Identifying winning stocks is hard. Holding winning stocks is a nightmare. 🫠

Plus a charted review of the macro crosscurrents 🔀

📈 The stock market rallied last week, with the S&P 500 gaining 1.9% to close at 5,911.69. It’s now down 3.8% from its February 19 closing high of 6,144.15 and up 65.3% from its October 12, 2022 closing low of 3,577.03. For more on how the market moves, read: It's OK to have emotions — just don't let them near your stock portfolio 📉

-

We’ve discussed exhaustively how difficult it is to pick stocks that outperform the market.

But let’s assume you were able to identify these winning stocks. Is it smooth sailing from there as you smoke the competition?

No. Far from it.

It turns out that the stocks offering the best returns for investors historically experienced incredibly painful max drawdowns (i.e. percentage declines from a price peak to a trough).

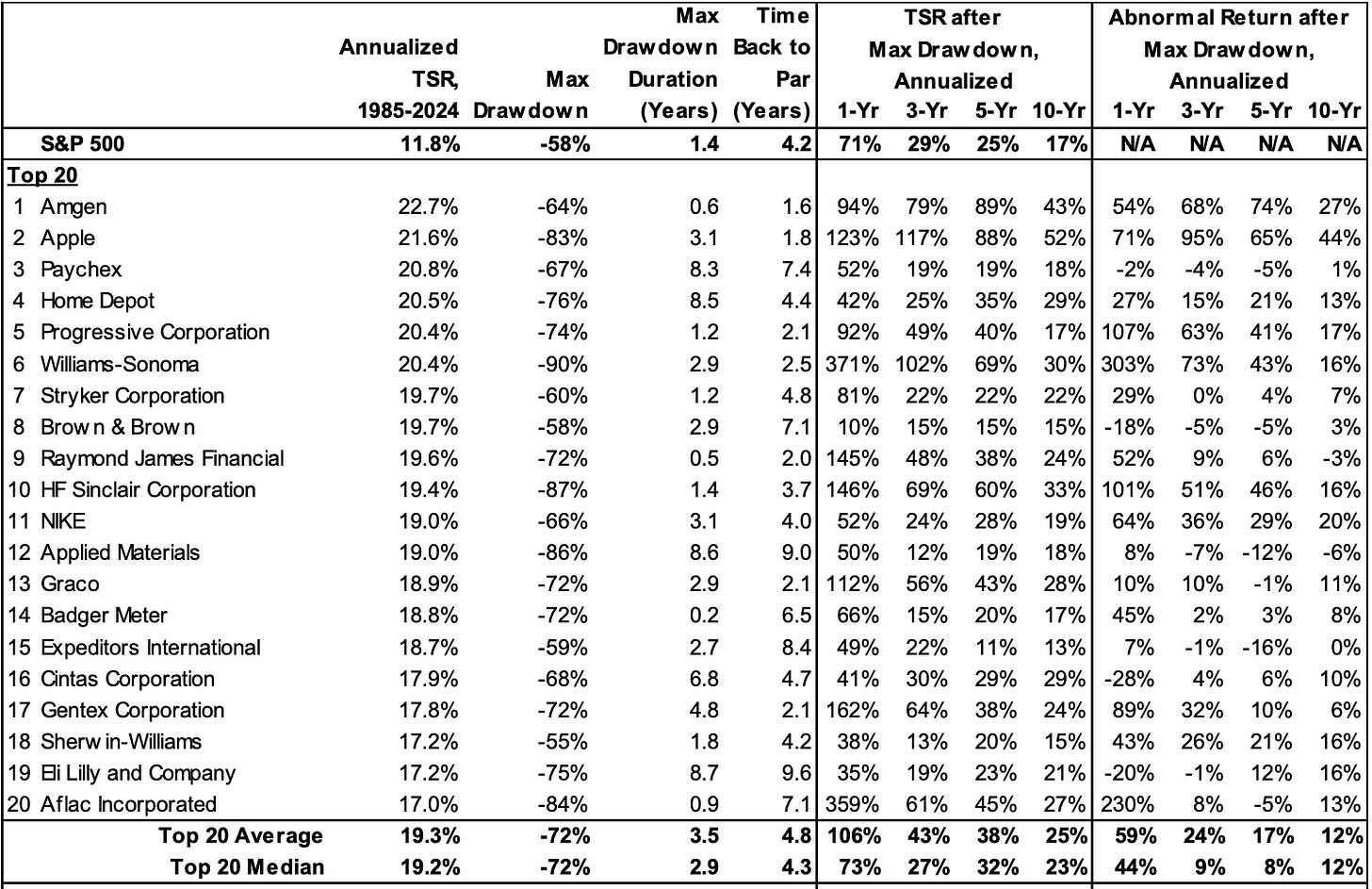

Morgan Stanley’s Michael Mauboussin and Dan Callahan recently studied the price behavior of 6,500 stocks. Among other things, they took a closer look at the 20 stocks with the best total shareholder returns over the 40-year period from 1985 to 2024. They also reviewed the performance of the 20 worst performers during the period. (Note: They only considered stocks listed on the NYSE, NASDAQ and NYSE American exchanges that traded during the entire measurement period. They excluded companies worth less than $1 billion at the beginning and $250 million at the end of their maximum drawdowns.)

“The median maximum drawdown was 72% for the best group, and the median maximum drawdown duration, the time from peak to trough, was 2.9 years,” they found. “The median time to return to the prior peak was 4.3 years. The median annualized abnormal returns following the bottom was 8% for the next 5 years and 12% for the next 10 years. This is based on the unrealistic assumption the stock was purchased at the low.”

Just thinking about one of my positions losing 72% of its value makes me queasy, even knowing full well this is the average behavior of the best stocks.

Now imagine being a fund manager with the conviction to hang on to these types of stocks.

Mauboussin and Callahan note that Alpha Architect’s Wes Gray considered this thought experiment in a paper titled: “Even God Would Get Fired as an Active Investor.”

“[Gray’s] point is that if you had the (godlike) foresight to build a portfolio of the stocks that would produce the highest TSRs over the next five years, you would have ‘great returns, but gut-wrenching drawdowns,’” they wrote. “In other words, the drawdowns are so large that a client who hired you to be their active manager might fire you.”

Investing in index funds has its benefits 👍

The analysts considered the performance of the S&P 500 over this measurement period to show the benefits of diversification.

“The maximum drawdown for the index was 58%, the maximum drawdown duration was 1.4 years, and the time to recover back to par was 4.2 years,” they observed. “Following the trough, the annual TSR for the S&P 500 was 25% over 5 years and 17% over 10 years.”

So maybe your return isn’t as high as investing in the top performing stocks. But the max drawdown for the S&P is shallower, and the duration of that drawdown is much shorter.

Obviously, you’d still opt for the more painful drawdowns if you knew you would outperform the market over time.

Unfortunately, almost no one has a consistent track record of identifying those long-term winners. And there are a lot of stocks with underperforming returns, including a whole lot of stocks that never recover from their max drawdowns.

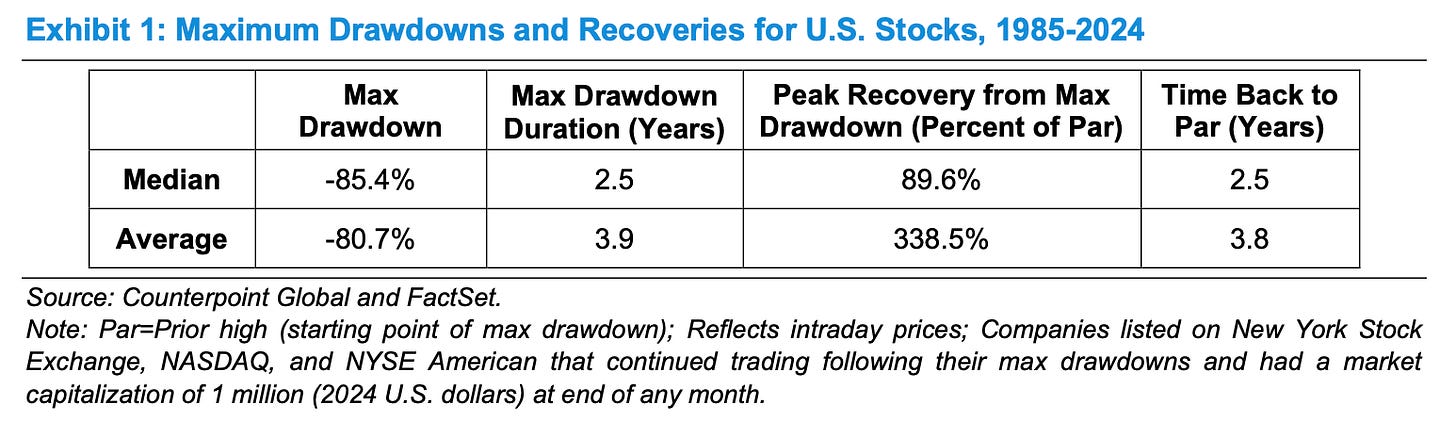

“The median stock’s recovery from its maximum drawdown is 90% of the prior peak price (par), which means it fails to return to its past high,” they found. “In fact, about 54% of stocks never return to par after hitting bottom.” (Note: For this review, they considered stocks listed on the NYSE, NASDAQ and NYSE American exchanges that traded during the entire measurement period. They only considered stocks that worth worth at least $1 million at the end of any month.)

One of the more notable findings in this study is that the average recovery from a drawdown is a whopping 338.5%, to which the analysts said: “This tells you that some stocks produced very high returns off of the bottom.“

Indeed, a few stocks — some generating >1,000% returns — can be responsible for the bulk of a portfolio’s returns.

To put it another way, the median 89.5% recovery figure tells us it’s very hard to pick winning stocks. Meanwhile, the average 338.5% recovery figure tells us that a broadly diversified portfolio with exposure to all stocks can generate returns that multiply the value of your initial investment.

It takes a strong stomach🫄🏻

Legendary stock picker Peter Lynch once said: "In the stock market, the most important organ is the stomach. It's not the brain.“

This is true for investors in broadly diversified index funds. This is even more true for investors who aim to pick stocks with the aim of producing market-beating returns.

-

Related from TKer:

Warren Buffett: 'It takes just a few winners to work wonders' 🏆

'Past performance is' clearly 'no guarantee of future results' 📊

Most stock-picking pros underperformed in 2024's market rally 🫤

Review of the macro crosscurrents 🔀

There were several notable data points and macroeconomic developments since our last review: