Wall Street's 2026 outlook for stocks 🔭

Plus a charted review of the macro crosscurrents 🔀

[UPDATE 12/17/25: This post has been updated with additional targets and strategists’ commentary.]

It’s that time of year when Wall Street’s top strategists tell clients where they see the stock market heading in the year ahead.

The strategists followed by TKer have year-end S&P 500 targets ranging from 7,100 to 8,000. This implies returns between 3.3% and 16.4% from the Dec. 5 close.

Following three consecutive years of above-average gains, some of these targets may seem aggressive. But historically, targets tend to assume 8% to 10% returns, consistent with the midpoint of this year’s predictions.

Before we move on, I’d once again caution against putting too much weight into one-year targets. It’s extremely difficult to predict short-term moves in the market with any accuracy. Few have ever been able to do this consistently. Also, the market rarely delivers an average return in a given year.

DataTrek’s Nick Colas has pointed out that the standard deviation around the mean annual total return for the S&P 500 is nearly 20 percentage points! In other words, the S&P could return 20 percentage points more or less than the long-term average and still be “consistent with historical norms.”

With that in mind, here are some of what’s driving Wall Street’s views on the stock market for 2026:

Revenue should benefit from economic tailwinds: While economic growth isn’t expected to be spectacular, it should be bolstered by fiscal stimulus from the One Big Beautiful Bill Act (expected to add 0.9% to GDP), easier monetary policy as the Federal Reserve continues to cut rates, trade policy that’s more friendly than 2025, and more spending in AI capex. (Of course, some sectors are expected to do better than others, but we’re not going to get into that level of detail here.)

There will be some economic challenges: Inflation is expected to remain above the Fed’s 2% target rate. And labor markets are expected to remain cool as companies focus on keeping costs down by turning to AI for increasingly complex tasks.

Profit margins are expected to get fatter: Analysts expect already-high profit margins to get even higher in 2026. Importantly, most sectors are expected to see profit margin growth. Since the pandemic, companies have adjusted their cost structures aggressively. This has come with strategic layoffs, consolidated office space, and investment in new equipment, including efficiency-enhancing tools powered by AI. These moves are resulting in positive operating leverage (i.e., the degree to which costs move when sales move). Read more here.

Earnings growth should be strong: The consensus calls for an impressive 14% earnings growth in 2026. The “Magnificent 7” names are expected to lead the surge, but their growth rate is expected to cool from recent years. Meanwhile, earnings growth rates are expected to pick up broadly in other sectors. Also, it’s worth noting that earnings estimates tend to be pretty accurate.

Valuations could stay high: The more bullish strategists argue today’s above-average P/E ratios are justified and should persist through 2026. Some even went as far as to use the word “bubble” to characterize their views. Read more here.

But valuation could be a headwind: The more conservative strategists expect P/E ratios to contract from elevated levels. That means any returns in 2026 would be primarily driven by earnings growth.

Beware midterm election years: Many strategists note that midterm election years tend to be the weakest of a president’s four-year term. CFRA’s Sam Stovall has the stats: “The intra-year drawdown for mid-term election years since 1946 averaged 18%, which was the highest of all four years of the presidential cycle. In addition, the S&P 500 experienced the weakest average annual price gain, at only 3.8% and rose in price only 55% of the time, versus an average gain of 10.8% and 76% frequency of advance for the other three years.“

In summary: Expanding profit margins are expected to turn modest revenue growth into double-digit earnings growth, which should drive stock prices higher. The magnitude of those price gains will depend on whether or not valuations stay high.

The 2026 S&P 500 price targets 🔮

Below is a roundup of 13 of these 2026 targets, including highlights from the strategists’ commentary.

BofA: 7,100, $310 (as of Nov. 26): “Multiple expansion and earnings growth both pushed the S&P 500 up 15% this year. In 2026, earnings will do the liſt (we forecast 14% growth, or $310) with about 10pt PE contraction. 7100 implies ~5% price return. In 2025, policy uncertainty stymied broadening, and guidance remained muted. But from here, bonus depreciation should pull forward capex, corporate guidance is 2 to 1 bullish, and sentiment is far from euphoric. Liquidity is full blast today, but the direction of travel is likely less, not more — less buybacks, more capex, less central bank cuts than last year, and a Fed cutting only if growth is weak.“

Societe Generale: 7,300, $310 (as of Nov. 26): “Fed rate cuts are unfinished business. The One Big Beautiful Bill Act (OBBBA) has front-loaded stimulus, profit margins are widening beyond Tech, and corporate activity is expanding. AI-driven capex is accelerating, and borrowing is up, but leverage remains in check overall. Bottom line: The backdrop is positive for US assets — it’s too early to call the bull run over.“

Barclays: 7,400, $305 (as of Nov. 19): “1) The AI story keeps rolling, despite recent volatility sparked by capex and financing concerns, as compute demand continues to scale and monetization grows to encapsulate paid users, ads, and enterprise/agents; 2) Fed cuts are constructive for valuations, especially for cyclical/growth equities; 3) easier financial conditions support healthy deal activity; 4) worst is likely past on the tariff front, while US fiscal profile has improved YTD + modest boost from OBBBA; 5) US ‘26 GDP likely sluggish vs. LT trend but better than most DMs, while US equities continue to lead RoW in EPS growth, margin expansion and revisions.“

CFRA: 7,400 (as of Nov. 24): “Despite favorable GDP and EPS forecasts, 2026 should be volatile, since it is a mid-term election year, especially since a ‘wave’ is at stake (single-party control of the executive and legislative branches). Therefore, as we approach the new year, we advise investors to remain invested but vigilant, focusing on higher quality growth companies.”

UBS: 7,500, $309 (as of Nov. 10): “[E]arnings expectations and valuations are among the highest in four decades. Industry and style performance suggests an imminent broadening and strengthening of growth. We see that happening but only from Q2 2026, with a speed bump up first as tariffs worsen the growth-inflation mix temporarily. The market should consolidate and high-quality stocks should outperform. From late Q1, we should see a broadening of the rally into lower-quality cyclicals. Base case, we see the S&P500 rising to 7,500 in ‘26 driven by ~14% earnings growth, nearly half of that from Tech. The contribution from valuation is likely to be a small negative.“

HSBC: 7,500, $300 (as of Nov. 24): “…suggesting another year of double-digit gains mirroring the late 1990s equity boom. Back then, like today, tech is leading, return concentration is high, and a new technology is promising to be transformational. We expect equities to remain supported by the AI-led capex boom. Our colleagues have weighed in on the question: Are we in a bubble? Bubble or not — history shows that rallies can last for quite some time (3-5 years in the dot com/housing boom), so we see more to come and recommend a broadening of the AI trade.“

JPMorgan: 7,500, $315 (as of Nov. 25): “Despite AI bubble and valuation concerns, we see current elevated multiples correctly anticipating above-trend earnings growth, an AI capex boom, rising shareholder payouts, and easier fiscal and monetary policies. Also, the earnings benefit tied to deregulation and broadening AI-related productivity gains remain underappreciated.“

Goldman Sachs: 7,600, $305 (as of Dec. 11): “Our estimates incorporate GS macro forecasts for solid US GDP growth and a weaker US dollar alongside GS equity analyst forecasts for continued earnings strength among the largest technology stocks. Our 12% EPS growth forecast for 2026 combines revenue growth of 7% with 70 bp of profit margin expansion.“

KKR: 7,600, $303 (as of Dec. 17): “From a valuation perspective, our 2026-27 outlook assumes equity multiples remain in a 22-23x forward earnings range, broadly in line with current levels near 22.5x. We are not underwriting further multiple expansion. However, we believe valuations can largely hold steady, supported by easing tariff concerns (barring Supreme Court outcomes), accommodative financial conditions, further (albeit fewer) Fed rate cuts, and ongoing tailwinds from prior global monetary easing.“

Yardeni: 7,700, $310 (as of Nov. 25): “We expect that 2026 will be just another year of the Roaring 2020s, which remains our base-case scenario.“

Fundstrat: 7,700, $307 (as of Dec. 11): “The significant ‘Wall of Worry’ is a tailwind for the bull market,” Lee wrote. “New Fed = dovish policy = positive for stocks in 2H.“

RBC: 7,750, $311 (as of Dec. 1): “Investor sentiment may have more room to fall in the near term, but is already at levels sending a contrarian buy signal over the longer term. … Expectations for solid EPS growth plus some modest valuation tailwinds from lower rates can offset the valuation headwinds from uncomfortable inflation in the year ahead. … Bonds shouldn’t scare investors away from stocks. … The anticipated GDP backdrop is a bit of a drag on our stock market forecast. … Fighting the Fed doesn’t make sense.“

Morgan Stanley: 7,800, $317 (as of Nov. 17): “The capitulation around Liberation Day marked the end of a three-year rolling recession and the start of a rolling recovery. We believe that we’re in the midst of a new bull market and earnings cycle, especially for many of the lagging areas of the index. We think that most of the elements of a classic early-cycle environment are with us today — compressed cost structures that set the stage for positive operating leverage, a historic rebound in earnings revisions breadth, and pent-up demand across wide swaths of the market/economy that were mired in the preceding rolling recession.“

Wells Fargo: 7,800, $310 (as of Nov. 21): “Our target is driven by our PRSM framework (Profits, Rates, Sentiment, Macro). Profits: +14% YoY for 2026E EPS and +13% for 2027E; Rates: negative due to tight liquidity, but we expect a Fed boost; Sentiment: contrarian Buy signal triggered (SPX +7.5% N3M on avg. & 90% hit rate); Macro: turned positive for the first time since Jan 2025. The overall PRSM score of 0.2 implies +12% return over N12M.“

Deutsche Bank: 8,000, $320 (as of Nov. 26): “In 2026, we see robust earnings growth and equity valuations remaining elevated. We expect a pickup in earnings growth in 2026 to 14% (from 10% in 2025), taking S&P 500 EPS to $320. Corporate cost-cutting and the labor market remain risks, but for administration policies we expect checks and balances in the run-up to the mid-term elections. At 25x, the S&P 500 trailing multiple is well above the historical average (15.3x) but easily explained by favorable drivers: higher payout ratios, higher perceived trend earnings growth, fewer large drawdowns in earnings, and inflation below its long-run average.“

Capital Economics: 8,000 (as of Nov. 19): “[W]e suspect that the near-term risks are more about perceived demand for AI, or whether capex is excessive. Our forecast for the S&P 500 to rise to 8,000 by end-2026 implicitly assumes that valuations will rise a lot further before the bubble, if there is one, bursts.“

Oppenheimer: 8,100, $305 (as of Dec. 7): “Our positive outlook for the S&P 500 is based on a number of factors that include persistent resilience evidenced in U.S. economic data, S&P 500 corporate results throughout most of this year beating expectations.“

Two things about one-year price targets 🙋🏻♂️

Most of the equity strategists TKer follows produce incredibly rigorous, high-quality research that reflects a deep understanding of what drives markets. Consequently, the most valuable things these pros have to offer have little to do with one-year targets. This is what we mostly cover at TKer. (And in my years of interacting with many of these folks, at least a few of them don’t care for the exercise of publishing one-year targets. They do it because it’s asked of them or it’s popular with clients.)

So first off, don’t dismiss a strategist’s work just because their one-year target is off the mark.

Second, I’ll repeat what I always say when discussing short-term forecasts for the stock market:

⚠️ It’s incredibly difficult to predict with any accuracy where the stock market will be in a year. In addition to the countless number of variables to consider, there are also the totally unpredictable developments that occur along the way.

Strategists will often revise their targets as new information comes in. In fact, some of the numbers you see above represent revisions from prior forecasts.

For most of y’all, it’s probably ill-advised to overhaul your entire investment strategy based on a one-year stock market forecast.

Nevertheless, it can be fun to follow these targets. It helps you get a sense of the various Wall Street firms’ level of bullishness or bearishness.

I think RBC’s Lori Calvasina said it best: The price target “should be viewed as a compass as opposed to a GPS. It is a construct that helps to articulate whether we believe stocks will move higher and why.“

Good luck in 2026!

For older forecasts, read: Wall Street’s 2025 outlook for stocks 🔭; Wall Street’s 2024 outlook for stocks 🔭; Wall Street’s 2023 outlook for stocks 🔭.; and Wall Street’s 2022 outlook for stocks 🔭.

-

Related from TKer:

Forecasters are making a bold 2026 prediction that skeptics will hate 😤

Where Wall Street’s year-end price target calculations often go wrong 😑

Review of the macro crosscurrents 🔀

There were several notable data points and macroeconomic developments since our last review:

🚨Despite the government reopening after a lengthy shutdown, economic data from federal agencies continues to be delayed. Until that data is released on its normal, timely schedule, we’ll be leaning more on private sources of data.

📈The stock market moved higher last week, with the S&P 500 climbing 0.3% to close at 6,870.40. The index is now down 0.3% from its Oct. 29 closing high of 6,890.89 and up 16.8% year-to-date. For market insights, check out the Stock Market tab at TKer. »

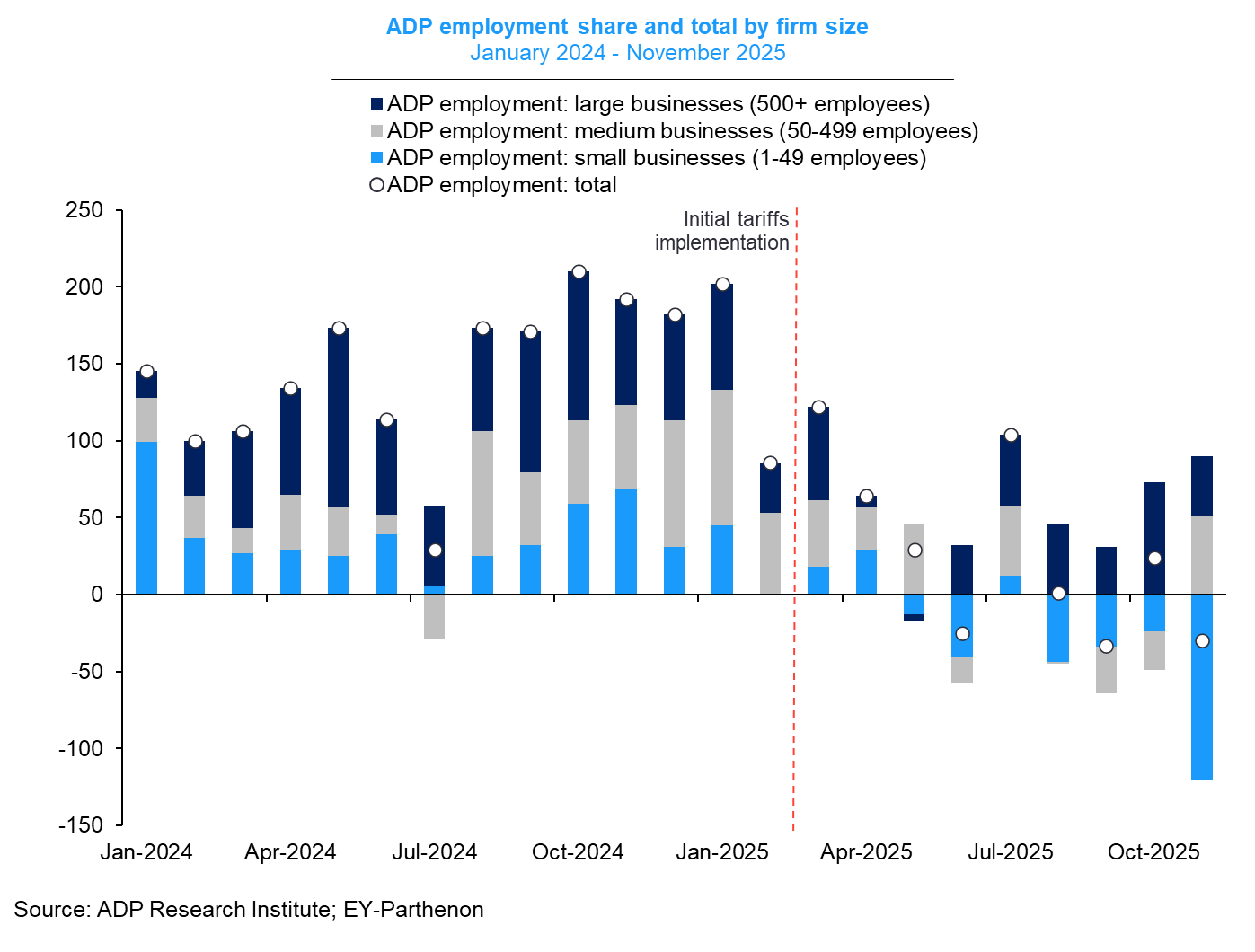

💼 Jobs appear to be declining. According to payroll processor ADP, private sector employers shed 32,000 jobs in November. This is the fourth negative reading in the past six months.

Small businesses have been responsible for the weakness.

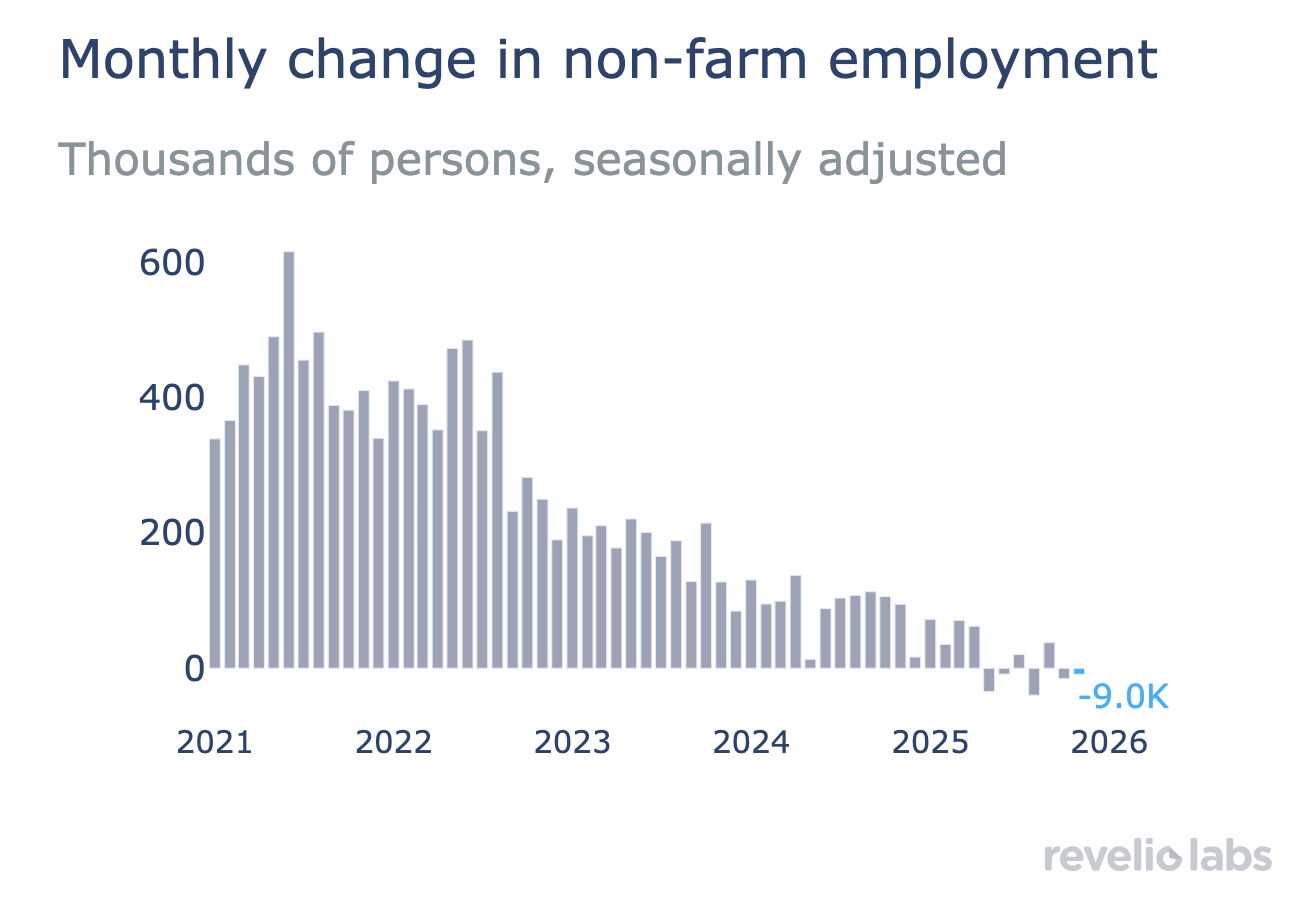

Revelio Labs, which analyzes online professional profiles, estimates nonfarm payroll employment, which includes public and private sector employers, fell by 9,000 jobs in November.

This is consistent with other data showing the labor market has been cooling.

For more, read: The unofficial data is unambiguously discouraging 💼

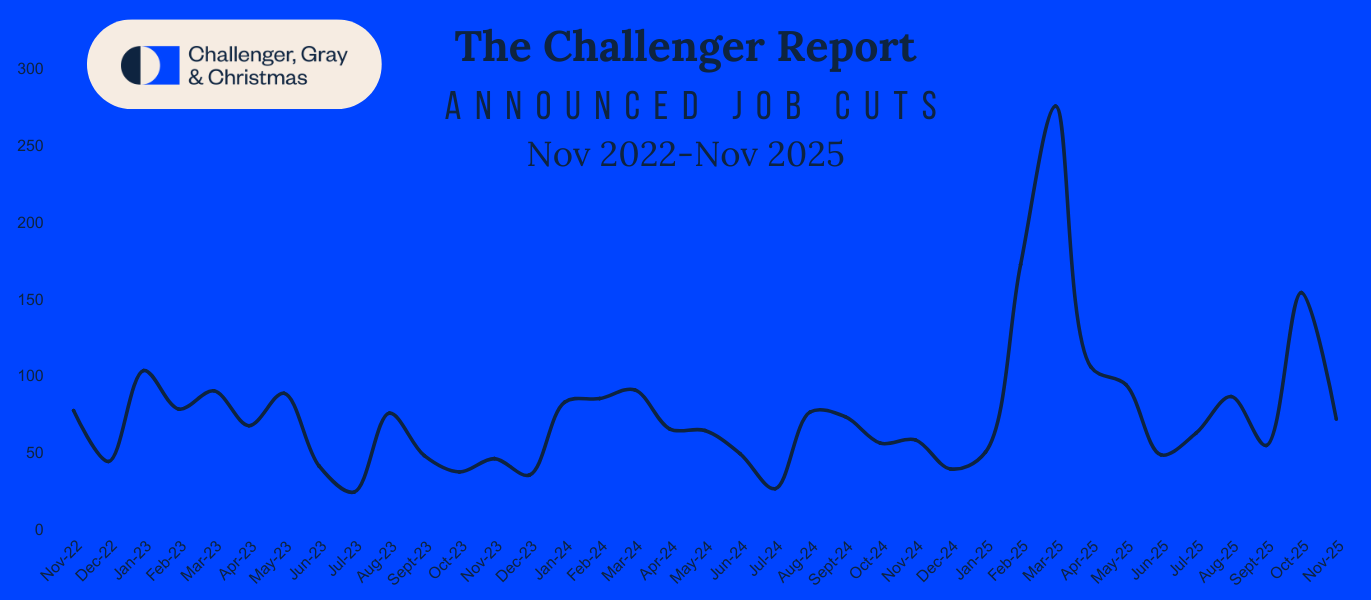

👎 Layoffs may be picking up. Challenger, Gray & Christmas, which tracks layoffs in corporate announcements and regulatory filings, said U.S. employers announced 71,321 job cuts in November.

Year to date, employers have announced 1,170,821 job cuts, up 54% from a year ago.

These figures are unsettling. But it’s also worth noting that the sample represents a relatively small segment of the economy. Most layoffs occur quietly and are not made public. According to the BLS, which uses surveys to estimate labor market turnover across the economy, U.S. employers lay off about 1.5 million to 2 million workers per month, even during economic booms.

That said, it’s not a stretch to assume layoff activity is picking up based on everything else we know.

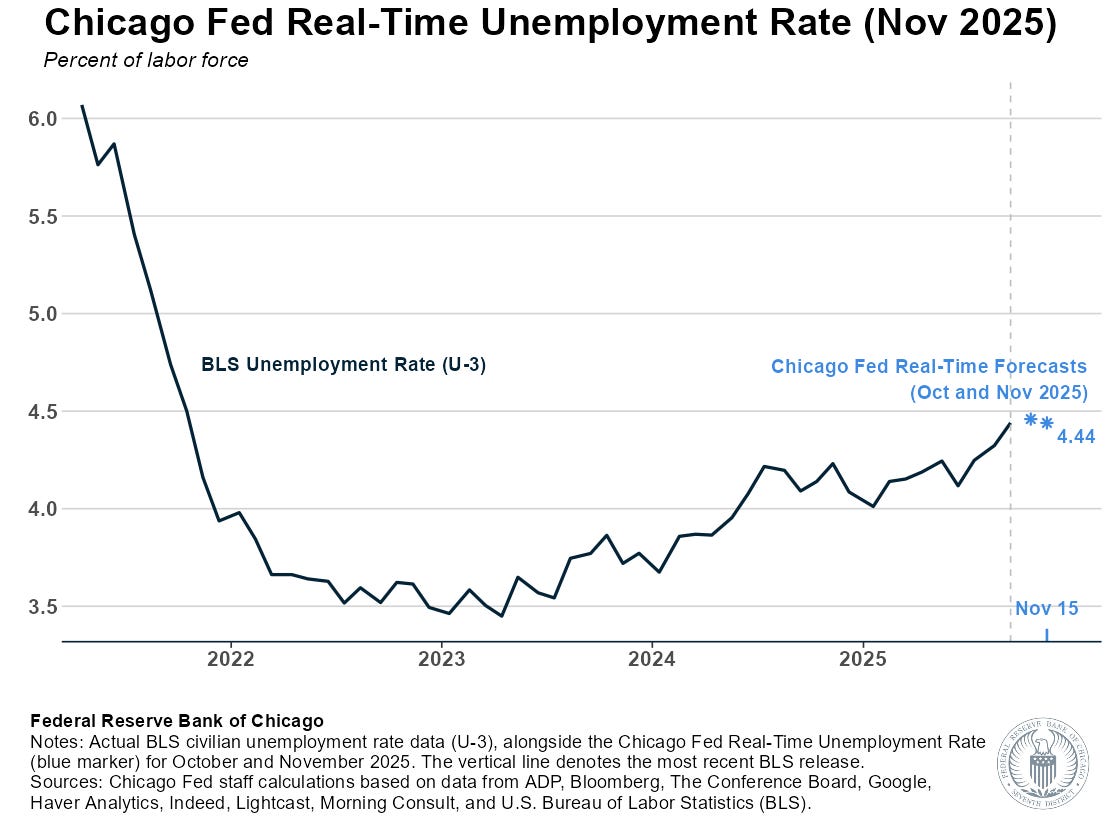

👎 The unemployment rate may be climbing. The Chicago Fed has a model that combines a bunch of available data to estimate the unemployment rate. And based on what’s out there, they estimate the unemployment rate was 4.44% in November, which would be the highest rate in four years.

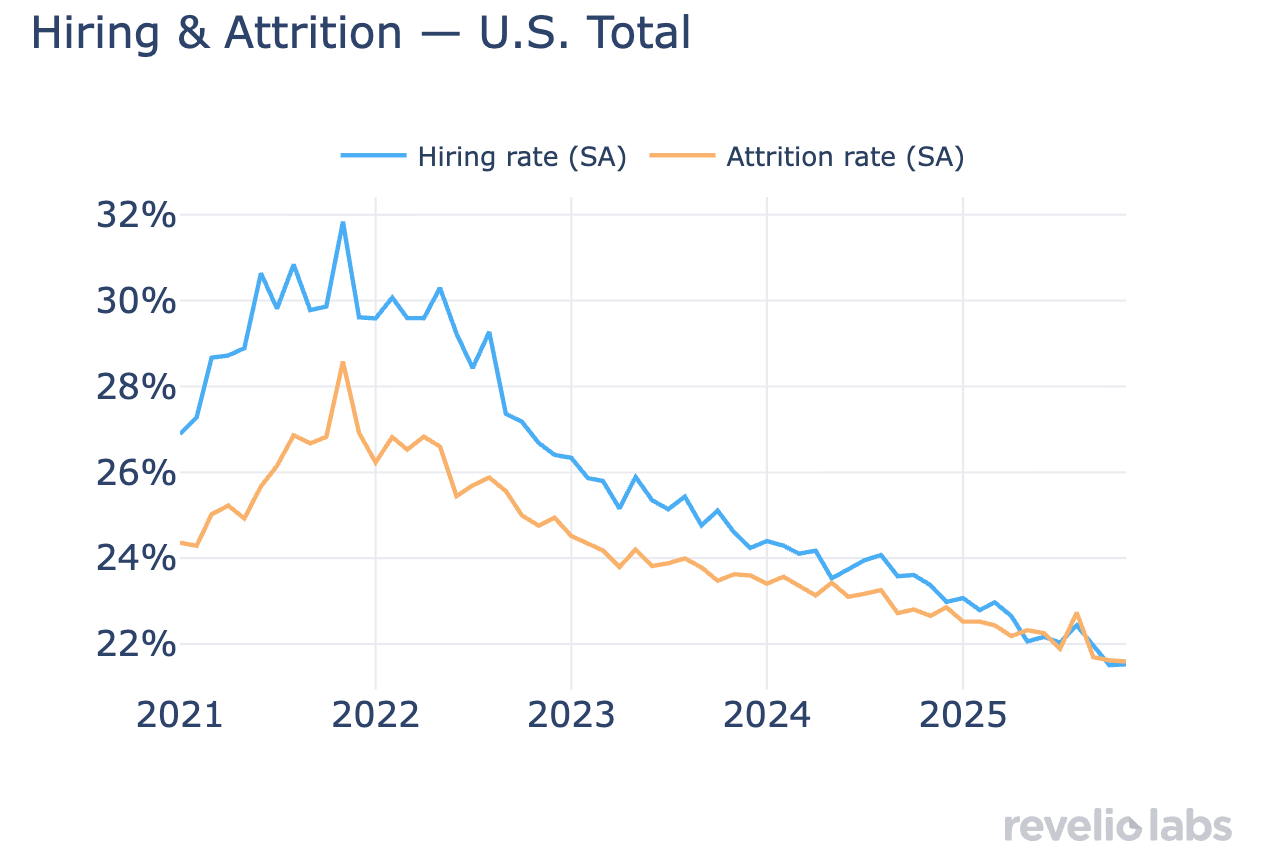

💼 Hiring activity is slowing, workers are staying put. According to Revelio Labs, the hiring rate continues to trend lower, suggesting companies have become less eager to fill open roles or add staff. Similarly, attrition rates have fallen, suggesting employees are holding tight to their jobs or aren’t finding better opportunities elsewhere.

When the hiring rate — the number of hires as a percentage of the employed workforce — is trending lower, it could be a sign of trouble to come in the labor market.

For more on why this metric matters, read: The hiring situation 🧩

💼 New unemployment insurance claims decline, but total ongoing claims remain elevated. Initial claims for unemployment benefits declined to 191,000 during the week ending Nov. 29, down from 218,000 the week prior. This metric remains at levels historically associated with economic growth.

Goldman Sachs economists caution against reading too much into the most recent tally: “We suspect that much of the decline in initial claims reflects seasonal adjustment difficulties around the Thanksgiving holiday, as the seasonal factor expected a much smaller decline in non-seasonally-adjusted initial jobless claims than took place in previous years with similar calendar configurations.“

Insured unemployment, which captures those who continue to claim unemployment benefits, declined to 1.939 million during the week ending Nov. 22. This metric is hovering near its highest level since November 2021.

Low initial claims confirm that layoff activity remains low. Elevated continued claims confirm hiring activity is weakening. This dynamic warrants close attention, as it reflects a deteriorating labor market.

For more context, read: The hiring situation 🧩 and The labor market is cooling 💼

💰 The wage growth gap between job switchers and stayers is narrowing. According to ADP, annual pay in November for people who changed jobs was up 6.3% from a year ago. For those who stayed at their job, pay was up 4.4%.

For more on why policymakers are watching wage growth, read: Revisiting the key chart to watch amid the Fed’s war on inflation 📈

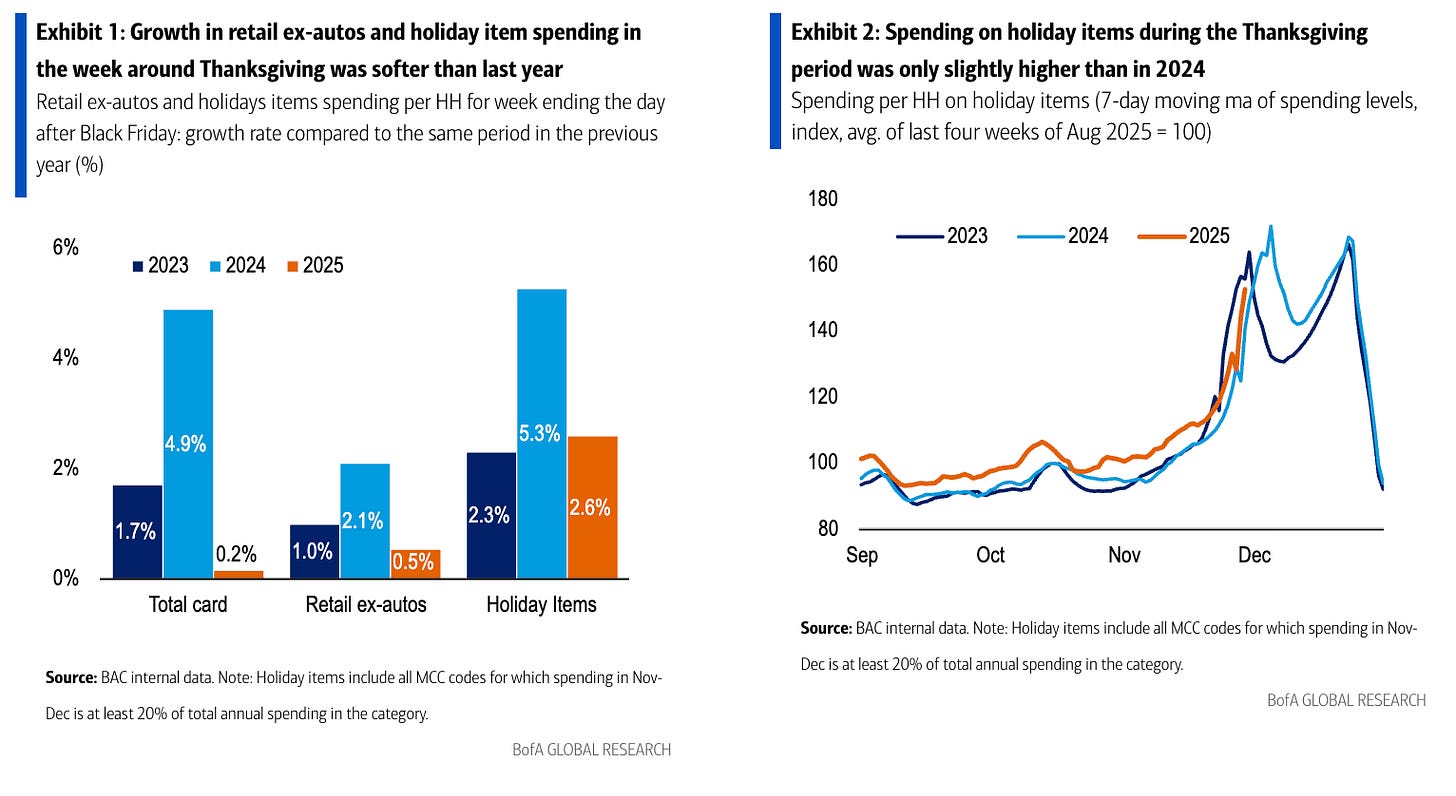

💳 Card spending data is holding up. From BofA: “During the week ending November 29, total card (+0.2%) and retail ex-autos (+0.5%) spending per HH, as measured by BAC aggregated credit and debit cards, were only modestly higher than in the Thanksgiving period last year. The corresponding spending growth rate for holiday items was slightly better (2.6%).”

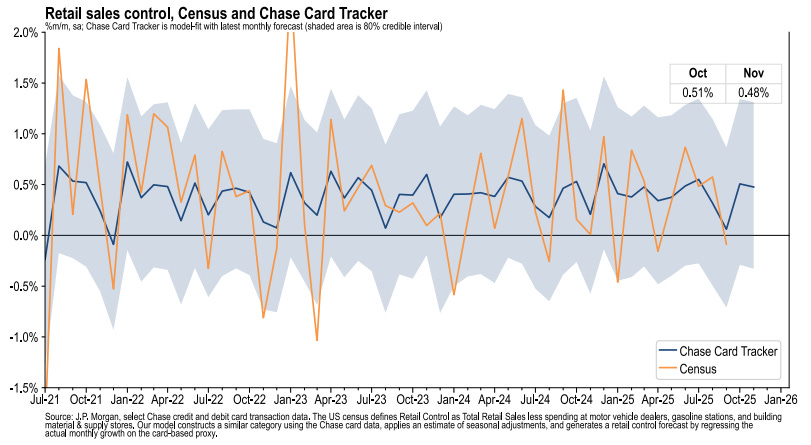

From JPMorgan: “As of 28 Nov 2025, our Chase Consumer Card spending data (unadjusted) was 3.5% above the same day last year. Based on the Chase Consumer Card data through 28 Nov 2025, our estimate of the US Census October control measure of retail sales m/m is 0.51%.”

For more on economic activity, read: 9 once-hot economic charts that cooled 📉 and We’re at an economic tipping point ⚖️

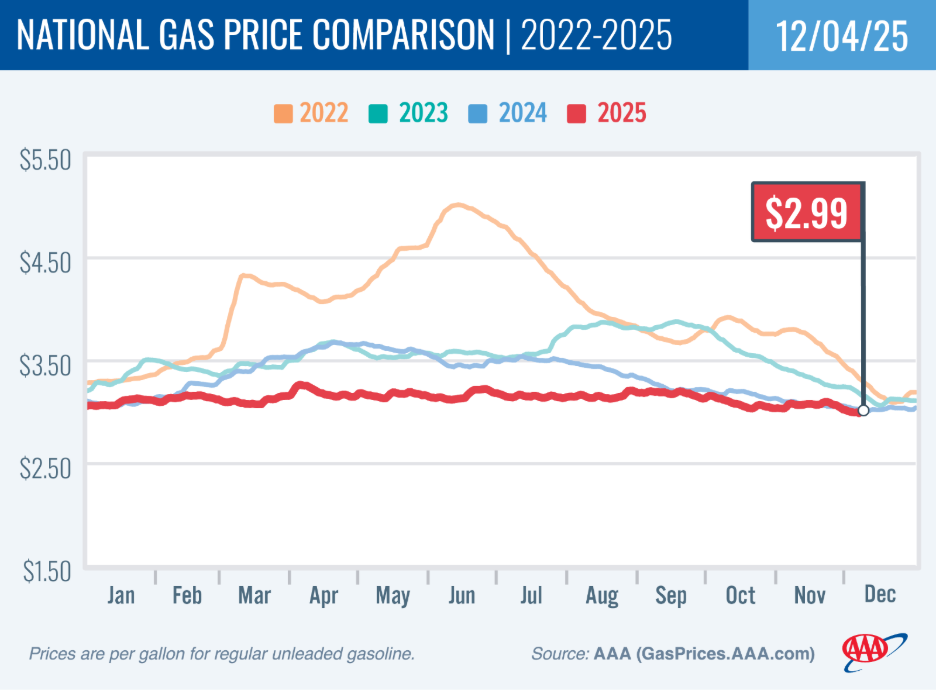

⛽️ Gas prices dip below $3. From AAA: “The last time the national average reached an even $3.00 or below was in May of 2021. Crude oil prices remain on the lower side around $60 a barrel. Sluggish gas demand and cheaper-to-produce winter blend gasoline are also contributing to the drop at the pump.”

For more on energy prices, read: Higher oil prices meant something different in the past 🛢️

👎 Consumer vibes are in the dumps. According to the University of Michigan’s Surveys of Consumers, sentiment ticked higher in December, but overall remains low: “Overall, while views of current conditions were little changed, expectations improved, led by a 13% rise in expected personal finances, with improvements visible across age, income, education, and political affiliation. Still, December’s reading on expected personal finances is nearly 12% below the beginning of the year. Similarly, labor market expectations improved a touch but remained relatively dismal. Consumers see modest improvements from November on a few dimensions, but the overall tenor of views is broadly somber, as consumers continue to cite the burden of high prices.”

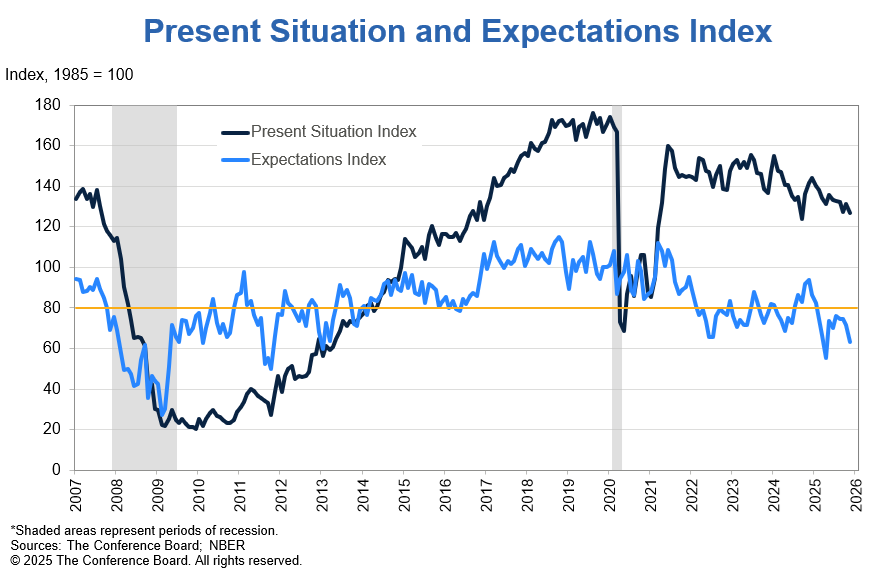

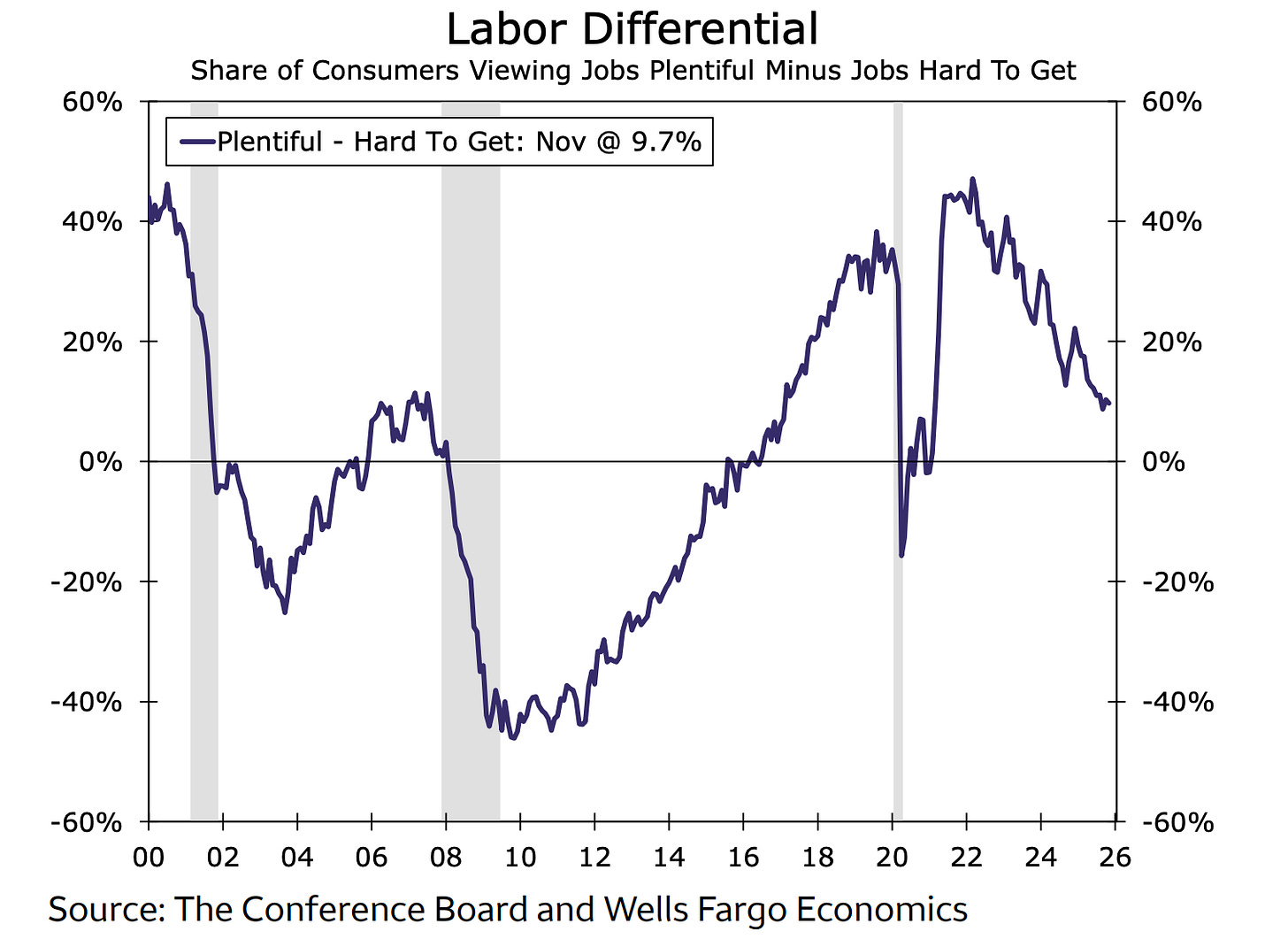

The Conference Board’s Consumer Confidence Index fell 6.8 points in November. From the firm’s Dana Peterson: “Consumer confidence tumbled in November to its second lowest level since April after moving sideways for several months. The Present Situation Index dipped as consumers were less sanguine about current business and labor market conditions. The labor market differential—the share of consumers who say jobs are ‘plentiful’ minus the share saying ‘hard to get’—dipped again in November after a brief respite in October from its year-to-date decline. All three components of the Expectations Index deteriorated in November. Consumers were notably more pessimistic about business conditions six months from now. Mid-2026 expectations for labor market conditions remained decidedly negative, and expectations for increased household incomes shrunk dramatically, after six months of strongly positive readings.“

Relatively weak consumer sentiment readings appear to contradict relatively strong consumer spending data. For more on this contradiction, read: What consumers do > what consumers say 🙊 and We’re taking that vacation whether we like it or not 🛫

👎 Consumers don’t feel good about the labor market. From The Conference Board: “On balance, consumers’ views of the labor market on net were a tad weaker in November. 6% of consumers said jobs were ‘plentiful,’ down from 28.6% in October. However, 17.9% of consumers said jobs were ‘hard to get,’ down from 18.3%.“

Many economists monitor the spread between these two percentages (a.k.a., the labor market differential). The direction of the spread reflects a cooling labor market.

More from The Conference Board: “Consumers were on net a bit more worried about the labor market outlook in November. 6% of consumers expected more jobs to be available, down from 15.8% in October. 5% anticipated fewer jobs, down from 28.8%.“

For more on the labor market, read: The labor market is cooling 💼

🏠 Mortgage rates tick lower. According to Freddie Mac, the average 30-year fixed-rate mortgage declined to 6.19%, down from 6.23% last week: “Mortgage rates decreased for the second straight week, emerging from the Thanksgiving holiday. Compared to this time last year, mortgage rates are half a percent lower, creating a more favorable environment for homebuyers and homeowners.”

As of the summer, there were 147.9 million housing units in the U.S., of which 86.1 million were owner-occupied and about 39% were mortgage-free. Of those carrying mortgage debt, almost all have fixed-rate mortgages, and most of those mortgages have rates that were locked in before rates surged from 2021 lows. All of this is to say: Most homeowners are not particularly sensitive to the small weekly movements in home prices or mortgage rates.

For more on mortgages and home prices, read: Why home prices and rents are creating all sorts of confusion about inflation 😖

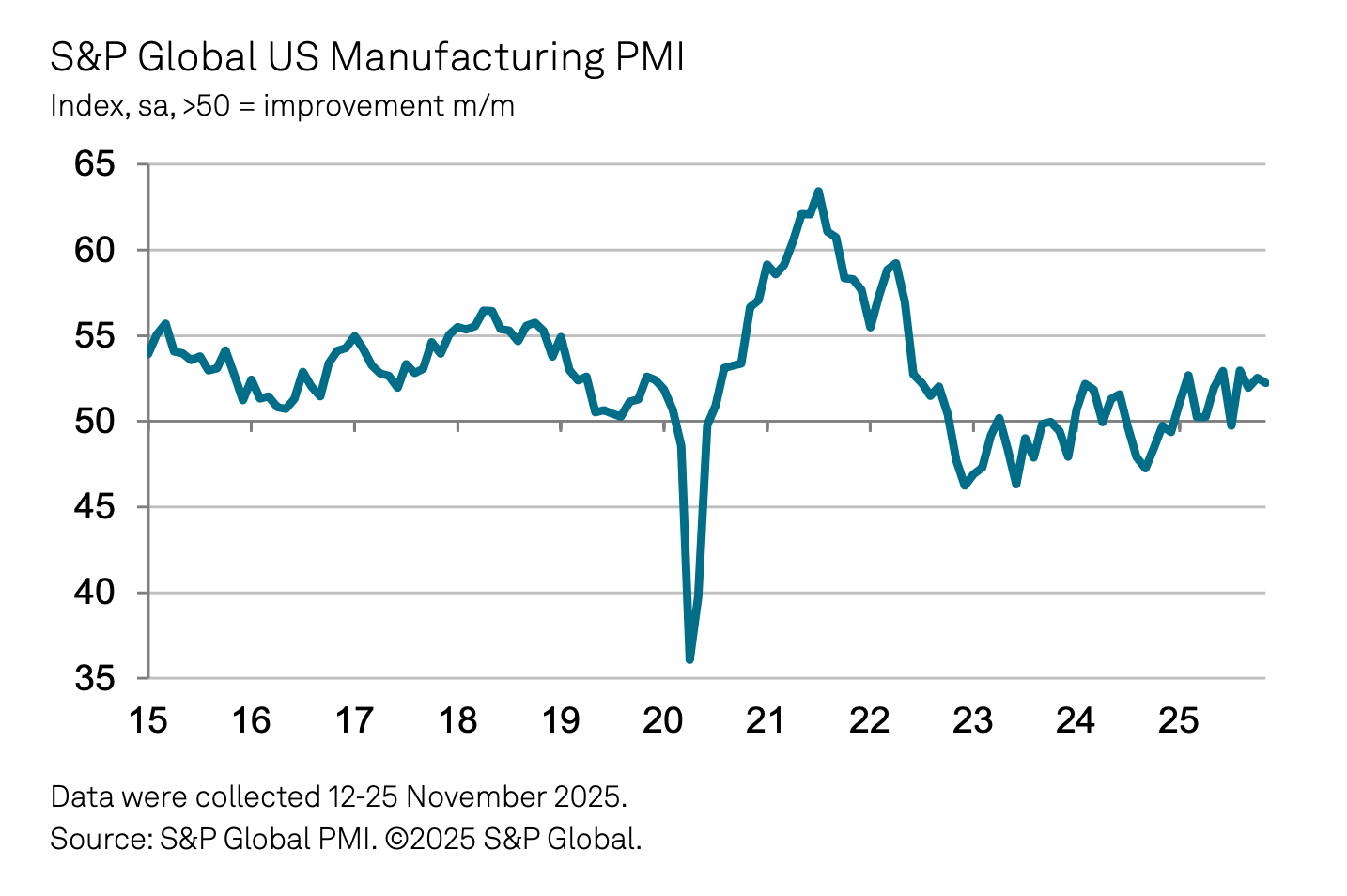

👎 Manufacturing activity surveys weren’t great. From S&P Global’s November U.S. Manufacturing PMI: “Although the headline PMI signalled a further expansion of factory activity in November, the health of the US manufacturing sector gets more worrying the more you scratch under the surface. The main impetus came from a strong rise in factory production, but growth in new order inflows slowed sharply, hinting at a marked weakening of demand growth. In short, manufacturers are making more goods but often not finding buyers for these products. This combination of sustained robust production growth alongside weaker-than-expected sales led to a worryingly steep rise in unsold inventories. For two successive months now, warehouses have filled with unsold stock to a degree not previously seen since comparable data were available in 2007. This unplanned accumulation of stock is usually a precursor to reduced production in the coming months.”

The ISM’s November Manufacturing PMI suggests the sector is contracting and that the pace of contraction has deteriorated from the prior month.

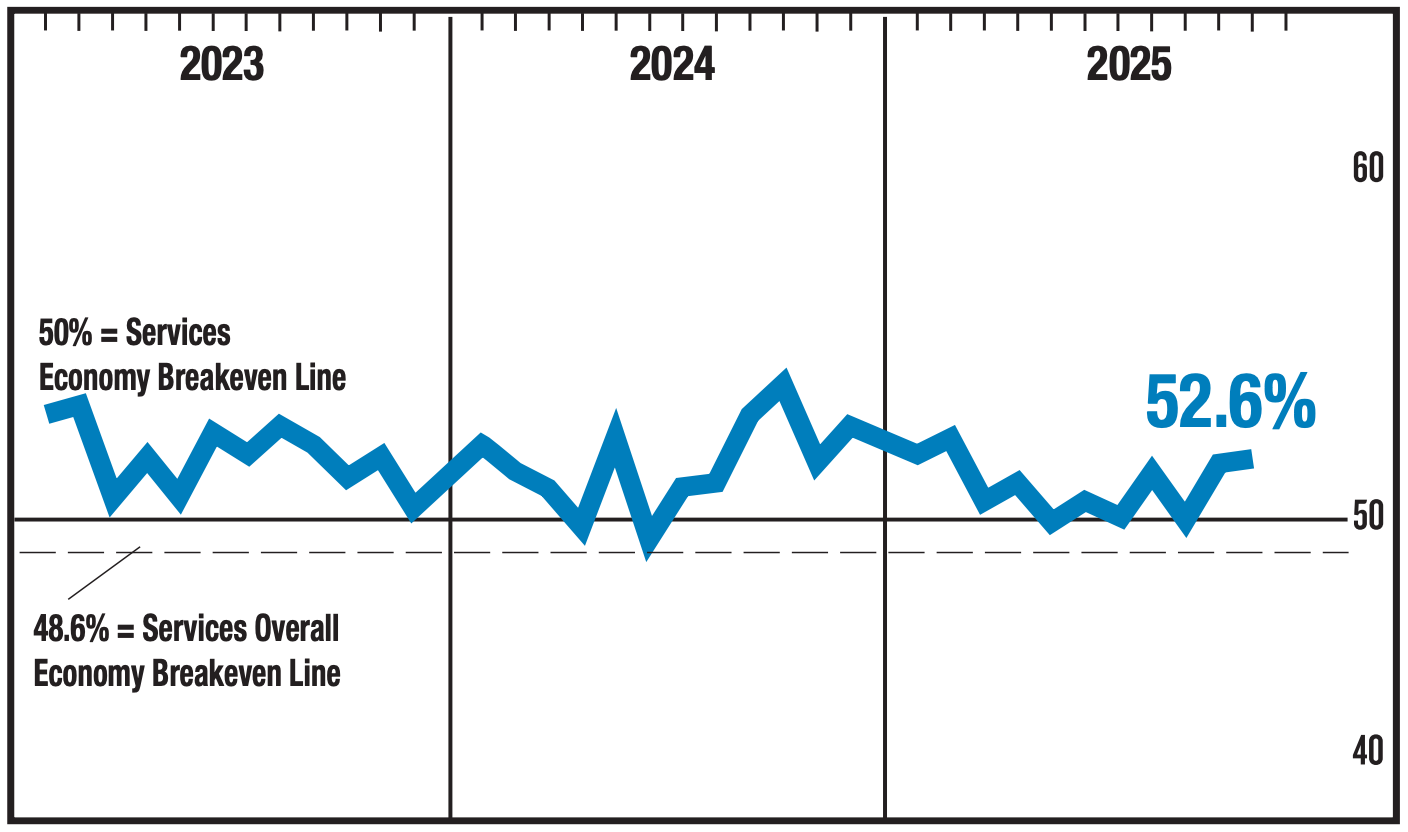

👍 Services activity surveys signal growth. From S&P Global’s November U.S. Services PMI: “The US service sector has reported another strong expansion in November, with demand for services rising at the fastest rate seen so far this year. Together with a robust increase in output reported by the manufacturing sector, the survey indicates that the economy is so far expanding at a 2.5% annualized GDP growth rate in the fourth quarter. Supportive financial conditions, including lower interest rates and the equity market gains seen this year, are helping drive the sustained resilience of the economy, with a further surge in financial services activity reported in November. Consumer and business services are also continuing to expand, but report pressure on customer demand from affordability issues in particular. Worryingly, prices charged for services rose at an increased rate in November as firms sought to pass on higher costs, in turn often linked to tariffs.”

Similarly, the ISM’s November Services PMI suggests the sector is expanding.

Keep in mind that during times of perceived stress, soft survey data tends to be more exaggerated than actual hard data.

For more on this, read: What businesses do > what businesses say 🙊

Below are data that were released by Federal agencies last week. The numbers are a bit stale, but worth seeing.

🎈 Inflation could be cooler. The personal consumption expenditures (PCE) price index in September was up 2.7% from a year ago. The core PCE price index — the Federal Reserve’s preferred measure of inflation — was up 2.8% during the month, down from August’s 2.9% rate. While it’s above the Fed’s 2% target, it remains near its lowest level since March 2021.

On a month-over-month basis, the core PCE price index was up 0.2%. If you annualized the rolling three-month and six-month figures — a reflection of the near-term trend in prices — the core PCE price index was up 2.7%.

For more on inflation and the outlook for monetary policy, read: The Fed closes a chapter with a rate cut ✂️ and The other side of the Fed’s inflation ‘mistake’ 🧐

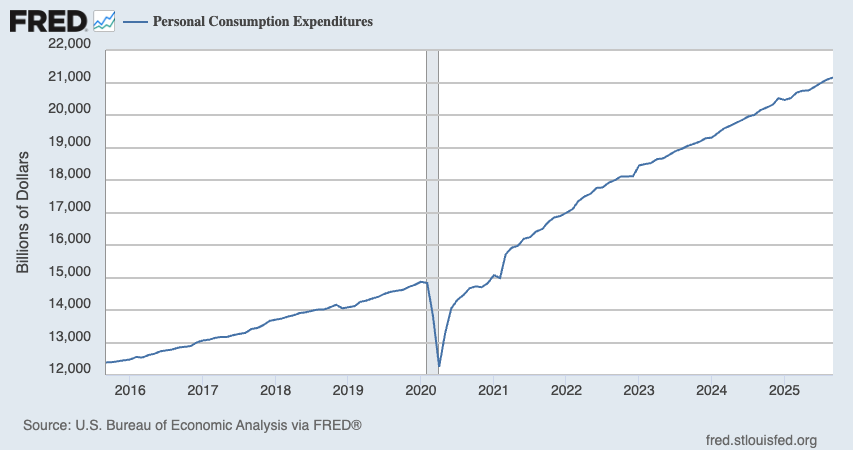

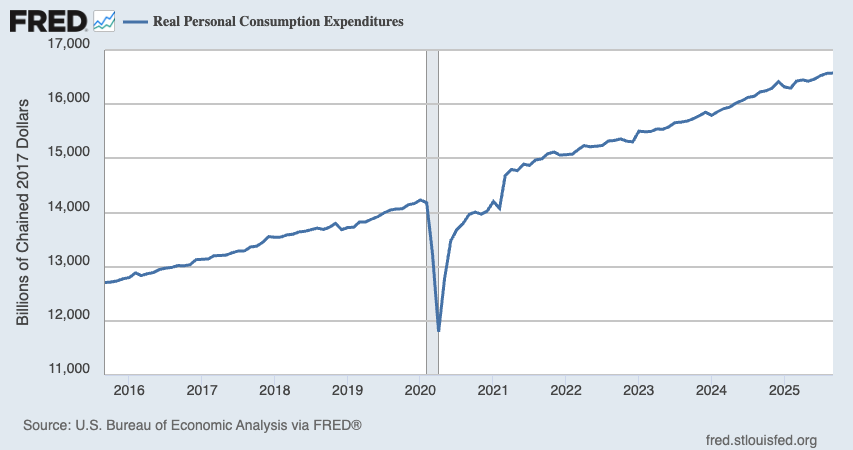

🛍️ Consumer spending ticks higher. According to BEA data, personal consumption expenditures increased 0.3% month-over-month in September to an annual rate of $21.15 trillion.

Adjusted for inflation, real personal consumption expenditures were unchanged from the prior month.

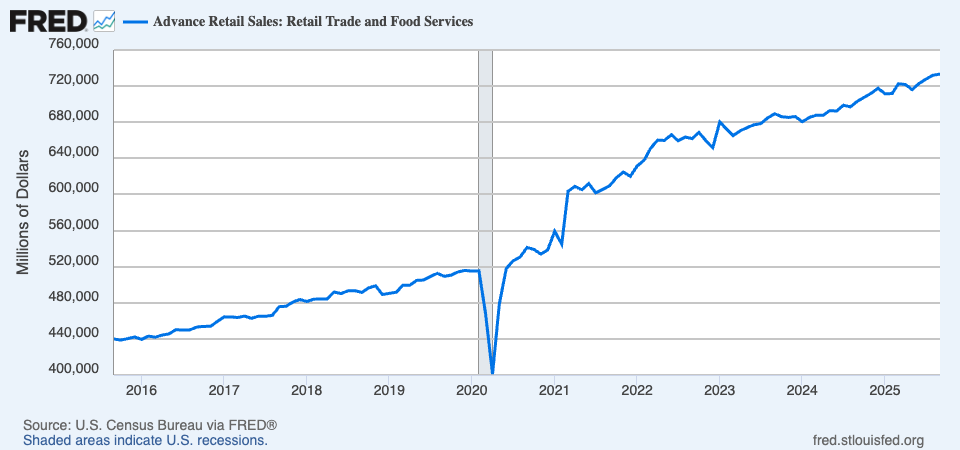

🛍️ Retail shopping ticked higher. Retail sales increased 0.2% in September to a record $733.3 billion.

Some categories saw growth. Others didn’t.

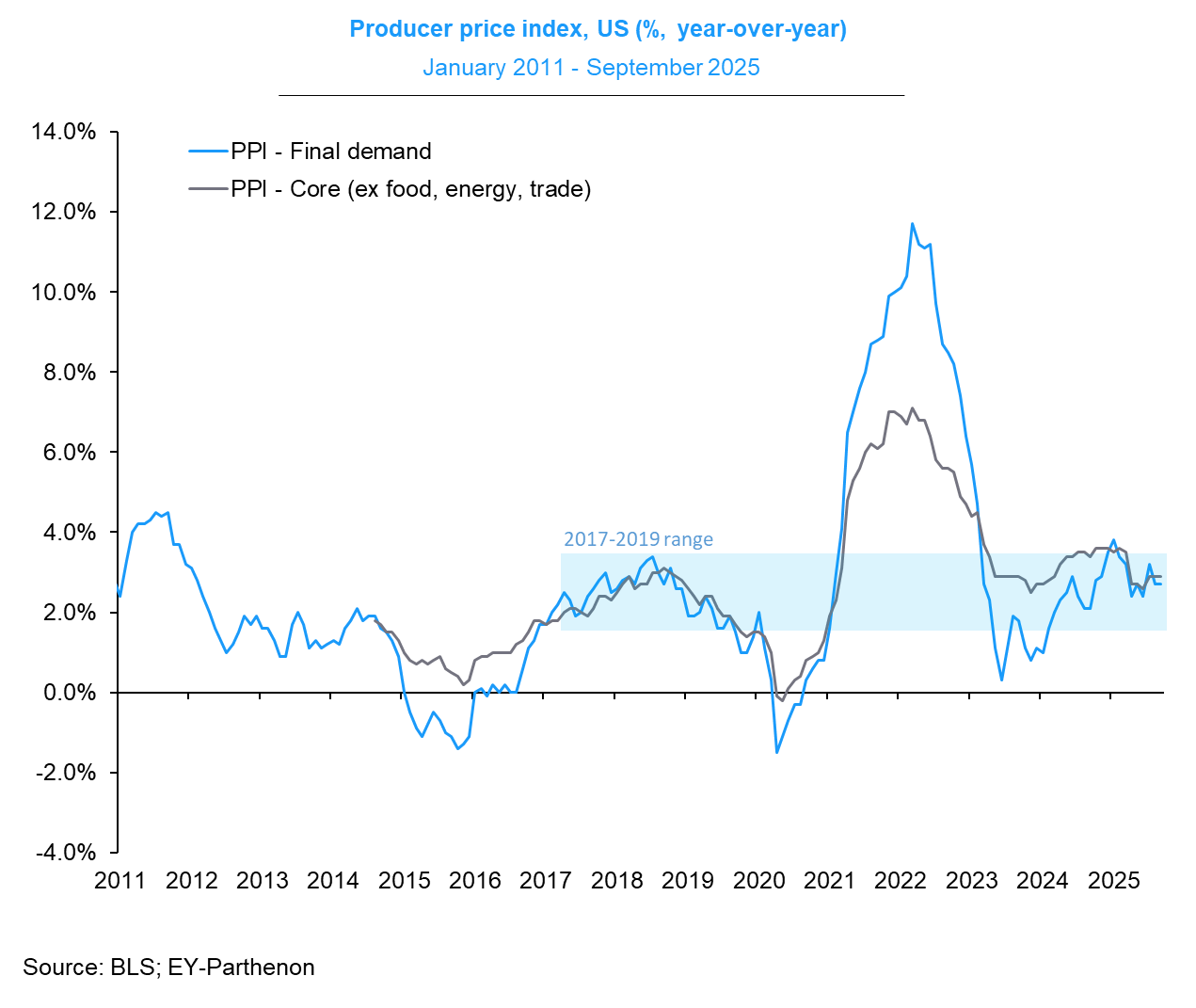

👍 Wholesaler price inflation was cool. The Producer Price Index (PPI) in September was up 2.7% from a year ago. Adjusted for food and energy prices, core PPI was up 2.9%.

On a month-over-month basis, PPI climbed 0.3% and core PPI rose 0.1%.

🏭 Business investment activity improved in September. Orders for nondefense capital goods excluding aircraft — a.k.a. core capex or business investment — increased 0.9% to $77.5 billion in September.

Core capex orders are a leading indicator, meaning they foretell economic activity down the road.

For more on key economic metrics, read: We’re at an economic tipping point ⚖️

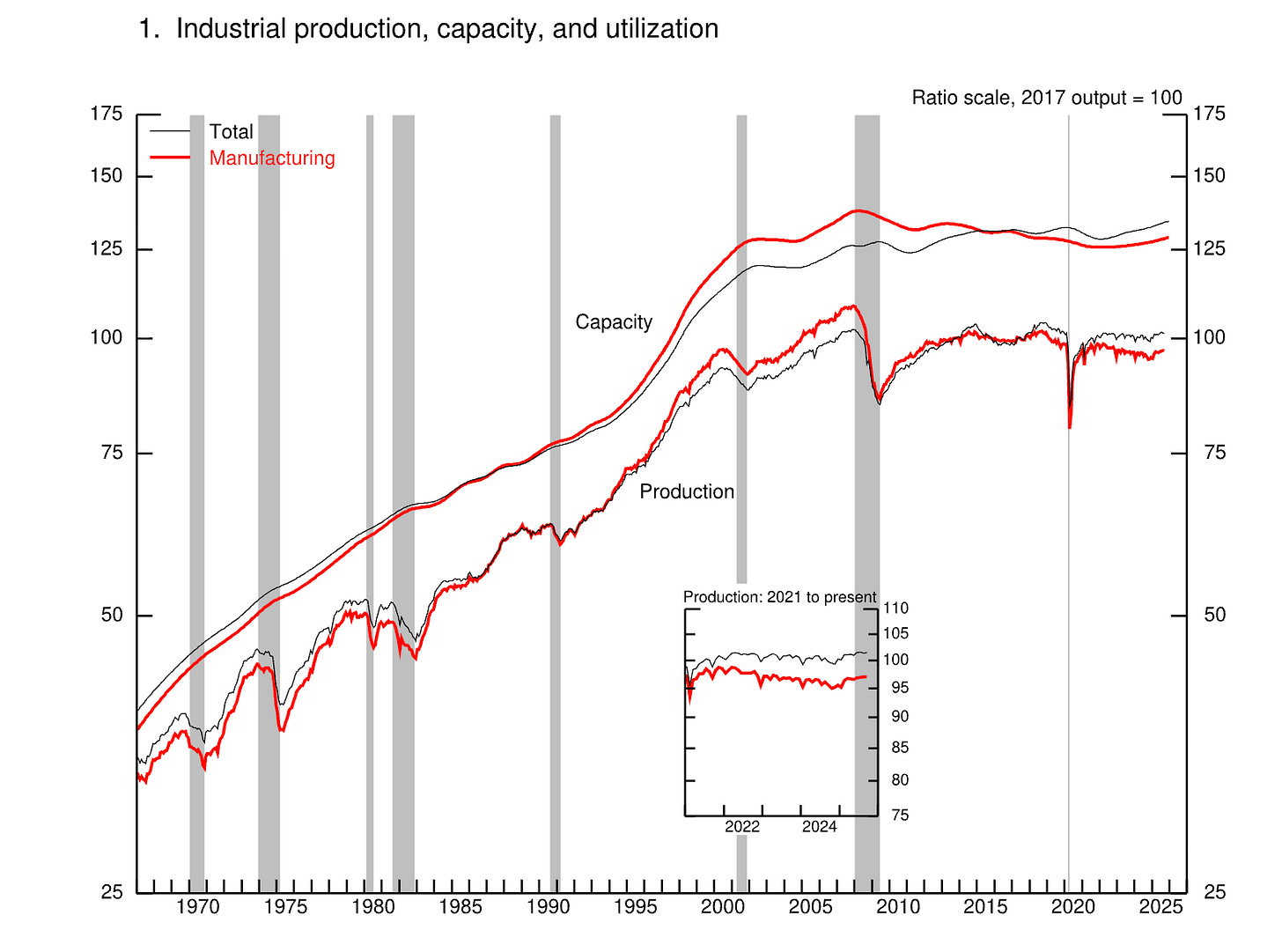

🛠️ Industrial activity ticked higher. Industrial production activity in September increased 0.1% from prior month levels. Manufacturing output was unchanged from the prior month.

🤑 Wage growth is cool. According to the Atlanta Fed’s wage growth tracker, the median hourly pay in September was up 4.1% from the prior year, unchanged from the prior month.

For more on why policymakers are watching wage growth, read: Revisiting the key chart to watch amid the Fed’s war on inflation 📈

📈 Near-term GDP growth estimates are tracking positively. The Atlanta Fed’s GDPNow model sees real GDP growth rising at a 3.5% rate in Q3.

For more on GDP and the economy, read: 9 once-hot economic charts that cooled 📉 and We’re at an economic tipping point ⚖️

Putting it all together 📋

🚨 The Trump administration’s pursuit of tariffs is disrupting global trade, with significant implications for the U.S. economy, corporate earnings, and the stock market. Furthermore, the delay of economic data from federal agencies due to the government shutdown has made it more challenging to read the economy. Until we get more clarity, here’s where things stand:

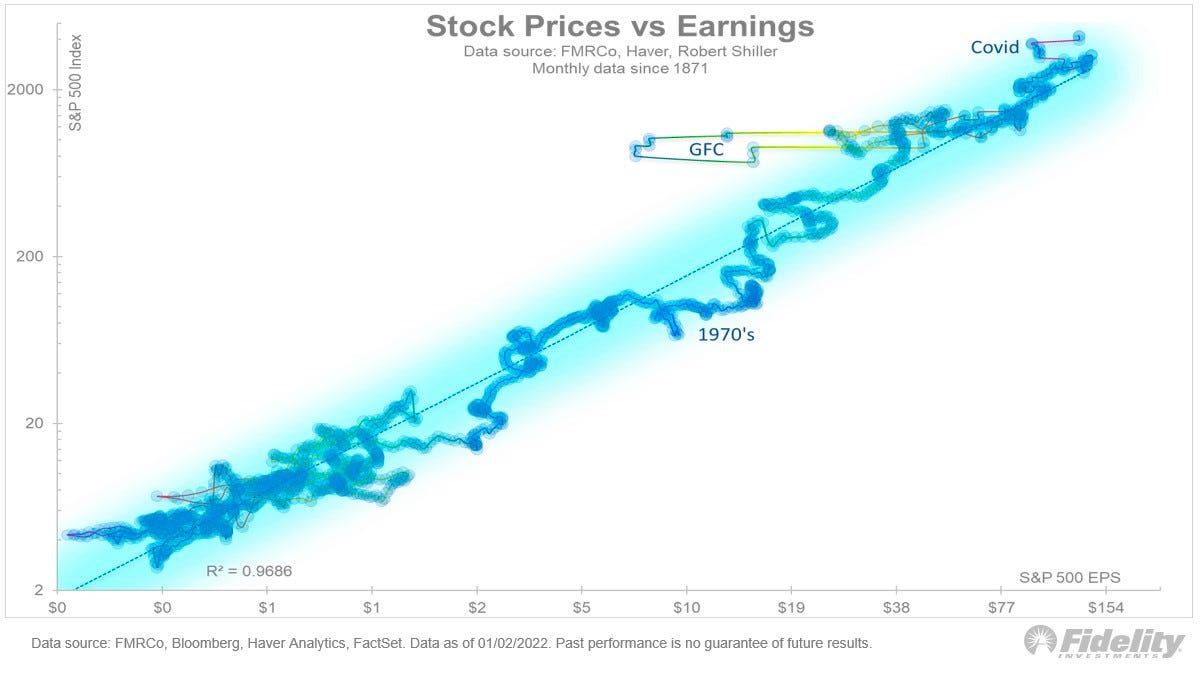

Earnings look bullish: The long-term outlook for the stock market remains favorable, bolstered by expectations for years of earnings growth. And earnings are the most important driver of stock prices.

Demand is positive: Demand for goods and services remains positive, supported by healthy consumer and business balance sheets. Job creation, although cooling, appears to be modestly positive, and the Federal Reserve — having resolved the inflation crisis — shifted its focus toward supporting the labor market.

But growth is cooling: While the economy remains healthy, growth has normalized from much hotter levels earlier in the cycle. The economy is less “coiled” these days as major tailwinds like excess job openings and core capex orders have faded. It has become harder to argue that growth is destiny.

Actions speak louder than words: We are in an odd period, given that the hard economic data decoupled from the soft sentiment-oriented data. Consumer and business sentiment has been relatively poor, even as tangible consumer and business activity continues to grow and trend at record levels. From an investor’s perspective, what matters is that the hard economic data continues to hold up.

Stocks are not the economy: There’s a case to be made that the U.S. stock market could outperform the U.S. economy in the near term, thanks largely to positive operating leverage. Since the pandemic, companies have aggressively adjusted their cost structures. This came with strategic layoffs and investment in new equipment, including hardware powered by AI. These moves are resulting in positive operating leverage, which means a modest amount of sales growth — in the cooling economy — is translating to robust earnings growth.

Mind the ever-present risks: Of course, we should not get complacent. There will always be risks to worry about, such as U.S. political uncertainty, geopolitical turmoil, energy price volatility, and cyber attacks. There are also the dreaded unknowns. Any of these risks can flare up and spark short-term volatility in the markets.

Investing is never a smooth ride: There’s also the harsh reality that economic recessions and bear markets are developments that all long-term investors should expect as they build wealth in the markets. Always keep your stock market seat belts fastened.

Think long-term: For now, there’s no reason to believe there’ll be a challenge that the economy and the markets won’t be able to overcome over time. The long game remains undefeated, and it’s a streak that long-term investors can expect to continue.

For more on how the macro story is evolving, check out the previous review of the macro crosscurrents. »

Key insights about the stock market 📈

Here’s a roundup of some of TKer’s most talked-about paid and free newsletters about the stock market. All of the headlines are hyperlinked to the archived pieces.

10 truths about the stock market 📈

The stock market can be an intimidating place: It’s real money on the line, there’s an overwhelming amount of information, and people have lost fortunes in it very quickly. But it’s also a place where thoughtful investors have long accumulated a lot of wealth. The primary difference between those two outlooks is related to misconceptions about the stock market that can lead people to make poor investment decisions.

The makeup of the S&P 500 is constantly changing 🔀

Passive investing is a concept usually associated with buying and holding a fund that tracks an index. And no passive investment strategy has attracted as much attention as buying an S&P 500 index fund. However, the S&P 500 — an index of 500 of the largest U.S. companies — is anything but a static set of 500 stocks.

The key driver of stock prices: Earnings💰

For investors, anything you can ever learn about a company matters only if it also tells you something about earnings. That’s because long-term moves in a stock can ultimately be explained by the underlying company’s earnings, expectations for earnings, and uncertainty about those expectations for earnings. Over time, the relationship between stock prices and earnings has a very tight statistical relationship.

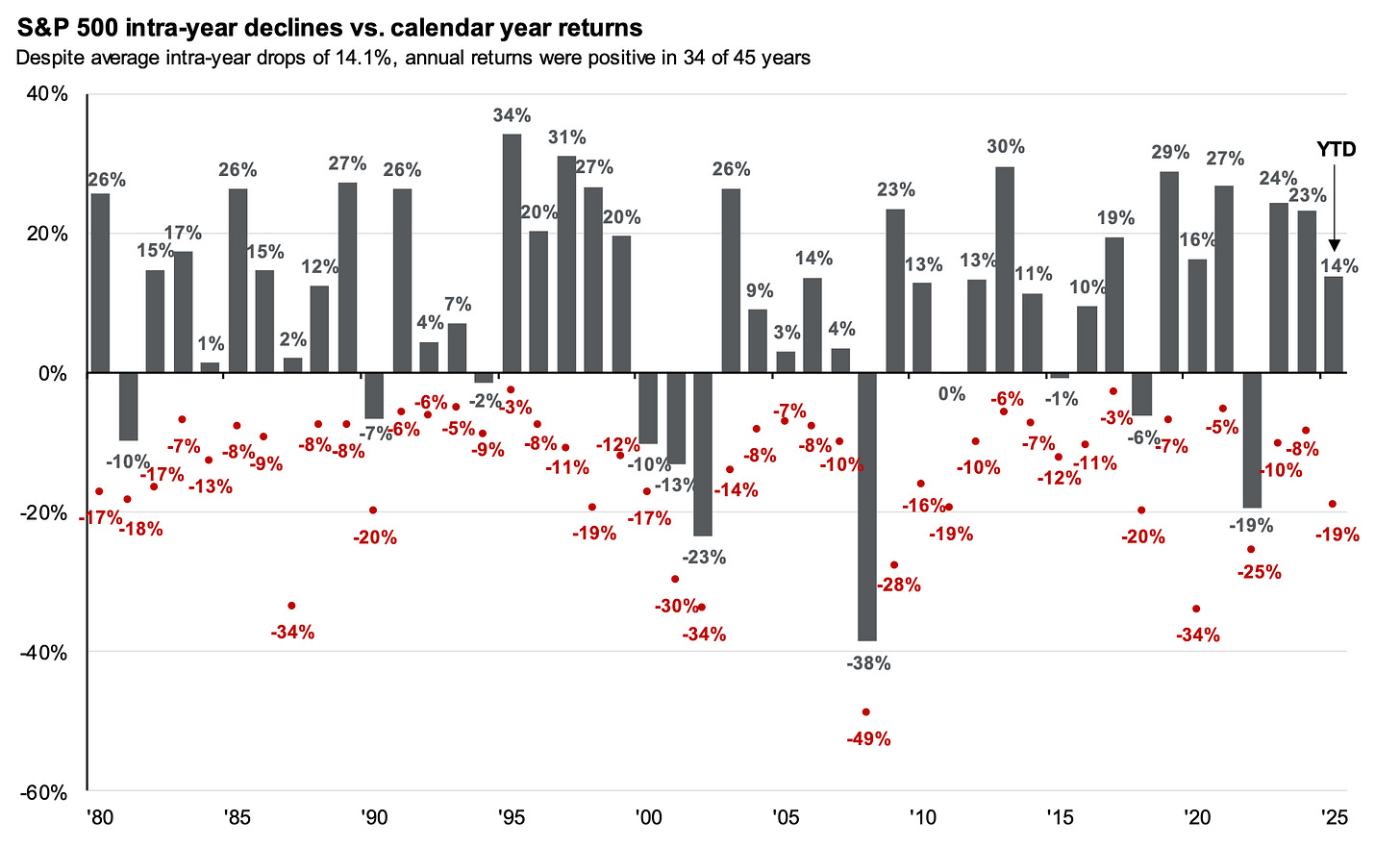

Stomach-churning stock market sell-offs are normal🎢

Investors should always be mentally prepared for some big sell-offs in the stock market. It’s part of the deal when you invest in an asset class that is sensitive to the constant flow of good and bad news. Since 1950, the S&P 500 has seen an average annual max drawdown (i.e., the biggest intra-year sell-off) of 14%.

How the stock market performed around recessions 📉📈

Every recession in history was different. And the range of stock performance around them varied greatly. There are two things worth noting. First, recessions have always been accompanied by a significant drawdown in stock prices. Second, the stock market bottomed and inflected upward long before recessions ended.

In the stock market, time pays ⏳

Since 1928, the S&P 500 has generated a positive total return more than 89% of the time over all five-year periods. Those are pretty good odds. When you extend the timeframe to 20 years, you’ll see that there’s never been a period where the S&P 500 didn’t generate a positive return.

What a strong dollar means for stocks 👑

While a strong dollar may be great news for Americans vacationing abroad and U.S. businesses importing goods from overseas, it’s a headwind for multinational U.S.-based corporations doing business in non-U.S. markets.

Stanley Druckenmiller's No. 1 piece of advice for novice investors 🧐

…you don't want to buy them when earnings are great, because what are they doing when their earnings are great? They go out and expand capacity. Three or four years later, there's overcapacity and they're losing money. What about when they're losing money? Well, then they’ve stopped building capacity. So three or four years later, capacity will have shrunk and their profit margins will be way up. So, you always have to sort of imagine the world the way it's going to be in 18 to 24 months as opposed to now. If you buy it now, you're buying into every single fad every single moment. Whereas if you envision the future, you're trying to imagine how that might be reflected differently in security prices.

Peter Lynch made a remarkably prescient market observation in 1994 🎯

Some event will come out of left field, and the market will go down, or the market will go up. Volatility will occur. Markets will continue to have these ups and downs. … Basic corporate profits have grown about 8% a year historically. So, corporate profits double about every nine years. The stock market ought to double about every nine years… The next 500 points, the next 600 points — I don’t know which way they’ll go… They’ll double again in eight or nine years after that. Because profits go up 8% a year, and stocks will follow. That's all there is to it.

Warren Buffett's 'fourth law of motion' 📉

Long ago, Sir Isaac Newton gave us three laws of motion, which were the work of genius. But Sir Isaac’s talents didn’t extend to investing: He lost a bundle in the South Sea Bubble, explaining later, “I can calculate the movement of the stars, but not the madness of men.” If he had not been traumatized by this loss, Sir Isaac might well have gone on to discover the Fourth Law of Motion: For investors as a whole, returns decrease as motion increases.

Most pros can’t beat the market 🥊

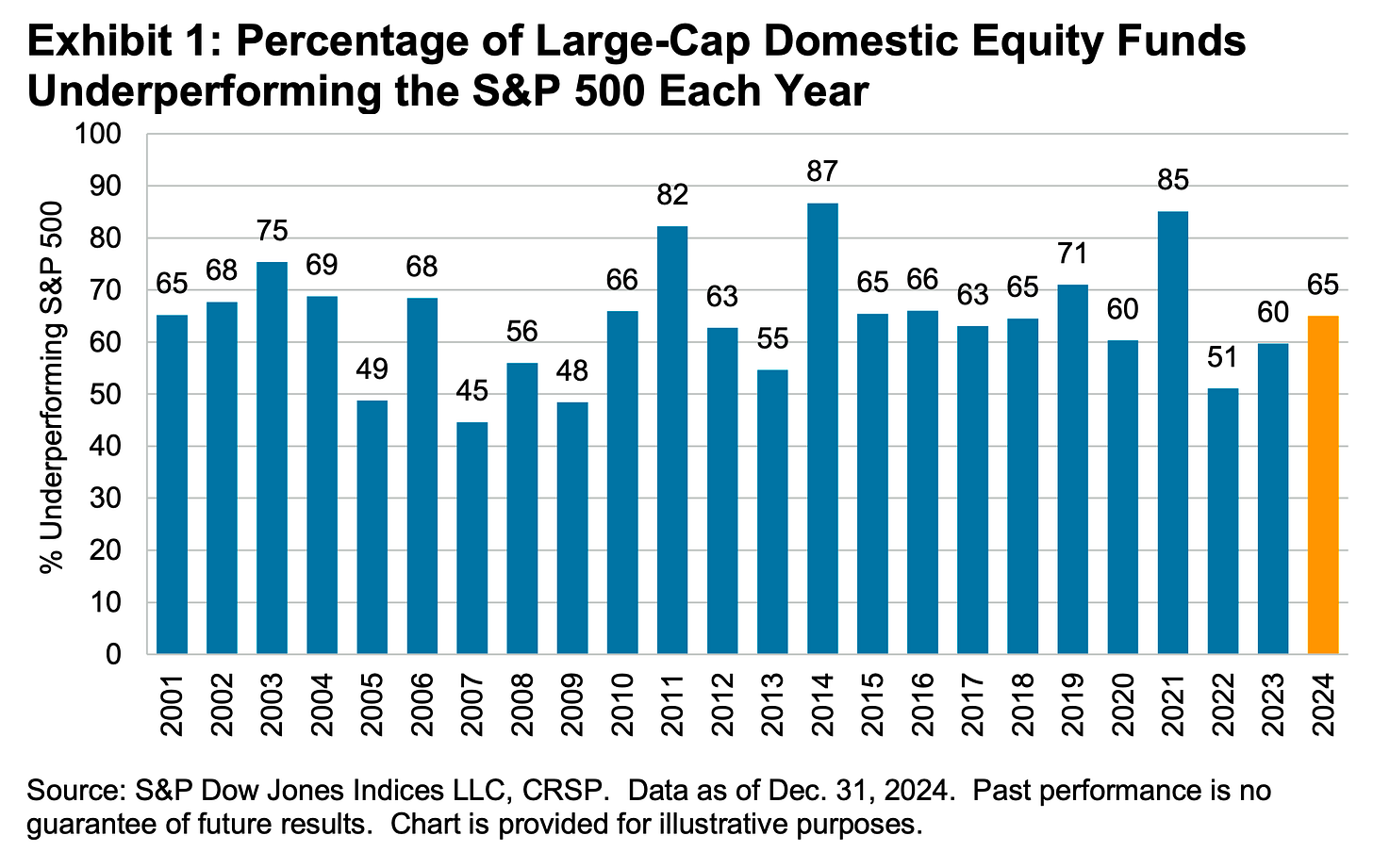

According to S&P Dow Jones Indices (SPDJI), 65% of U.S. large-cap equity fund managers underperformed the S&P 500 in 2024. As you stretch the time horizon, the numbers get even more dismal. Over a three-year period, 85% underperformed. Over a 10-year period, 90% underperformed. And over a 20-year period, 92% underperformed. This 2023 performance follows 14 consecutive years in which the majority of fund managers in this category have lagged the index.

Proof that 'past performance is no guarantee of future results' 📊

Even if you are a fund manager who generated industry-leading returns in one year, history says it’s an almost insurmountable task to stay on top consistently in subsequent years. According to S&P Dow Jones Indices, just 4.21% of all U.S. equity funds in the top half of performance during the first year were able to remain in the top during the four subsequent years. Only 2.42% of U.S. large-cap funds remained in the top half

SPDJI’s report also considered fund performance relative to their benchmarks over the past three years. Of 738 U.S. large-cap equity funds tracked by SPDJI, 50.68% beat the S&P 500 in 2022. Just 5.08% beat the S&P in the two years ending 2023. And only 2.14% of the funds beat the index over the three years ending in 2024.

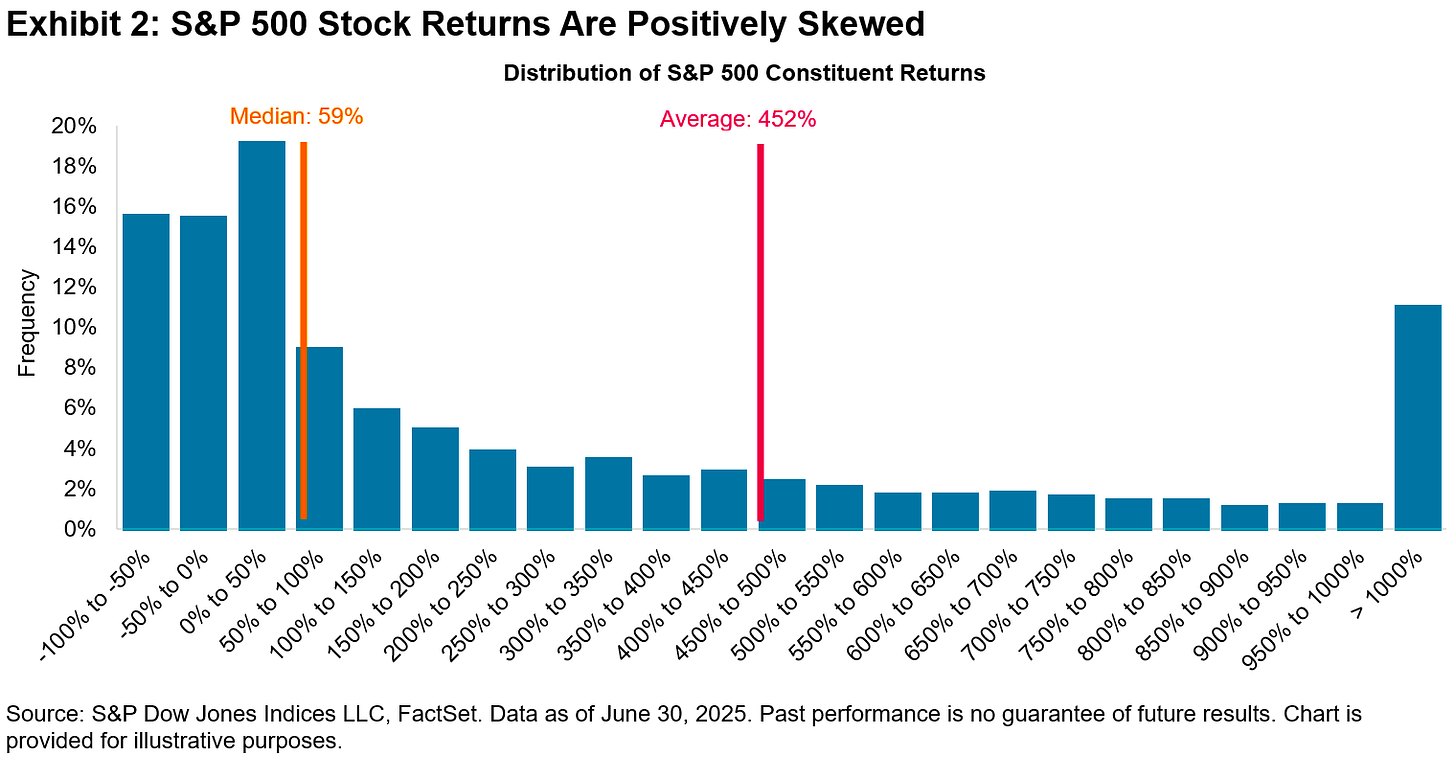

The odds are stacked against stock pickers 🎲

Picking stocks in an attempt to beat market averages is an incredibly challenging and sometimes money-losing effort. Most professional stock pickers aren’t able to do this consistently. One of the reasons for this is that most stocks don’t deliver above-average returns. According to S&P Dow Jones Indices, only 19% of the stocks in the S&P 500 outperformed the average stock’s return from 2001 to 2025. Over this period, the average return on an S&P 500 stock was 452%, while the median stock rose by just 59%.