bubble or some gross distortion that threatens to destabilize markets, right?

On the other side, some saw the news as nothing more than some random milestone in what’s been an inevitable trend. This is the view shared by all of the ETF experts I know.

“This is the correct take,” Dave Nadig, President and Director of Research for ETF.com, tweeted.

“Yes, massive product proliferation,” Nadig added in an email. “But there’s no real meaning to 4K vs 5K vs 10K ETFs trading. We've had >8000 mutual funds since the early 1990s.”

Eric Balchunas, Senior ETF Analyst for Bloomberg, offered his own analogy: “There are 12 notes and yet 100 million songs.”

Every investor has different needs and wants. And there are millions of investors. In response to this investor demand, the financial services industry has supplied almost every imaginable trading strategy with low-cost, tax-efficient ETFs.

Not all ETFs will fit your diet 🍱

To be clear, just because an ETF exists doesn’t mean it will be suitable for your portfolio. Everyone’s got their own tastes and dietary needs.

If you can’t stomach a lot of volatility, then maybe you shouldn’t be in leveraged single-stock ETFs. Similarly, not everyone can handle spicy food.

Perhaps a certain ETF is appropriate, but it shouldn’t dominate your portfolio. Tuna sashimi is tasty, but too much may lead to mercury poisoning.

Peanuts are one of the most beloved ingredients in the culinary world. But it’ll kill those who are allergic to it. I’m not sure if an ETF like that exists, but it may be coming.

By the way, just because ETFs offer a relatively low-cost way to trade doesn’t mean there aren’t active ETF managers offering strategies at a high cost. And many of these ETFs underperform their benchmarks. There are great restaurants worth paying up for. However, there are also plenty of TV chefs selling mediocre food at a high markup.

Check out my column in the Financial Times 📰

The fact that there are many ETFs is in itself not cause for alarm.

There are more poems than letters in the alphabet. There are more locker combinations than numbers on the lock. There are more chemical compounds than elements. There are more ways to fill out a March Madness bracket than teams. There are more recipes than ingredients.

There’s nothing remarkable about the fact that there are more ETFs than individual securities.

That said, there are some pitfalls.

The Financial Times invited me to write a column on the ups and downs of the ETF boom, including the issue of choice overload and the tax event that occurs when a fund closes. Many thanks to Tony Tassell for editing. And thanks to Strategas’ Todd Sohn and Morningstar’s Ben Johnson for providing color. You can read it here »

…Or go pick up a copy of the FT’s Weekend edition from your local news stand!

-

More from TKer: