A chart market skeptics will find frustrating 📉📈

Plus a charted review of the macro crosscurrents 🔀

Stocks made new record highs, with the S&P 500 setting a closing high of 5,175.27 on Tuesday. For the week, the S&P declined 0.1% to close at 5,117.09. The index is now up 7.3% year to date and up 43.1% from its October 12, 2022 closing low of 3,577.03.

One of the more controversial developments in the markets is the persistent rally in stocks as the number of expected Fed rate cuts for 2024 have been falling.

It’s a surprising dynamic because lower rates — all other things being equal — are considered bullish for stocks. And so expectations for fewer rate cuts than previously thought would logically be bearish.

Furthermore, one particularly notable aspect of the recent market rally is that prices are rising faster than expectations for future earnings growth, which means already elevated valuations have been rising. And higher rates are thought to be bad for valuations.

Morgan Stanley’s Michael Wilson recently charted these developments. Valuation is represented by the next-12 month price/earnings (NTM P/E) ratio — it’s the yellow line. The expected change in the Fed’s benchmark interest rate is the blue line. The lines diverged about two months ago.

Market skeptics will find this chart frustrating as it’s arguably a manifestation of irrational behavior.

There are at least two big premises to consider to understand the dynamic here.

First, the Fed’s upcoming moves on interest rates might not be that big of a deal for the stock market. During periods of economic and financial stress, Fed rate decisions can be highly impactful. Not so much when the economy is booming and the stock market is at record highs. For more on this argument, read: Whether or not the Fed cuts rates is not the right question 🔪.

Second, valuations aren’t particularly helpful in the short-term. They’re not really mean reverting, and they don’t really tell you what stocks will do in the next 12 months.

In other words, just because valuations are above some long-term average doesn’t mean they’re more likely to fall in the near term. Valuations can become increasingly stretched for reasons that can be hard to explain.

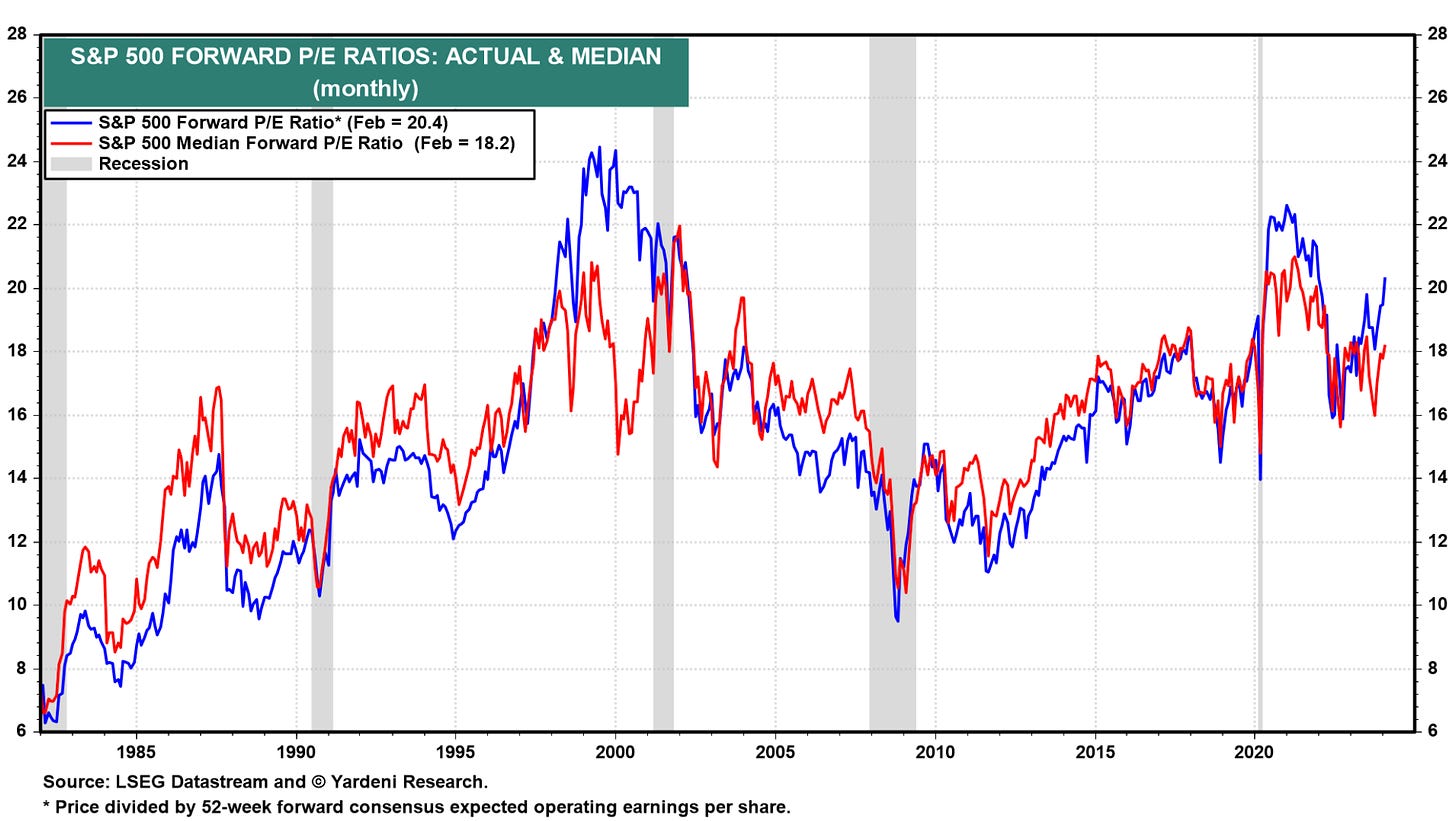

As you can see in the chart below from Yardeni Research, P/E ratios don’t gravitate back to their long term averages quickly. Rather, they often drift away from averages over extended periods that can last years.

Also, elevated valuations today don’t necessarily reflect irrational behavior on the part of investors and traders. Earlier this month, BofA’s Savita Subramanian made the case for why higher valuations today are fundamentally justified. Among other things, she observed that companies are much more efficient than they used to be.

Consider labor productivity for the S&P 500, which is at record highs.

Zooming out 🔭

Who knows what’ll happen next? A big correction in the markets would not surprise — in fact, a big intra-year correction in the coming months would be quite typical. A quick sell-off in prices would bring valuations down.

But the point of this discussion is to remind you that valuations aren’t helpful in the short-run, that there’s more to the story than “high interest rates are bad for stocks,” and that what the Fed does next might not be that big of a deal. As such, you should be prepared for the relationship between valuations and Fed decisions to become increasingly loose.

-

Related from TKer:

Stocks are unbothered by the shrinking number of expected rate cuts 🤷🏻♂️

Whether or not the Fed cuts rates is not the right question 🔪

There's more to the story than 'high interest rates are bad for stocks' 🤨

12 charts to consider with the stock market near record highs 📈

Reviewing the macro crosscurrents 🔀

There were a few notable data points and macroeconomic developments from last week to consider:

🛍️ Consumer spending is up, but the trend reflects cooling. Retail sales increased 0.6% in February to $700.7 billion.

Categories driving strength included building materials, restaurants and bars, cars and parts, electronics, and gas stations. Furniture, clothes, health and personal care, and department stores saw declines.

All of this is in line with an economy that has gone from very hot to pretty good.

For more, read: Economic growth: Slowdown, recession, or something else? 🇺🇸

💳 Card data suggests spending is holding up. From Bank of America: “Total card spending per HH was up 0.1% y/y in the week ending Mar 09, according to BAC aggregated credit & debit card data. Retail ex auto spending per HH came in at -1.0% y/y in the week ending Mar 09. Overall, after a soft but stable February, spending in March seems to be improving.“

For more on what’s bolstering personal consumption activity, read: Consumer finances are somewhere between 'strong' and 'normal' 💰

💼 Unemployment claims tick lower. Initial claims for unemployment benefits declined to 209,000 during the week ending March 9, down from 210,000 the week prior. While this is above the September 2022 low of 182,000, it continues to trend at levels historically associated with economic growth.

For more, read: Labor market: How cool will it get? 🥶

💵 Job switchers lose pay advantage. According to the Atlanta Fed’s wage growth tracker, the gap wage growth between those who switch jobs and those who stay at their jobs continues to close. Job switchers saw 5.9% wage growth in the 12 months ending in February, whereas job stayers saw 5.1% growth during the period.

For more on why the Fed is concerned about high wage growth, read: The complicated mess of the markets and economy, explained 🧩

👍 Inflation is cool-ish. The Consumer Price Index (CPI) in February was up 3.2% from a year ago. This was up modestly from the 3.1% rate in January. Adjusted for food and energy prices, core CPI was up 3.8%, the lowest level since May 2021.

On a month-over-month basis, CPI was up just 0.4%. Core CPI was also up 0.4%.

If you annualize the six-month trend in the monthly figures — a reflection of the short-term trend in prices — CPI was rising at a 3.2% rate and core CPI was climbing at a 3.9% rate.

Overall, while many broad measures of inflation continue to hover above the Fed’s target rate of 2%, they are way down from peak levels in the summer of 2022.

For more, read: Inflation: Is the worst behind us? 🎈

⛽️ Gas prices rise. From AAA: “The national average for a gallon of gas has been rising leisurely since last week, moving a mere two cents higher to $3.41. However, with the cost of oil crossing the $80 per barrel mark and gas demand popping with warmer temps and better weather, change may be coming to the pump. Another critical factor is the arrival of more expensive summer blend gas, which tends to increase pump prices by 10 to 15 cents.”

For more on energy prices, read: The other side of the oil price story 🛢

👎 Inflation expectations deteriorate. From the New York Fed’s February Survey of Consumer Expectations: “Median inflation expectations remained unchanged at 3.0% at the one-year horizon, increased to 2.7% from 2.4% at the three-year ahead horizon, and increased to 2.9% from 2.5% at the five-year ahead horizon.”

For more, read: The end of the inflation crisis 🎈

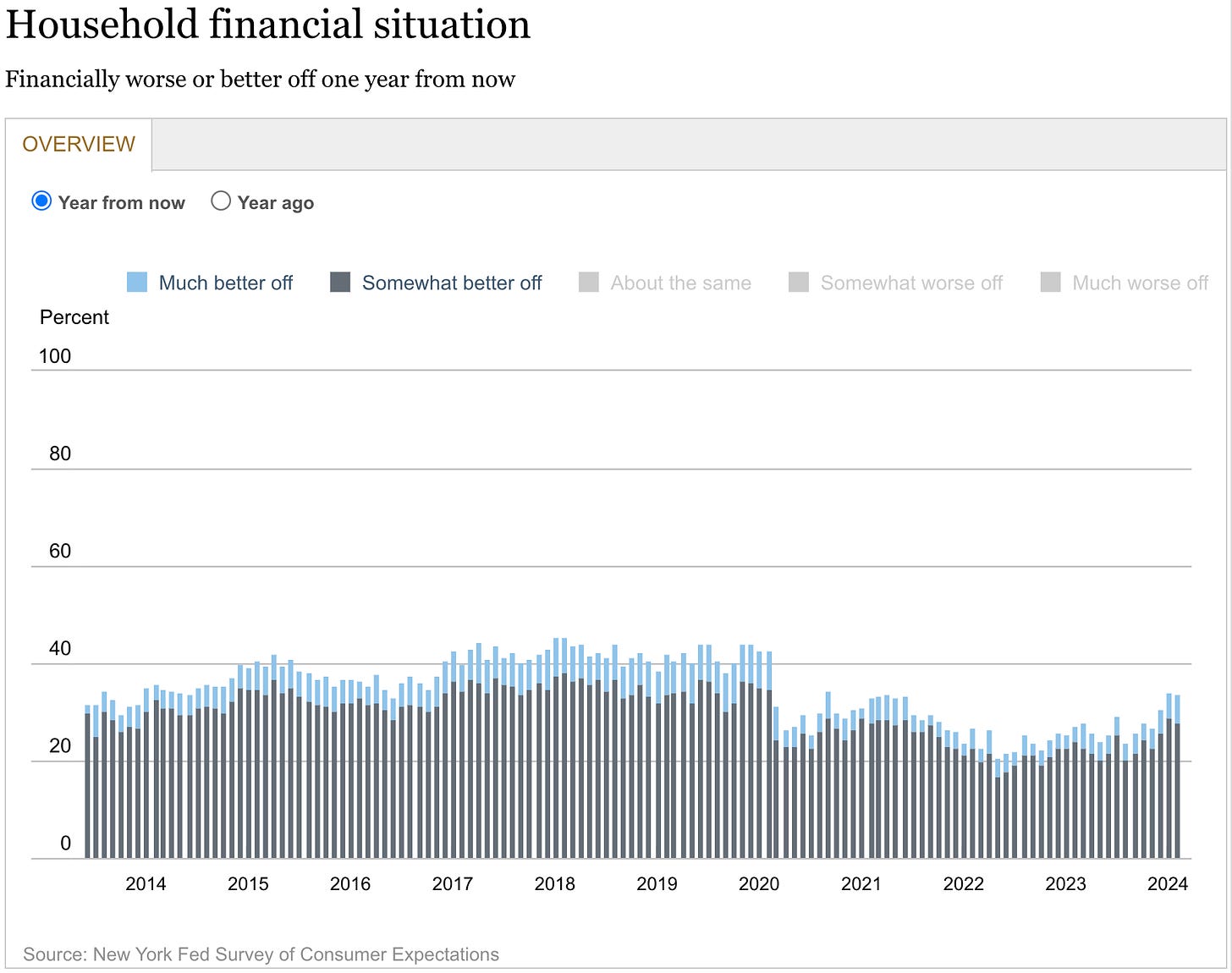

👎 Consumers feel less better off about their financial situation. From the New York Fed’s February Survey of Consumer Expectations: “Perceptions about households’ current financial situations deteriorated somewhat with fewer respondents reporting being better off than a year ago. Year-ahead expectations also deteriorated marginally with a smaller share of respondents expecting to be better off and a slightly larger share of respondents expecting to be worse off a year from now.“

For more on consumer finances, read: People have money 💵

👎 Consumer sentiment ticks modestly lower. From the University of Michigan’s March Surveys of Consumers: “After strong gains between November 2023 and January 2024, consumer views have stabilized into a holding pattern; consumers perceived few signals that the economy is currently improving or deteriorating. Indeed, many are withholding judgment about the trajectory of the economy, particularly in the long term, pending the results of this November’s election.“

For more on this, read: Sentiment: Finally a vibe-spansion? 🙃

👎 Small business optimism deteriorates. The NFIB’s Small Business Optimism Index ticked lower in February.

Importantly, the more tangible “hard” components of the index continue to hold up much better than the more sentiment-oriented “soft” components. However, they have been cooling.

Keep in mind that during times of perceived stress, soft data tends to be more exaggerated than actual hard data.

For more on this, read: What businesses do > what businesses say 🙊

🏠 Mortgage rates tick lower. According to Freddie Mac, the average 30-year fixed-rate mortgage fell to 6.74% from 6.88% the week prior. From Freddie Mac: “The 30-year fixed-rate mortgage decreased again this week, with declines totaling almost a quarter of a percent in two weeks’ time. Despite the recent dip, mortgage rates remain high as the market contends with the pressure of sticky inflation. In this environment, there is a good possibility that rates will stay higher for a longer period of time.”

For more on mortgages and home prices, read: Why home prices and rents are creating all sorts of confusion about inflation 😖

🛠️ Industrial activity picks up. Industrial production activity in February rose 0.1% from January levels, with manufacturing output rising 0.8%.

For more on activity stabilizing as inflation cools, read: The bullish 'goldilocks' soft landing scenario that everyone wants 😀

🍾 The entrepreneurial spirit is alive. Small business applications, while down slightly from the previous month, remain well above prepandemic levels. From the Census Bureau: “February 2024 Business Applications were 436,358, down 2.7% (seasonally adjusted) from January. Of those, 142,576 were High-Propensity Business Applications.“

For more on what the business formation boom means, read: Promising signs for productivity ⚙️

📈 Near-term GDP growth estimates look good. The Atlanta Fed’s GDPNow model sees real GDP growth climbing at a 2.3% rate in Q1.

For more on economic growth, read: Economic growth: Slowdown, recession, or something else? 🇺🇸

Putting it all together 🤔

We continue to get evidence that we are experiencing a bullish “Goldilocks” soft landing scenario where inflation cools to manageable levels without the economy having to sink into recession.

This comes as the Federal Reserve continues to employ very tight monetary policy in its ongoing effort to get inflation under control. While it’s true that the Fed has taken a less hawkish tone in 2023 and 2024 than in 2022, and that most economists agree that the final interest rate hike of the cycle has either already happened, inflation still has to stay cool for a little while before the central bank is comfortable with price stability.

So we should expect the central bank to keep monetary policy tight, which means we should be prepared for relatively tight financial conditions (e.g., higher interest rates, tighter lending standards, and lower stock valuations) to linger. All this means monetary policy will be unfriendly to markets for the time being, and the risk the economy slips into a recession will be relatively elevated.

At the same time, we also know that stocks are discounting mechanisms — meaning that prices will have bottomed before the Fed signals a major dovish turn in monetary policy.

Also, it’s important to remember that while recession risks may be elevated, consumers are coming from a very strong financial position. Unemployed people are getting jobs, and those with jobs are getting raises.

Similarly, business finances are healthy as many corporations locked in low interest rates on their debt in recent years. Even as the threat of higher debt servicing costs looms, elevated profit margins give corporations room to absorb higher costs.

At this point, any downturn is unlikely to turn into economic calamity given that the financial health of consumers and businesses remains very strong.

And as always, long-term investors should remember that recessions and bear markets are just part of the deal when you enter the stock market with the aim of generating long-term returns. While markets have had a pretty rough couple of years, the long-run outlook for stocks remains positive.

For more on how the macro story is evolving, check out the the previous TKer macro crosscurrents »

TKer’s best insights about the stock market 📈

Here’s a roundup of some of TKer’s most talked-about paid and free newsletters about the stock market. All of the headlines are hyperlinked to the archived pieces.

10 truths about the stock market 📈

The stock market can be an intimidating place: It’s real money on the line, there’s an overwhelming amount of information, and people have lost fortunes in it very quickly. But it’s also a place where thoughtful investors have long accumulated a lot of wealth. The primary difference between those two outlooks is related to misconceptions about the stock market that can lead people to make poor investment decisions.

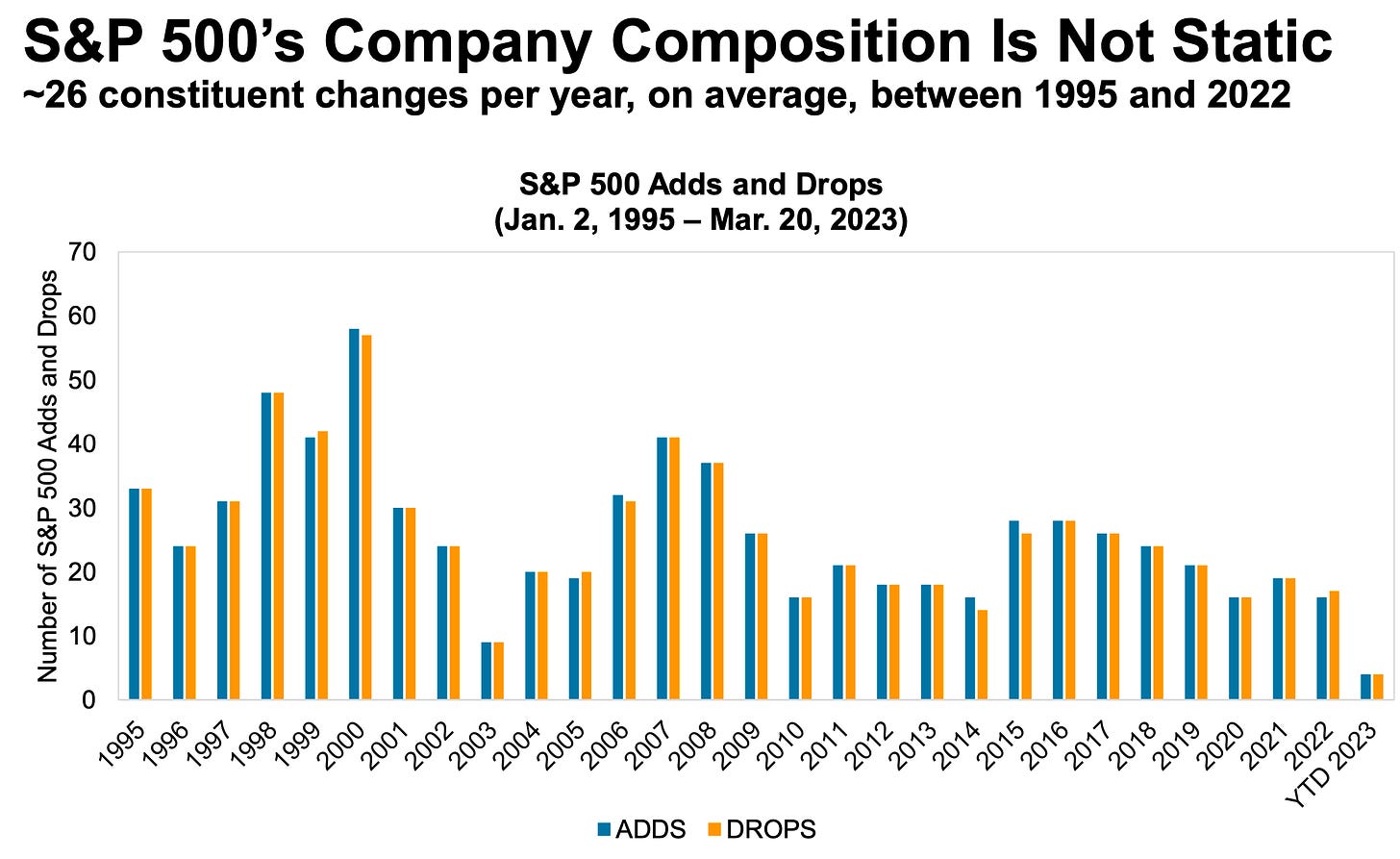

The makeup of the S&P 500 is constantly changing 🔀

Passive investing is a concept usually associated with buying and holding a fund that tracks an index. And no passive investment strategy has attracted as much attention as buying an S&P 500 index fund. However, the S&P 500 — an index of 500 of the largest U.S. companies — is anything but a static set of 500 stocks.

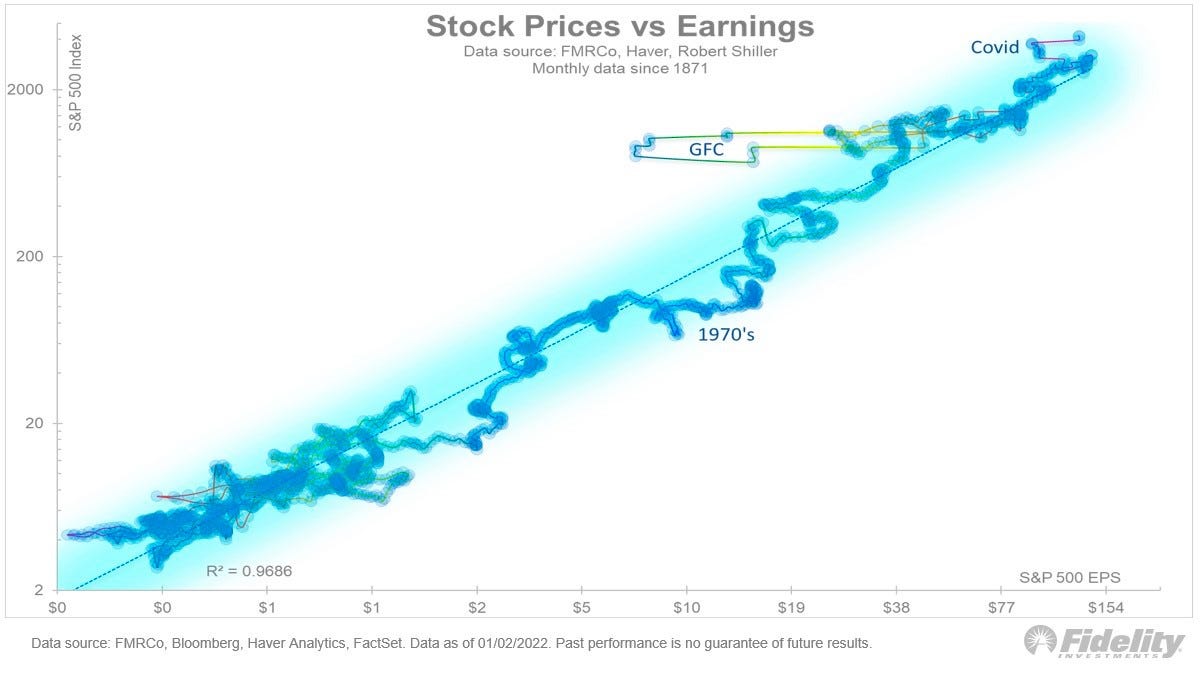

The key driver of stock prices: Earnings💰

For investors, anything you can ever learn about a company matters only if it also tells you something about earnings. That’s because long-term moves in a stock can ultimately be explained by the underlying company’s earnings, expectations for earnings, and uncertainty about those expectations for earnings. Over time, the relationship between stock prices and earnings have a very tight statistical relationship.

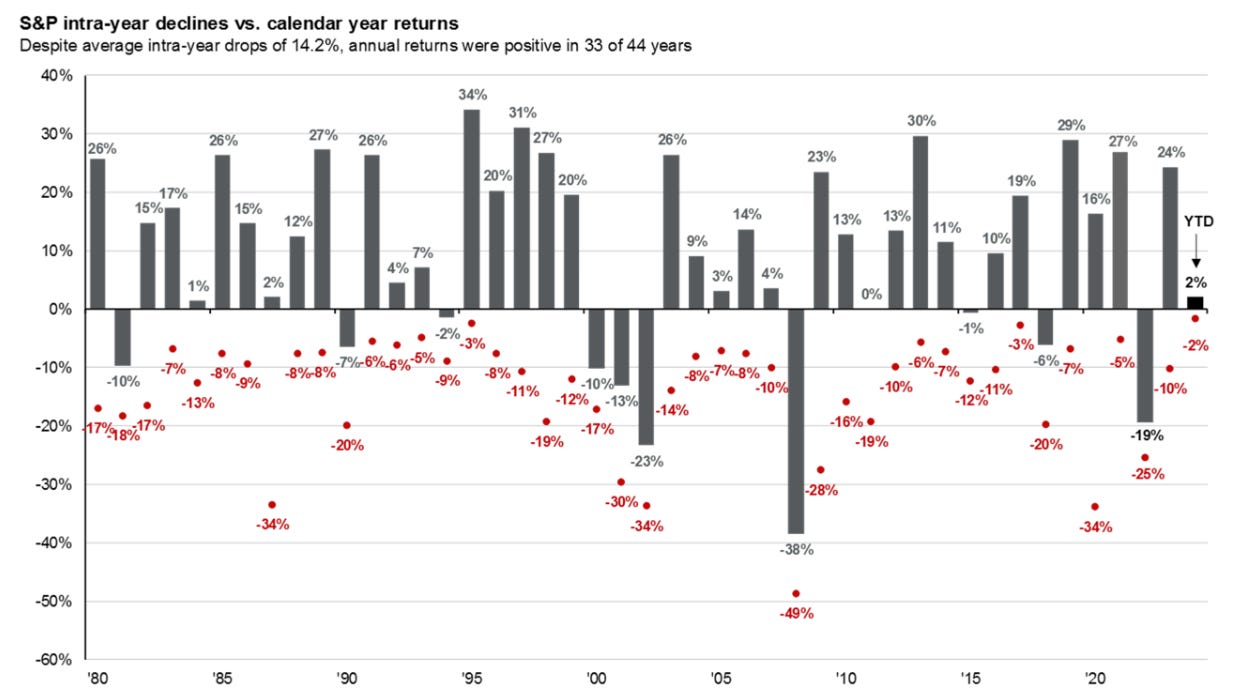

Stomach-churning stock market sell-offs are normal🎢

Investors should always be mentally prepared for some big sell-offs in the stock market. It’s part of the deal when you invest in an asset class that is sensitive to the constant flow of good and bad news. Since 1950, the S&P 500 has seen an average annual max drawdown (i.e., the biggest intra-year sell-off) of 14%.

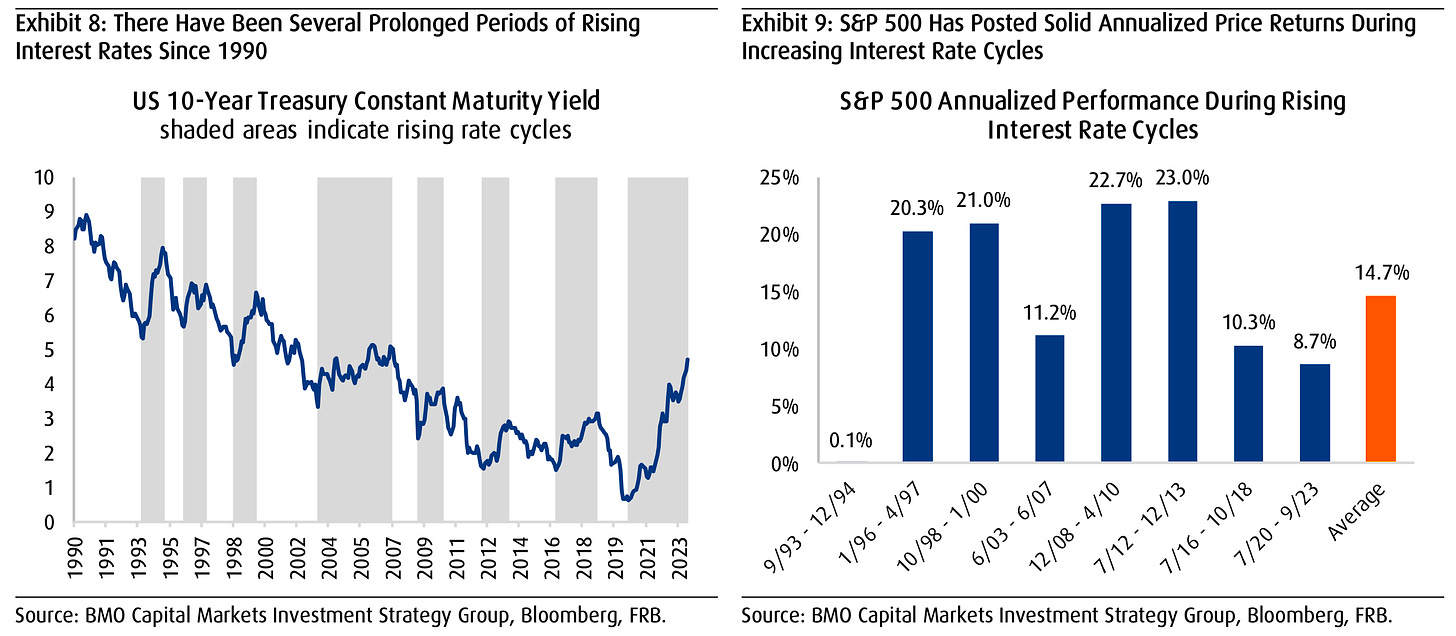

High and rising interest rates don't spell doom for stocks👍

Generally speaking, rising interest rates are not welcome news for the economy and the stock market. They represent higher financing costs for businesses and consumers. All other things being equal, rising rates represent a hindrance to growth. However, the world is complicated, and this narrative comes with a lot of nuance. One big counterintuitive piece to this narrative is that historically, stocks have actually performed well during periods of rising interest rates.

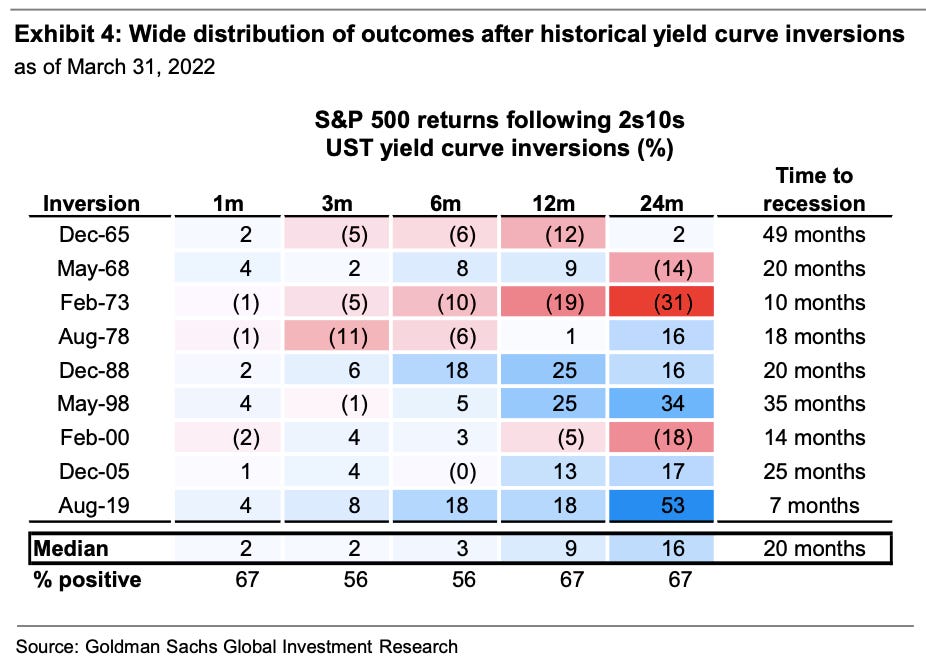

How stocks performed when the yield curve inverted ⚠️

There’ve been lots of talk about the “yield curve inversion,” with media outlets playing up that this bond market phenomenon may be signaling a recession. Admittedly, yield curve inversions have a pretty good track record of being followed by recessions, and recessions usually come with significant market sell-offs. But experts also caution against concluding that inverted yield curves are bulletproof leading indicators.

How the stock market performed around recessions 📉📈

Every recession in history was different. And the range of stock performance around them varied greatly. There are two things worth noting. First, recessions have always been accompanied by a significant drawdown in stock prices. Second, the stock market bottomed and inflected upward long before recessions ended.

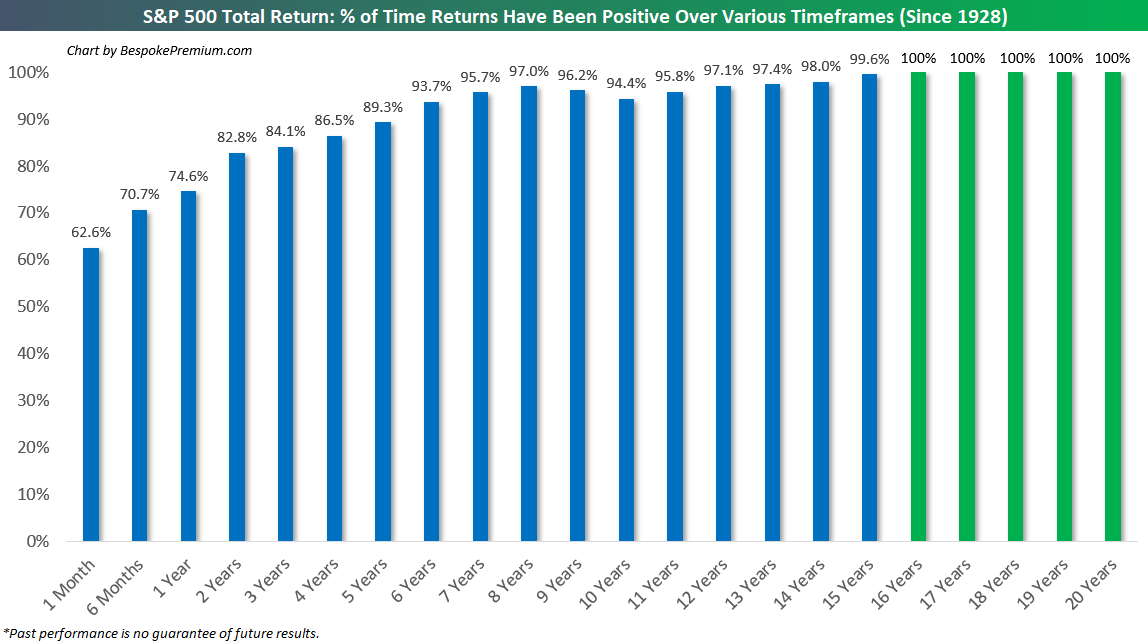

In the stock market, time pays ⏳

Since 1928, the S&P 500 generated a positive total return more than 89% of the time over all five-year periods. Those are pretty good odds. When you extend the timeframe to 20 years, you’ll see that there’s never been a period where the S&P 500 didn’t generate a positive return.

What a strong dollar means for stocks 👑

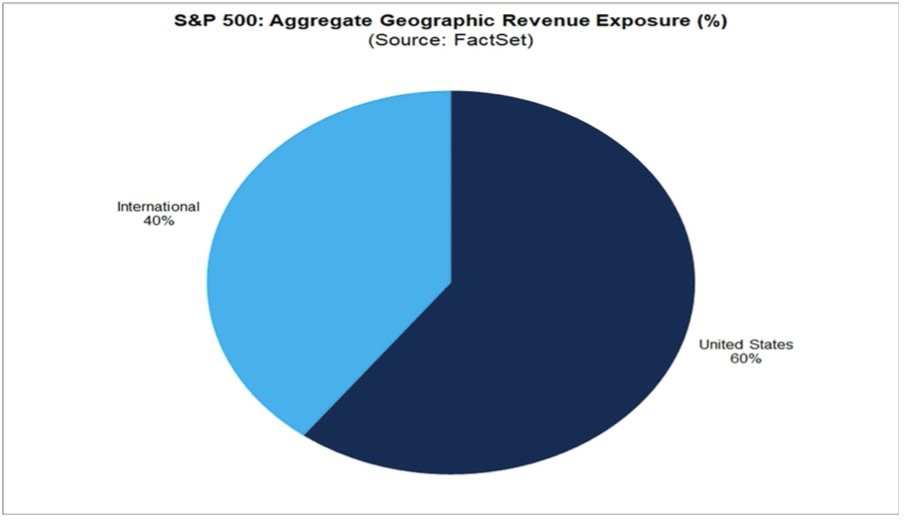

While a strong dollar may be great news for Americans vacationing abroad and U.S. businesses importing goods from overseas, it’s a headwind for multinational U.S.-based corporations doing business in non-U.S. markets.

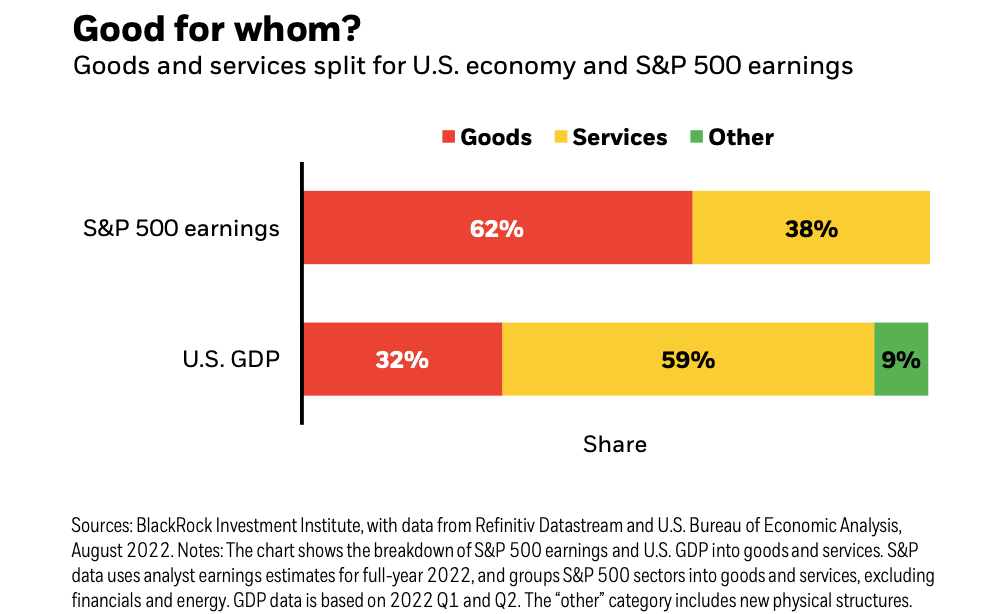

Economy ≠ Stock Market 🤷♂️

The stock market sorta reflects the economy. But also, not really. The S&P 500 is more about the manufacture and sale of goods. U.S. GDP is more about providing services.

Stanley Druckenmiller's No. 1 piece of advice for novice investors 🧐

…you don't want to buy them when earnings are great, because what are they doing when their earnings are great? They go out and expand capacity. Three or four years later, there's overcapacity and they're losing money. What about when they're losing money? Well, then they’ve stopped building capacity. So three or four years later, capacity will have shrunk and their profit margins will be way up. So, you always have to sort of imagine the world the way it's going to be in 18 to 24 months as opposed to now. If you buy it now, you're buying into every single fad every single moment. Whereas if you envision the future, you're trying to imagine how that might be reflected differently in security prices.

Peter Lynch made a remarkably prescient market observation in 1994 🎯

Some event will come out of left field, and the market will go down, or the market will go up. Volatility will occur. Markets will continue to have these ups and downs. … Basic corporate profits have grown about 8% a year historically. So, corporate profits double about every nine years. The stock market ought to double about every nine years… The next 500 points, the next 600 points — I don’t know which way they’ll go… They’ll double again in eight or nine years after that. Because profits go up 8% a year, and stocks will follow. That's all there is to it.

Warren Buffett's 'fourth law of motion' 📉

Long ago, Sir Isaac Newton gave us three laws of motion, which were the work of genius. But Sir Isaac’s talents didn’t extend to investing: He lost a bundle in the South Sea Bubble, explaining later, “I can calculate the movement of the stars, but not the madness of men.” If he had not been traumatized by this loss, Sir Isaac might well have gone on to discover the Fourth Law of Motion: For investors as a whole, returns decrease as motion increases.

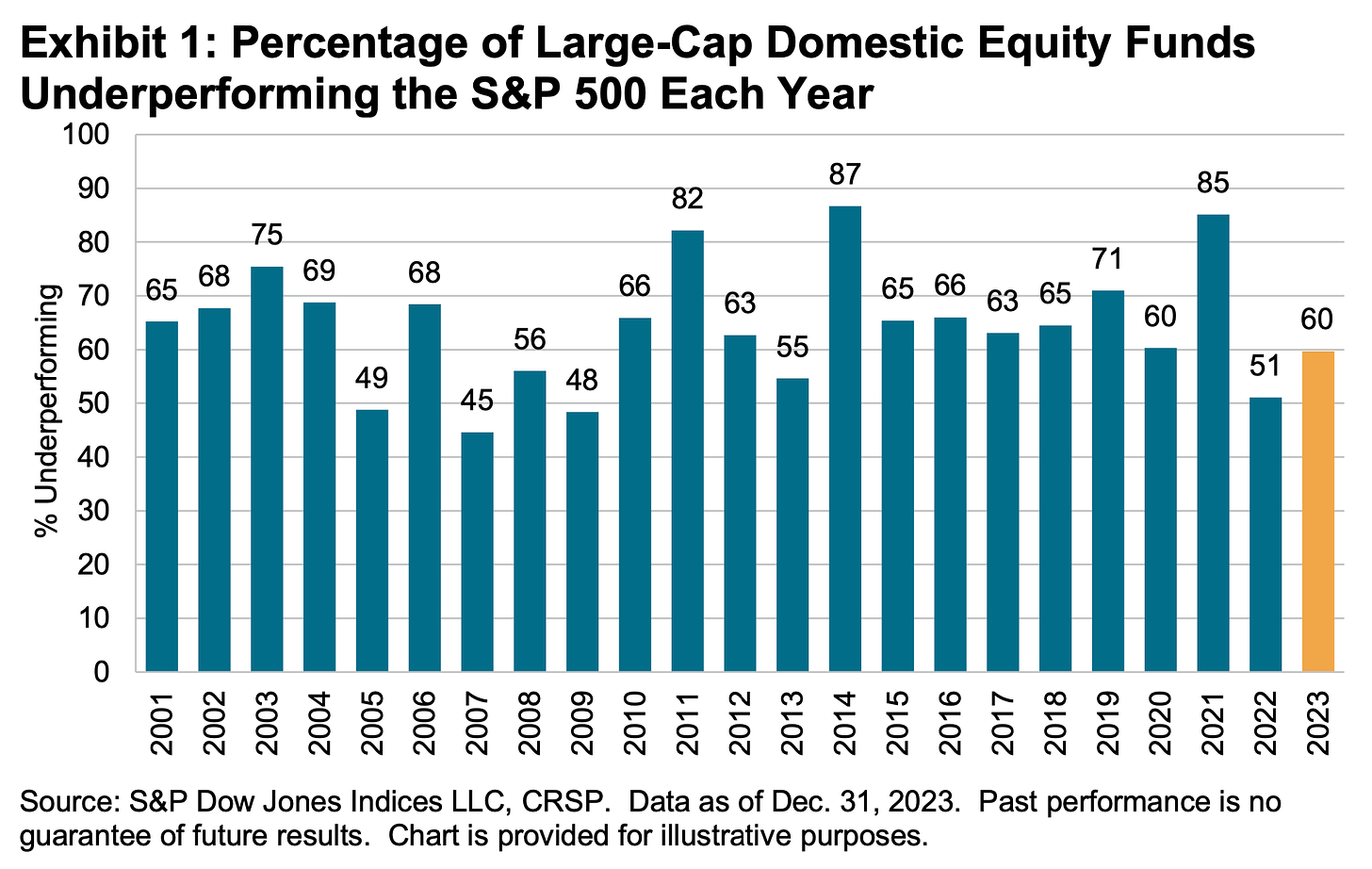

Most pros can’t beat the market 🥊

According to S&P Dow Jones Indices (SPDJI), 59.7% of U.S. large-cap equity fund managers underperformed the S&P 500 in 2023. As you stretch the time horizon, the numbers get even more dismal. Over a three-year period, 79.8% underperformed. Over a 10-year period, 87.4% underperformed. And over a 20-year period, 93% underperformed. This 2023 performance follows 13 consecutive years in which the majority of fund managers in this category have lagged the index.

The sobering stats behind 'past performance is no guarantee of future results' 📊

S&P Dow Jones Indices found that funds beat their benchmark in a given year are rarely able to continue outperforming in subsequent years. For example, 318 large-cap equity funds were in the top half of performance in 2020. Of those funds, 39% came in the top half again in 2021, and just 5% were able to extend that streak through 2022. If you set the bar even higher and consider those in the top quartile of performance, just 7% of 156 large-cap funds remained in the top quartile in 2021. No large-cap funds were able to stay in the top quartile for the three consecutive years ending in 2022.

The odds are stacked against stock pickers 🎲

Picking stocks in an attempt to beat market averages is an incredibly challenging and sometimes money-losing effort. In fact, most professional stock pickers aren’t able to do this on a consistent basis. One of the reasons for this is that most stocks don’t deliver above-average returns. According to S&P Dow Jones Indices, only 24% of the stocks in the S&P 500 outperformed the average stock’s return from 2000 to 2022. Over this period, the average return on an S&P 500 stock was 390%, while the median stock rose by just 93%.