SPECIAL EDITION: Telling the story of how the stock market usually goes up, year 1 📈🎂

TKer’s first year was all about Stock Market Truth No. 2 📜

One year ago on October 14, I launched TKer as the newsletter telling the story about how the stock market usually goes up.

So it would seem appropriate that the stock market would spend most of the past year getting smoked in what’s been one of the messiest selloffs in history.

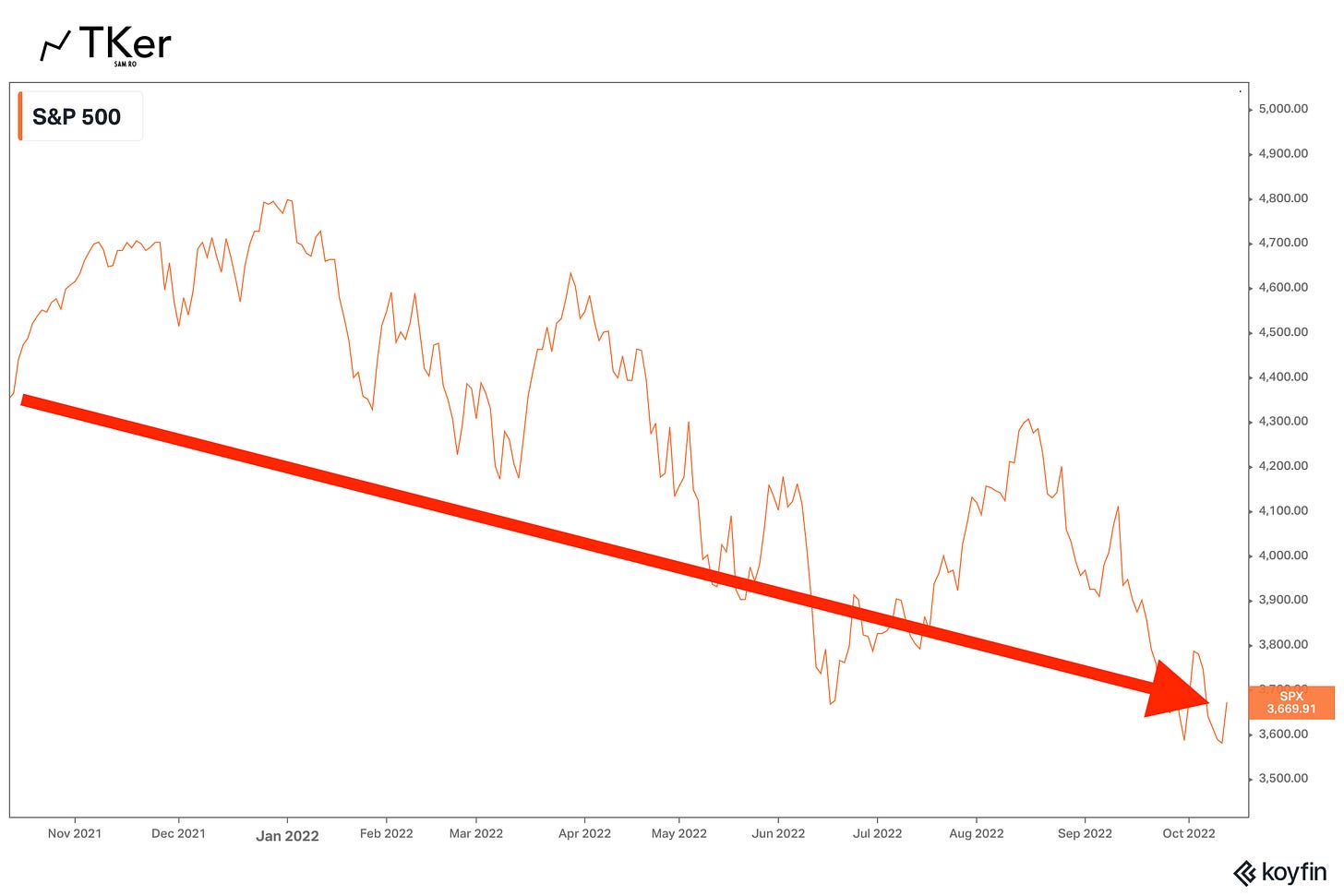

From TKer’s launch, the S&P 500 climbed 9% to its January intraday high of 4,818. Then the market turned, with the S&P tumbling 27.5% to an intraday low of 3,491 on October 13.

Putting it all together, the S&P has fallen 17% during the existence of TKer.

TKer Stock Market Truth No. 2 📉

While it may be the case that the stock market usually goes up, it doesn’t always go up.

This speaks to TKer Stock Market Truth No. 2: You can get smoked in the short-term.

Investing for long-term returns means being able to stomach a lot of intermediate volatility.

One of my favorite illustrations of this deal comes from JPMorgan Asset Management’s “Guide to the Markets.” The gray bars represent each calendar year’s return for the S&P 500, and the red dots represent intra-year drawdowns (i.e., declines from the index’s high).

While the S&P has usually generated positive annual returns, it’s also seen an average drawdown of 14% during those years. Some years had worse drawdowns than others.

When I wrote “10 truths about the stock market” a year ago, my intention wasn’t to help traders make predictions about where prices would head in the short term. I wrote it to provide a mental framework for investors to help process the ups and downs of the markets as they aim to achieve long-term financial goals.

Part of that is reminding investors during downturns that stocks have historically gone up when given time.

Similarly, it’s also about reminding investors during market highs that stocks have historically seen sharp selloffs during shorter time frames. From the January 3 newsletter to paid subscribers:

… 2021 was an unusually calm year for the stock market. Even as the S&P 500 surged 27% during the period, it experienced just one pullback greater than 5%. (The S&P fell by 5.2% from its September 2 high to its October 4 low.) This is not normal, and it’s something investors shouldn’t get used to.

Investors should always be mentally prepared for some big sell-offs in the stock market. It’s part of the deal when you invest in an asset class that is sensitive to the constant flow of good and bad news.

To be clear, I was not attempting to make any kind of market-timing call. That piece was mostly about reminding folks that big sell-offs happen.

For the purposes of this piece, I’m not gonna go into why I think the market is lower. (You can read more about that here and here.1)

But I will say that the drivers of today’s market downturn are very different from history’s downturns. AND they’ll be very different from the downturns that happen in the future.

The bottom line is brutal market sell-offs happen. They’re happening now. And they’ll happen again and again even as the market trends higher in the long run.

Related from TKer:

The state of TKer 📈

TKer’s first year has exceeded my expectations.

There are currently more than 10,000 subscribers2 receiving TKer newsletters in their inboxes. Thank you for subscribing!

As other newsletter writers will tell you, somewhere between 1% to 10% of those willing to be free subscribers can be convinced into becoming paid subscribers. That’s very much been the experience with TKer.3

Since launch, TKer has sent out 157 newsletters. The email open rate for most newsletters is between 50% and 70%. (The lowest open rate for a newsletter was 47%.4 That one was sent out the day after Thanksgiving. 🤷🏻)

Free and paid subscriptions have increased every month, and growth shows no sign of plateauing.5

I’ve had the good fortune of interacting with some subscribers, which include financial services industry professionals, entrepreneurs, journalists, students, and many other folks with financial exposure to the stock market.

Many subscribers already follow market prices very closely but read TKer to keep current on macroeconomic matters. Other subscribers follow the economy pretty closely but read TKer to get a better understanding of why markets move the way they do.

It’s a lot of people who care about their finances, have limited free time, and seek curated yet comprehensive coverage of news and data relevant to long-term investors.

It’s been refreshing and encouraging to speak with so many people who — despite the recent market volatility — understand that there must be a reason to have some money invested in stocks for the long run.

These are the people I’m here to serve, and I expect to keep serving them as long as they keep reading.

For more on what TKer is about, read here »

Best of TKer 📈

Here’s a roundup of some of TKer’s most talked-about paid and free newsletters. All of the headlines are hyperlinked to the archived pieces.

700+ reasons why S&P 500 index investing isn't very 'passive'💡

Passive investing is a concept usually associated with buying and holding a fund that tracks an index. And no passive investment strategy has attracted as much attention as buying an S&P 500 index fund. However, the S&P 500 — an index of 500 of the largest U.S. companies — is anything but a static set of 500 stocks. From January 1995 through April 2022, 728 tickers have been added to the S&P 500, while 724 have been removed.

You can make any piece of data look bad if you try 🔄

There’s more than one way to frame a piece of economic or financial market data. It might be better than expected relative to economists’ expectations, but it could also be worse than expected relative to traders’ expectations. That same stat could be down on a month over month basis and also up on a year over year basis. It may be high relative to the 10-year average but low relative to the 5-year average. It may look bad on an absolute basis but it may look good relative to what may be the normal course of business. With that in mind, let’s look at nine unsettling — albeit accurate — market observations that miss the point when you take a look at the big picture.

10 truths about the stock market 📈

The stock market can be an intimidating place: it’s real money on the line, there’s an overwhelming amount of information, and people have lost fortunes in it very quickly. But it’s also a place where thoughtful investors have long accumulated a lot of wealth. The primary difference between those two outlooks is related to misconceptions about the stock market that can lead people to make poor investment decisions.

Your guide to 'good news is bad news' and 'bad news is good news' 🙃

The Fed is actively trying to slow the economy — even if it means “some pain” for businesses and consumers — because it believes that is the prescription for getting inflation under control. In this world, good news about the economy is potentially bad news if it’s exacerbating the dislocation between supply and demand. Let’s review a few hypothetical headlines and examine why good news might be bad news — and vice versa.

Why the recession we may or may not be heading for won't be that bad 💪

While the economy may not be in a recession now, it’s certainly slowing and is at risk of going into a recession. However, not every recession has to be an outright economic debacle like the global financial crisis or the Great Depression. Yes, unemployment would likely rise during the next recession, which would be unquestionably painful for those affected. But the losses could be limited and the duration of the economic contraction could be relatively short.

The complicated mess of the markets and economy, explained 🧩

Economic growth has since been awesome, powered by tons of job growth. GDP, personal consumption, and home prices roared to record levels as the unemployment rate tumbled. One problem: Inflation. Why? Supply hasn’t been able to keep up with booming demand, a dynamic that’s been fanning the flames of inflation.

On Thursday, the S&P 500 fell to 3,491 — its intraday low for the year — following a surprisingly hot consumer price index report. High inflation means market volatility should persist as the Federal Reserve continues to move in ways unfriendly to the economy and stock prices. We’ve been discussing this dynamic for weeks. But for you newer subscribers, it may be helpful to read up on these archived paid newsletters from June:

For those wondering, I did not start with an existing email list. When I launched on October 14, 2021, I had zero subscribers.

I have exact figures for all of this that get updated in real time. But it’s unclear to me what that information is worth to you unless you’re thinking about buying TKer.

This does not include newsletters sent in the past week. Many subscribers open their newsletter emails on a lag.

If you’re reading this footnote, I’m guessing there’s a chance you want to understand more about how TKer’s business works. I’ll note that I was pretty aggressive about promoting TKer newsletters on Twitter during the first few weeks. But audience growth started getting momentum on its own. Subscribers have been sharing TKer with their friends, family, colleagues, and audiences. I’ve also benefited greatly from subscribers who themselves write newsletters on the Substack platform and recommend my newsletter to their subscribers. I’m eternally grateful!

Regarding audience development, I have other levers I can pull. But for now, I’m learning a lot from my current subscribers, who are very engaged.

(By the way, I can’t stop people from forwarding TKer’s paid newsletters. I know it’s happening quite a bit. That’s part of the risk you build into the business model. That said, if you find the paid newsletters valuable, help an independent small business owner out and consider upgrading to a paid subscription! 🙏)

If you’re interested in hearing more about the business of newsletters and my experience with newsletters — keep in mind I’ve been involved with finance newsletters since 2006 — let me know! Send questions to sam@tker.co and I’ll consider writing more about this in the near future.

Thank you for all your work. Hoping to see 10,000 paid subscribers by next year!

Congratulations on the 1 year anniversary. I can vouch that the premium subscription is well worth it. 👍🏼