SPECIAL EDITION: The complicated mess of the markets and economy, explained 🧩

Good is bad and bad is good as the world fights inflation 🎈

The economy is growing. Jobs are booming. Consumers are spending. Corporate earnings are high and rising. And massive tailwinds suggest all of this can persist.

And yet the stock market has been getting absolutely crushed.

Below is a very brief summary of what’s going on, how we got here, where we we could be headed, and importantly, what it means for long-term investors in the stock market. It’s essentially a summary of everything thing TKer’s written since launching in October. If you want to go deeper, click on one of the many hyperlinks!

Demand has been awesome

At the onset of the coronavirus pandemic, the stock market crashed as much of the economy screeched to a halt. The federal government and the Federal Reserve swiftly unleashed tons of emergency stimulus, successfully pulling the economy back from the brink.1

Economic growth has since been awesome, powered by tons of job growth. GDP, personal consumption, and home prices roared to record levels as the unemployment rate tumbled.

All of this fueled a rebound in corporate earnings, which surged to record highs. The stock market followed suit, smashing records month after month.

One problem: Inflation.

Why?

Supply has been lagging

Supply hasn’t been able to keep up with booming demand, a dynamic that’s been fanning the flames of inflation.

You see, the pandemic caused huge disruptions in the global supply chain. Many businesses operated at limited capacity, and many people were unable to work. And the disruptions have continued amid new waves of infections spurred by new COVID-19 variants.

Everything from housing construction materials to chips for automobiles have been in short supply. Even goods that have been available have been held up due to bottlenecks at shipping ports and other transportation hubs, where labor has been tight.

On top of all that, supply chains have been further strained by the war between Russia and Ukraine, which has been particularly damaging to the global food and energy supply chains.

All of this is reflected in depleted inventories, bloated order backlogs, elongated supplier delivery times, and unfilled job openings.

But inflation hasn’t slowed the buying

Higher prices have been weighing on consumer and business sentiment for months. But it hasn’t stopped anyone from buying anyway.

Why? Because consumers and businesses can afford to pay up.

Consumers accumulated trillions in excess savings during the early phases of the pandemic, and they’ve also been getting raises. Meanwhile, the economy is creating hundreds of thousands of jobs every month, further increasing the spending power of the consumer.

Consumers have also spent much of the past two years cooped up in their homes, so they’ve been very eager to go out and do stuff.

Similarly, businesses have accumulated lots of cash. They also took advantage of the low interest rate environment to refinance their debt cheaply, and now their balance sheets are as strong as they’ve ever been.

Because many businesses have been seeing extraordinary demand, and because many have extra cash, many have been ordering tons of equipment while also paying up to fill millions of open jobs. At the same time, they’ve also been doling out raises in their efforts to retain employees.

Ironically, all of this incremental hiring and paying has only boosted consumers’ capacity to spend. This means even more demand amid lagging supply, perpetuating the inflation problem.

It hasn’t fixed itself, so central banks are intervening

We might not be having this inflation problem right now if supply chains had returned to their pre-pandemic order. Unfortunately, that hasn’t happened due to the ware in Ukraine and the successive waves of COVID infections around the world.

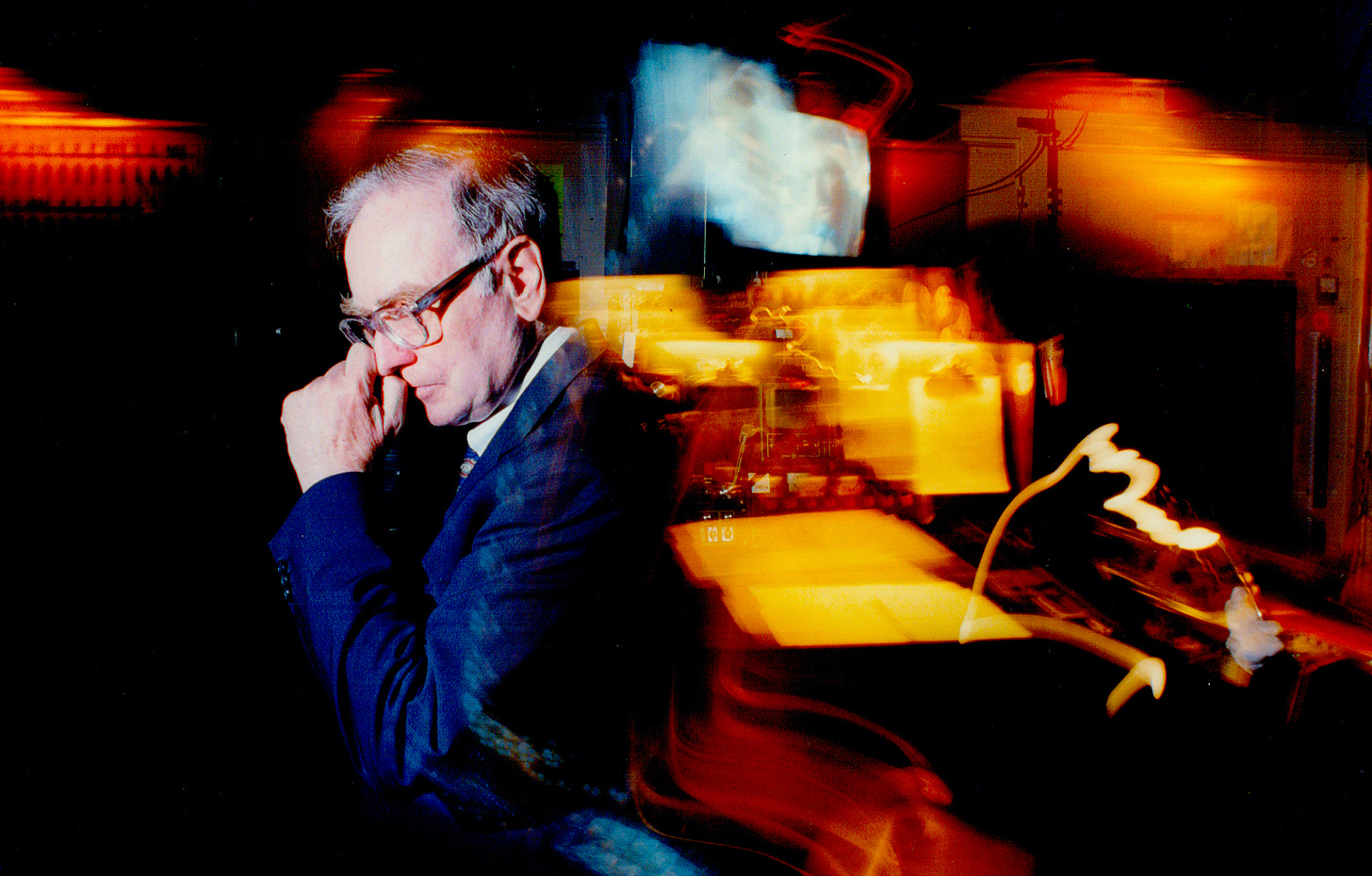

And so, in the U.S., the Fed is now moving aggressively to tighten monetary policy in its effort to cool inflation. The central bank — and many in the economics profession — believe that tighter monetary policy will translate into tighter financial conditions, which should help reduce excess demand for goods and services, which should ease the demand for workers, which in turn should allow wage growth to cool, which should ultimately help ease inflation.

In theory, the Fed can accomplish this without sending the economy all the way into a recession. How? Because, as we’ve noted, there is so much demand in excess of supply.

This is reflected in the fact that there are currently almost twice as many job openings as unemployed people. The Fed thinks that a monetary policy that reduces the gap between job openings and unemployment should help ease wage pressures. If things work out as planned, this could all happen without the unemployment rate rising materially.

Nevertheless, the whole process by definition increases the risk that the economy goes into recession, which may help explain why investors and traders have been dumping stocks as if we’re destined to do just that.

Good news is bad for now, and Powell will bring the ‘pain’

The challenge for Powell is that economic growth is being propped up by massive tailwinds, which — despite emerging headwinds — have enabled economic data to continue to break records.

As long as the economic data comes in such that demand is pressuring supply, then that good economic data is actually bad, in a way, because it’s inflationary.

Because the Fed’s only transmission mechanism for cooling the economy is through financial markets, it will continue to turn the knobs of tighter monetary policy until inflation comes down. And it’s been very explicit about this.

“Our overarching focus is using our tools to bring inflation back down to our 2% goal,” Fed Chair Jerome Powell emphasized at the central bank’s May policy meeting.

“What we need to see is clear and convincing evidence that inflation pressures are abating and inflation is coming down,” he said at a Wall Street Journal event on Tuesday. “And if we don’t see that, then we’ll have to consider moving more aggressively.“

And he also warned this may not be the smoothest process.

“There could be some pain involved in restoring price stability,“ he added.

In other words, Powell is willing to accept economic and market volatility in his efforts to rein in inflation.

BUT DON’T PANIC. Be prepared.

Some economic metrics may take a hit in the coming days, weeks, and months as the Fed cools inflation. But keep in mind that the economy is on very strong footing supported by those robust tailwinds. It would take a lot to push the economy into recession.

Even expectations for corporate earnings, which are the most important long-term driver of stock prices, could get revised down. However, they haven’t so far: Expectations for earnings have been resilient, which has made for more attractive valuations as stock prices have fallen.

Keep in mind that the Fed’s ultimate goal isn’t to slow the economy. Its ultimate goal is to cool inflation. Using policy tools to slow the economy is just a means to achieve those ends.

And so before the economy slows too much, it’s quite possible that supply chains improve, inventory levels correct, and job openings get filled, which could help ease inflation from the supply side.

A reminder for investors: Even Warren Buffett gets smoked in the short-run

The stock market is way down.

The S&P 500 had a closing low of 3,900.78 on Thursday, down 18.7% from its all-time closing high of 4,796.56 on January 3. If you consider the intraday market action, the S&P traded as low as 3,858.87 on Thursday, down 19.9% from its intraday high of 4,818.62 on January 4.

In other words, the market is a rounding error away from entering an official bear market.

Stock prices are a reflection of future expectations. And so, you could argue that the market appears to be pricing in a high probability of recession, which may not actually happen.

With interest rates trending higher, there’s a good justification for lower valuations, which explains some of the price decline. (But keep in mind that stocks don’t have to fall for valuations to fall if earnings are rising.)

It’s not hard to back into a laundry list of reasons for why stocks are down. Then again, if prices were up, we could easily back into a list of reasons for that too.

Ultimately, it’s incredibly difficult to predict the short-term direction of the market.

During periods of volatility, it can be tempting to dump stocks temporarily in an effort to minimize losses. However, the big risk is that you miss out on important intermittent rallies, which can do irreversible damage to long-term returns.

Keep in mind that if you do some short-term selling, you also need a plan for buying. That means you have to time the market twice, which even the pros have trouble doing.

There is an entire industry of well-paid professionals aiming to outperform the market, but most fail to do so in most years. And the few who manage to beat the market in one year are unlikely to repeat that performance in subsequent years.

Even Warren Buffett, arguably the greatest investor in history, will tell you he’s not great at timing the market. In fact, during the financial crisis, Buffett did the bulk of his buying in October 2008. The S&P 500 fell by more than 20% after his purchases before bottoming in March 2009.

But those trades ended up working out over the long run because he held.

In May, Buffett revealed that he went on another historic buying spree in the first quarter, investing $41 billion in the stock market from February 21 to March 15. Sure, the stock market has moved lower since then. But then again, his time horizon is longer than a few weeks.

Buffett’s purchases ahead of unanticipated sell-offs remind me of a great quote from legendary stock picker Peter Lynch. He said: “In the stock market, the most important organ is the stomach. It's not the brain.“

This brings us to TKer’s truths about the stock market: In the long run, things almost always work out for the better. But in the short run, you can get smoked. In fact, big stomach-churning sell-offs are quite common.

This is just what investing in the stock market is all about.

EDITOR’S NOTE: This piece was updated to include more quotes from Powell’s May 17 speaking engagement.

This is an incredibly important aspect of this whole discussion. While inflation is far from an ideal outcome, an economic depression with persistent job losses and price deflation would’ve been a far worse scenario. From a policy perspective, it’s much easier to slow an economy that’s growing too much than to reverse an economy that’s spiraling.

This is one of your best TKer pieces so far, Sam.

Thank you for putting this together.