A key business story to watch in 2026 🗓️

Plus a charted review of the macro crosscurrents 🔀

📈The stock market rallied to all-time highs, with the S&P 500 setting an intraday high of 6,671.82 and a closing high of 6,664.36 on Friday. The index is now up 13.3% year-to-date. For more on the market, read: The stock market and the economy are diverging 📊

-

With almost three quarters of 2025 in the rear-view mirror, market participants are increasingly shifting their focus toward 2026.

“As we met with a variety of US equity investors last week — ranging from hedge funds to high-net-worth retail, from high-level macro investors to stock pickers, and everything in between — it became clear to us that it’s time to start talking more about 2026,” RBC Capital Markets’ Lori Calvasina said Monday.

She preliminarily sees the S&P 500 ending 2026 at 7,100 as earnings per share (EPS) grow about 10% to $297. (For more on how to think about year-end targets, read: A better way of thinking about Wall Street's year-end price targets 🗺️)

Her projections are derived from a blend of five models that factor in almost every imaginable macro variable.

But one assumption caught my attention.

Analysts expect fatter profit margins 🤑

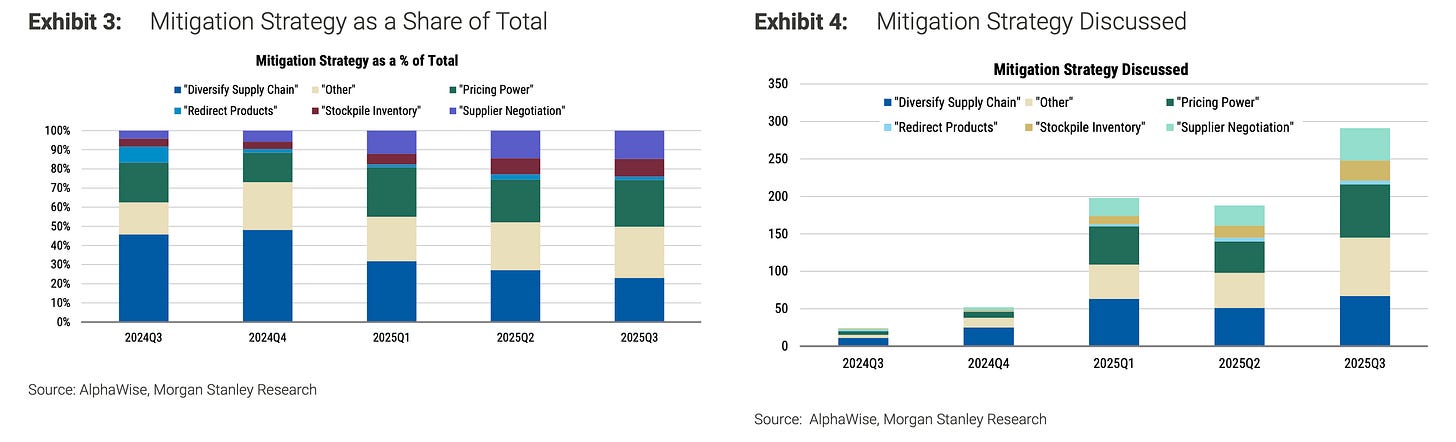

“We are baking in some margin expansion for 2026,” she wrote. On the subject of profit margins, she added, “One of our biggest takeaways from 2Q25 reporting season is that companies are laser focused on mitigation strategies around tariffs.“

This is in line with Morgan Stanley’s analysis of Q2 earnings calls: “Unsurprisingly, we saw a significant increase in the number of mentions of tariff mitigation strategies last quarter with many companies citing multiple strategies.“

And it’s not just tariff mitigation that could bolster profit margins in the quarters to come.

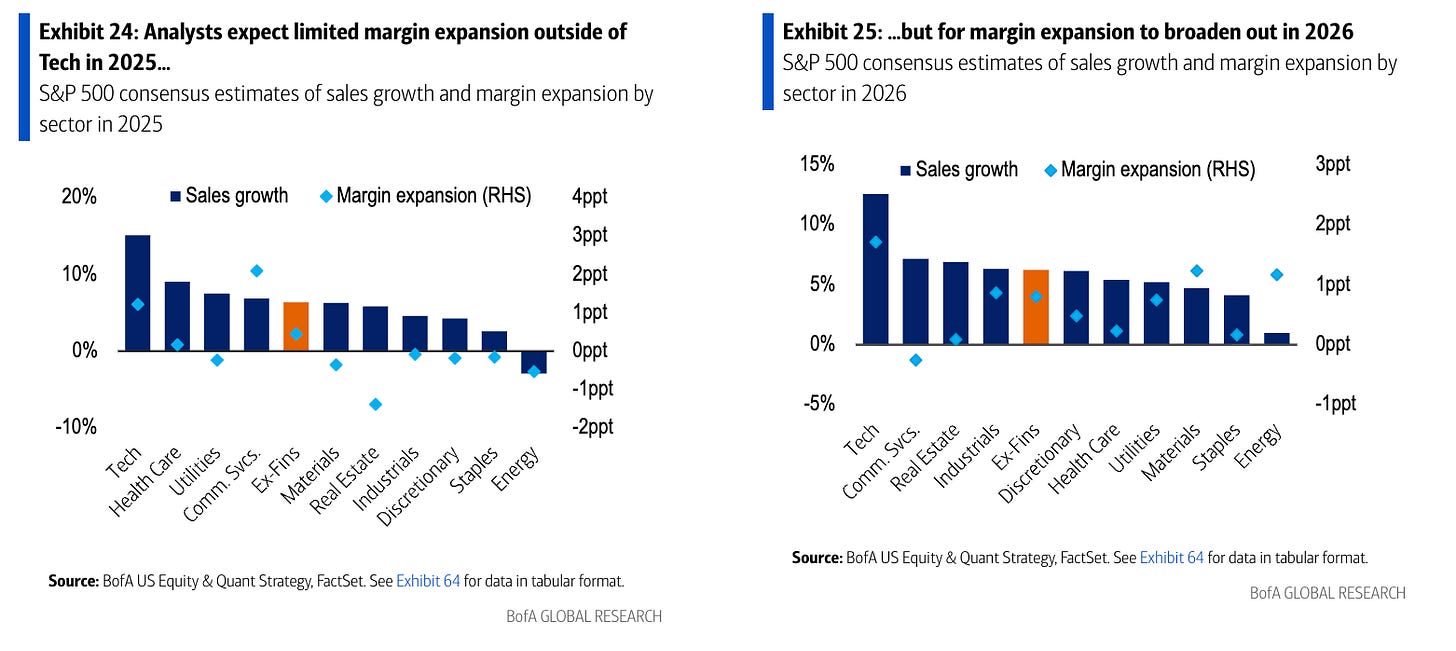

“Drivers for margin strength include operating leverage, continued efficiency gains (AI and others), slowing employment inflation in many labor-intensive sectors, and the potential for cost-cutting from deregulation,” BofA’s Savita Subramanian wrote Wednesday.

While margin expansion in 2025 has mostly been driven by big tech companies, that growth is expected to broaden out across industries in 2026.

Subramanian expects EPS to grow about 10% to $298 in 2026 as net margins increase by 40 basis points to 13.2%. She has yet to offer a 2026 price target for the S&P 500.

Goldman Sachs also has yet to publish forecasts for 2026. (These calls typically come later in Q4.) However, they have been discussing the prospects for growth in profit margins.

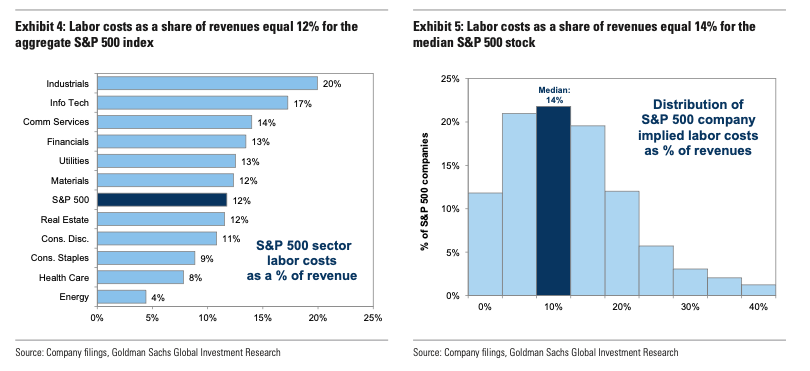

“[A] cooling labor market is a tailwind to corporate profits, all else equal,” Goldman Sachs’ David Kostin wrote in a Sept. 12 note.

“Profit margins typically expand when companies can raise prices more quickly than materials input and labor costs,” Kostin said. “Our economists expect the U.S. economy will continue to expand in 2H 2025 and 2026, but slow job growth will keep a lid on wage growth.”

Indeed, with the economy cooling, workers don’t have as much leverage as they used to to push for a raise.

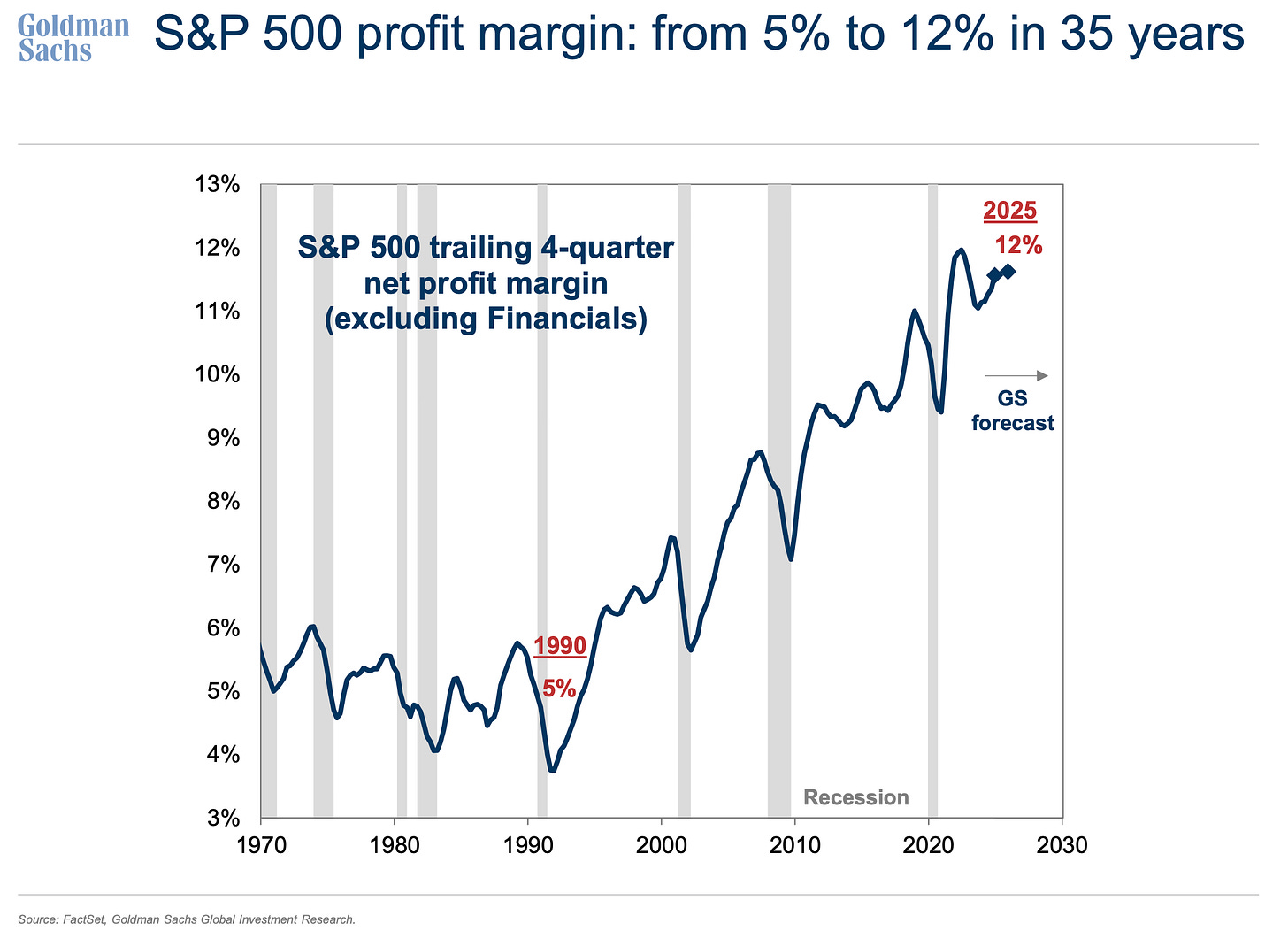

Surprising us every year since 2021 🔄

In what’s arguably been the most surprising business development of the current economic cycle, profit margins remained historically high throughout 2021, 2022, 2023, 2024, and, so far, 2025. And now analysts expect margins to expand in 2026 (and 2027!).

Whether it was supply chain disruptions, hot inflation, tight monetary policy, or the threat of higher tariffs, Corporate America has successfully navigated the treacherous cost environment to maintain historically high profit margins and generate record-high earnings.

Can this trend really persist? We’ll see.

But for now, the case for high profit margins looks strong, supported by recent years of success.

-

Related from TKer:

It remains 'dangerous' to underestimate Corporate America ⚠️

The most surprising business story of the past four years is expected to persist 🤯

The simple explanation for why the stock market is holding up 💪

A better way of thinking about Wall Street's year-end price targets 🗺️

Watch and Listen! 📺🎧

I was on the Excess Returns podcast with Matt Zeigler and Kai Wu. We discussed TKer’s 10 Truths About the Stock Market and how investors can apply them to make sense of the markets today. Check it out on Apple Podcasts, Spotify, or YouTube!